When the new Federal tax reform Bill was signed into law in late 2017, the entire landscape of American taxation changed. Knowing the nature and extent of these changes will allow you to work more effectively with your tax and wealth advisors.

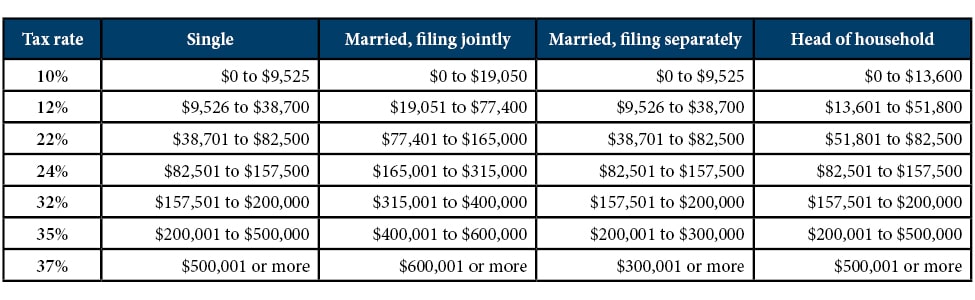

2018 Federal Income Tax Brackets

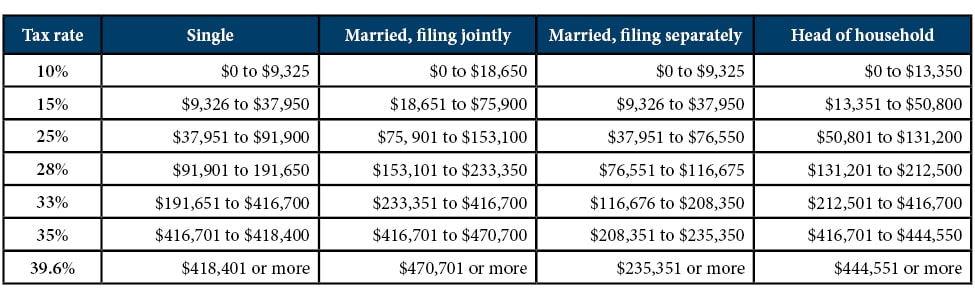

2017 Federal Income Tax Brackets

Note: To comply with Senate budget rules, the majority of changes to personal income tax expire as of January 1, 2026.

The Standard Deduction

One of the fundamental changes baked into the new Tax Law is the elimination of many (but not all) itemized deductions. In exchange for their elimination, the standard deduction amount is going up for both singles and married couples. Under the old law, the standard single deduction was $6,350 but under the new law it rises to $12,000. For married couples, the old standard deduction amount was $12,700, which goes up to $24,000 for married couples under the new law.

Personal Exemptions

Under the old law, each taxpayer and dependent was entitled to a $4,150 personal exemption. Under the new law, personal exemptions are completely eliminated.

Family Tax Credits

The child tax credit under the old tax law was $1,000 per child. Under the new law, there is a $2,000 tax credit for each child. For any child over the age of 18 but still a dependent, the new law provides for a $500 tax credit.

The Fate of Itemized Deductions

Below are the most commonly invoked itemized deductions, along with their fate under the new tax law:

- State and Local Taxes – All State and Local Tax deductions are limited to $10,000

- Mortgage Interest Deduction – Limited to interest payments on mortgages up to $750,000. Interest on Home Equity Lines of Credit is no longer deductible. Mortgage debt incurred before December 15, 2017 is grandfathered under the old limit of $1,000,000.

- Medical Expenses deduction – Expanded by reducing threshold to 7.5% of adjusted gross income. Applies to both 2017 and 2018.

- Student Loan Interest Deduction – No change.

- Moving Expenses – Eliminated, except for members of the military.

- Tax preparation deduction – Eliminated.

- Investment Services fees – Eliminated.

- Gambling losses – Can still deduct gambling losses only up to the amount of gambling income for the year, but the new law clarifies that those people who deduct wagering expenses (i.e. lodging, travel) must add those expenses to their total losses.

- Unreimbursed business expenses – Eliminated.

- Casualty losses – Eliminated UNLESS the President officially declares your property to be within a Disaster Area. In which case you can deduct losses after the first $100 that exceed 10% of your adjusted gross income.

- The “Pease Limitation” is repealed, which means that taxpayers above a certain income levels are now able to itemize all of their deductions; not just a portion of them.

- Alimony deduction – Eliminated (but see entry on same below).

Alimony

Previously, alimony was a deductible expense for those taxpayers paying it and taxable income for those taxpayers receiving it. The new law has implemented a dramatic change. Alimony is no longer deductible and equally significant, it is no longer income to the person receiving it. Note: This change will take effect for divorce and separation agreements executed starting in 2019.

The Alternative Minimum Tax (“AMT”)

Many people had hoped that the AMT would simply be eliminated, but it was not. However, it has been modified to be less onerous to those taxpayers who are affected. The AMT exemption amount has been increased to $70,300 for a single taxpayer, and increased to $109,400 for married taxpayers.

529 Plans

This tax savings vehicle has been made even more robust by the new tax law. Nothing changes with regards to payments for higher education, but taxpayers are now able to withdraw up to $10,000 each year, per child, to pay for private or religious school.

Roth I.R.A. Do-Overs

The current law allows a taxpayer (if it meets certain conditions) to perform a kind of do-over to an IRA that has been recently converted to a Roth IRA. This conversion is no longer allowable under the new tax law – once an IRA has been converted to a Roth IRA, it must remain a Roth IRA.

List of Items That Did Not Change Under The New Law:

- Capital Gains When Selling A Home – Married couples can still exclude up to $500,000 and a single individual can exclude up to $250,000 (some restrictions apply).

- Employer Paid Tuition – Employer paid tuition is not taxable up to $5,250 per year.

- Dependent Care Accounts – Employees can still put away up to $5,000 free of income taxes each year.

- 401(K) Tax Breaks – The rules for these accounts remain the same.

- Electric Cars – Buyers of qualifying plug-in electric cars can still get a tax credit for up to $7,500 (some restrictions apply).

- Teacher Deduction – Teachers can still take up to a $250 deduction for money they spend on job-related and classroom expenses.

- Timing of Sale of Stock and Mutual Funds – The Senate version of the Bill had proposed incorporating a “First In First Out” method for the sale of stocks and mutual funds, but it was not incorporated into the final law.

- Capital Gains – No change.

Note: This portion of the new law expires on December 31, 2025.

Although not eliminated, the Federal Exclusion Amount has been doubled and will now stand at $11.2 million per person. In light of this significant increase, it is strongly suggested that you consult your attorney with regards to your current Estate Plan, as well as any gifting regiments that might be appropriate. Failure to consult with an attorney could result in both unintended results and unexpected taxes.

Estate Taxation

The top estate tax remains at 40%. The basic exclusion amount has been doubled, so that the 2018 estate tax exclusion amount will be $11.2 million per person.

Gift Tax

The top gift tax remains at 40%. Just as with the Estate tax, the basic exclusion amount has doubled so that the 2018 gift tax exclusion amount will be $11.2 million per person.

Generation Skipping Transfer Tax

Often referred to as “The GST”, the top tax rate for this tax remains at 40%. Once again, the basic exclusion amount has been doubled, so that the 2018 GST tax will be $11.2 million per person.

Top Corporate Tax Rate

Reduced from 35% to 21%.

Business Interest Deduction

No longer fully deductible. The new law caps deductions at 30% of income (excluding depreciation).

Alternative Minimum Tax

The Alternative Minimum Tax has been eliminated for corporations.

Taxation of Multinational Companies

The old law allowed for a worldwide system with deferral and credit for taxes paid abroad. The new law implements a territorial system with anti-abuse tax features. What this means is that the United States now moves from a worldwide tax system, in which income earned abroad is taxed in the United States (but only when brought back to the United States), to a territorial system in which only domestic profits will be taxed.

One-Time Repatriation

The new law requires that cash and assets held abroad be brought back to the United States (“repatriated”) and be taxed at 7.5% (14.5% for cash).

This material is provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Information is obtained from sources deemed reliable, but there is no representation or warranty as to its accuracy, completeness or reliability. All information is current as of the date of this material and is subject to change without notice. Any views or opinions expressed may not reflect those of the bank as a whole. FineMark National Bank & Trust services might not be available in all jurisdictions or to all client types.