Last week’s swoon in equity markets pushed the benchmark S&P 500 into a technical bear market, defined as a peak to trough drawdown of greater than 20%. While we’ve been operating in what seems to be a bear market for some time now, this point is worth noting.

Not including the very brief drawdown when COVID-19 was declared a pandemic in early 2020, investors have not experienced a classic bear market since 2008. This abnormally long hiatus has bred complacency among many market participants. Additionally, memories have faded in terms of how these market downturns play out.

Source: Strategas Research Partners, LLC

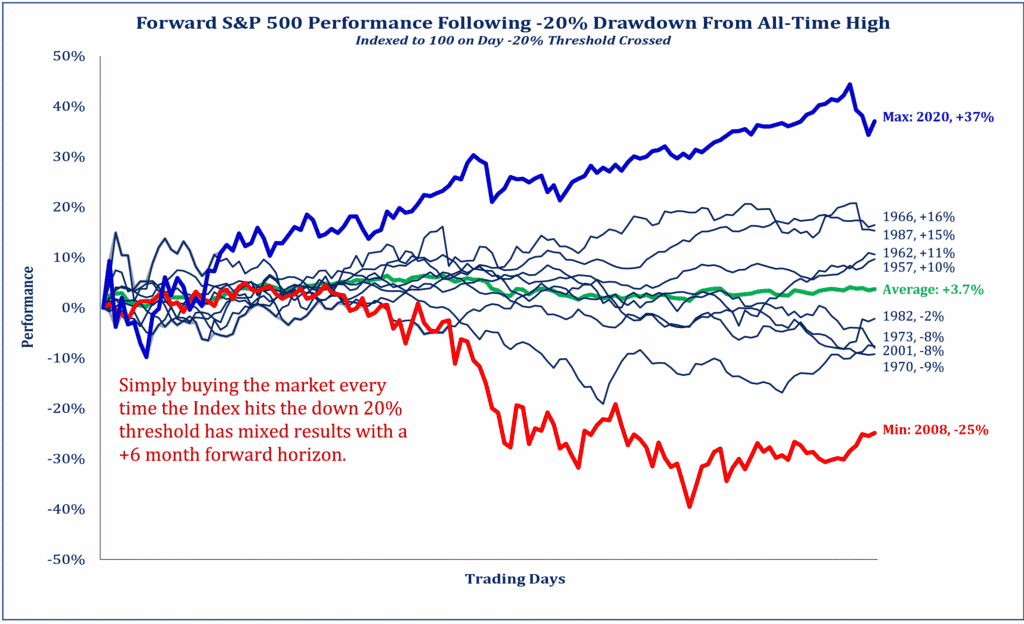

We believe our history informs our future, and a look at the data above is helpful to refresh our memories. It highlights that, on average, if you buy the index after a 20% correction, the average return is 3.7% six months later. We would also note that the two extreme outcomes of this study, (+37% in 2020 and -25% in 2008) are unlikely scenarios in the next 6 months.

The 2020 scenario involved unprecedented levels of both fiscal and monetary stimulus to offset the economic damage caused by COVID-19. We do not believe that sort of stimulus is in our future, rather it is more likely we will continue to see the US Fed move away from its current accommodative stance and toward a neutral and possibly even slightly restrictive posture in the coming months.

The 2008 scenario happened in the early days of the Global Financial Crisis, which involved a near collapse of the entire global financial system. The root cause of the crisis stemmed from woefully lax residential lending practices, resulting in an unprecedented number of loans in default. This caused a ripple effect across the globe as loans were securitized and resold exacerbating already severe losses. Again, this is not a scenario that we face today in 2022.

Excluding these two extreme market outcomes, the average return falls slightly but remains an attractive 3.1% over the ensuing 6 months.

It is our belief; this bear market will be a more “normal” equity bear market. While certainly not pleasant, as evidenced by the 23% drawdown in market value through last Friday’s close, bear markets are part of normal market cycles. While we cannot predict with any certainty when this market cycle will end, we would make the following observations.

- Given the degree of value destruction experienced to date, most of the losses are likely behind us.

- Based on historical data, selling equities at this point in the market cycle has been a poor decision.

- Current market valuations are nearly 30% below peak, thus investors should continue with any planned capital deployments.

We will continue to have more frequent communications while market volatility remains elevated. Should you have any specific questions, please reach out to your private wealth advisor at FineMark or contact us.