After the extreme price volatility global equity markets exhibited in response to the Russian invasion of Ukraine, we want to share FineMark’s position.

We expect volatility to remain elevated for the foreseeable future, but would encourage investors to remain pragmatic and calm in the face of what could be more troubling news to come.

At the beginning of the year, we had forecasted greater market volatility and lower equity-market returns than we had experienced in the prior three years. We did not include the current geopolitical situation between Russia and the Ukraine in our forecast but did discuss the possibility of a Russian invasion when our Investment Policy Committee last met on the 9th of February. We concluded there was a likelihood reasonably high chance of military action and thus did not deploy further risk capital.

As it stands today, we do not see the action taken by Russia changing our baseline assumptions for the near term. Specifically, that this event is likely to further stoke the flames of inflation, as Russia is the third largest producer of oil and second largest producer of natural gas. The sanctions that have been put in place, and additional even more restrictive sanctions, that will be placed on Russia in the future by the US and other nations (Germany, France, Canada, UK, Japan, Australia etc.), will contribute to higher global energy prices. Russia’s largest export market is the UK and the EU at nearly 46%. Russia supplies one third of European natural gas consumption and imports one quarter of its oil from Russia (Strategas Research). These sanctions will have negative economic consequences on both sides, and the effects will drive their implementation in the future.

This means that the trajectory for higher rates that the US Federal Reserve has outlined in their FOMC minutes, designed to curb inflation, will likely remain intact. This will continue to act as a headwind to traditional fixed-income returns, as it has for 2022 to date.

We would not view the actions by Russia as a reason to upend asset allocations as they stand today, provided that those allocations are still in keeping with the risk tolerance you and your FineMark Private Wealth Advisor have established. However, if your portfolio has grown in risk profile as a result of outsized equity market performance, then considering rebalancing back toward your appropriate risk allocation is prudent.

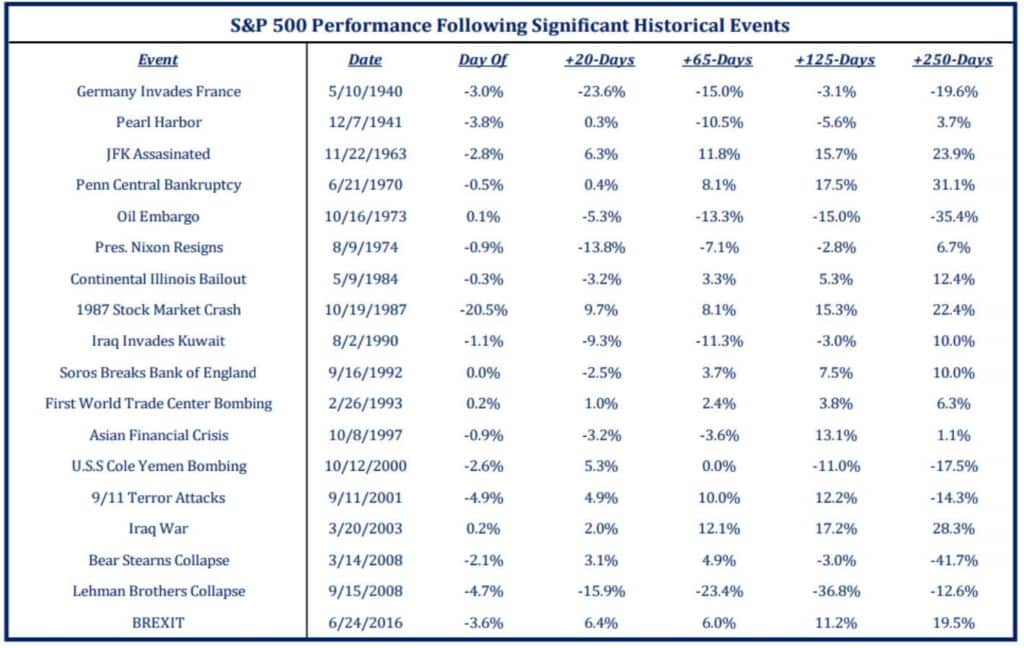

Those of you who regularly read our newsletters know we frequently look to the past for signals as to how the future may unfold. We think that Figure 1 below is highly informative in that regard. During moments of market panic, as we face today, averting any panic decision to sell is almost always the correct course of action.

FIGURE 1

Source: Strategas Securities, LLC

As depicted, the equity market is generally trading at higher price levels 250 days after a significant market dislocation event. The few exceptions include the German invasion of France in 1940 early during WWII, the Oil Embargo of 1973, the 9/11 Terror Attacks, or the collapse of investment banks Lehman Brothers and Bear Stearns which were the precursors to the Global Financial Crisis. We do not see the decision by Russia to invade Ukraine as one of these outlier events, but instead a more normal shock scenario and thus a more opportune period for adding to risk assets and not panic selling.

If our view of the Russian Invasion impact on capital markets evolves, we will communicate that in a future letter. However, at this juncture we see this as more of an opportunity to deploy capital into risk assets. We thank you for your continued confidence and are available should you have any questions or concerns, please contact your private wealth advisor.