Opportunity Zones May Offer Solution to Large Unrealized Capital Gains.

Written By: Paul D. Blatz and Dean Borland

Written By: Paul D. Blatz and Dean Borland

When Congress passed the Tax Cuts & Jobs Act in December 2017, most of the fanfare focused on the savings it bestowed on individual and corporate taxpayers. But the law also established a new program that may offer an attractive solution to investors looking to minimize large unrealized capital gains and add meaningful diversification to a portfolio.

By carving out designated “opportunity zones,” the program aims to help revitalize distressed communities across the country through private capital rather than federal funds. These opportunity zones currently offer qualified investors a way to reduce and delay capital gains taxes while diversifying into private real estate assets. The manager research team at FineMark National Bank & Trust has been exploring how our clients may benefit from investing in qualified opportunity zone funds.

WHAT IS AN OPPORTUNITY ZONE FUND?

Opportunity zone legislation was intended to encourage private investment in the re-development of both multi-family residential and commercial real estate in neglected communities. The key tenet behind the legislation is to free up capital currently tied up in appreciated investments such as equities, real assets, art, or jewelry that will create a new source of capital to allocate to improving under-invested areas of the country.

There are approximately 8,700 tracts identified as opportunity zones, which are selected by state governors and certified by the U.S. Treasury, across all 50 states, Washington, D.C., Puerto Rico, and the U.S. Virgin Islands.

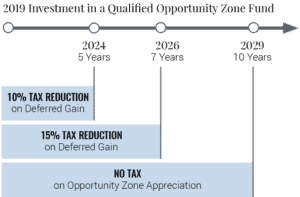

The legislation incentivizes opportunity zone investments in three ways. First, it reduces capital gains taxes on current investments. Second, it delays the payment of that reduced capital gains tax for seven years. Finally, it eliminates taxes on the potential appreciation for the duration of the investment, if held at least a decade.

WHO SHOULD CONSIDER OPPORTUNITY ZONE FUNDS?

Opportunity zone funds are most appropriate for taxable investors with large capital gains in a concentrated investment, looking to reduce the associated tax burden.

Opportunity zone funds can come in a variety of structures; however, we believe the limited partnership (LP) structure is most advantageous for clients. This structure requires that investors be qualified purchasers—individuals or family businesses must meet certain criteria, including holding investments of more than $5 million.

WHY INVEST IN AN OPPORTUNITY ZONE FUND?

While opportunity zone funds will not be appropriate for everyone, they do offer benefits to qualified investors.

Capital gain reduction and deferral

Capital gain reduction and deferral

You can both reduce and defer capital gains taxes on current investments. For example, if you purchased $100,000 worth of Amazon.com Inc. stock at $60.49 per share on March 9, 2009, today you’d have an investment worth approximately $3 million. If you were to sell the stock this year, you’d realize a $2.9 million capital gain, and incur a 2019 tax of $690,200. But if you invested that $2.9 million in a qualified opportunity zone fund before the end of this year, your tax burden would be reduced by 15% ($103,530), and would not be due until 2026. If you miss the 2019 deadline you would only see a tax reduction of 10%. As an investor, you have the flexibility to invest all or just a portion of your embedded capital gains. (Example tax illustration only includes federal tax, not any applicable state taxes)

Tax-free capital appreciation potential

Gains earned on qualified opportunity zone investments held for 10 years are not subject to capital gains taxes.

Diversification

While real estate can provide meaningful diversification to a concentrated stock portfolio, our research indicates that most investors are under-allocated to this asset class. For many investors holding highly appreciated assets, the specter of a large capital gains tax burden may be enough to prevent them from rebalancing—even if they believe those investments are likely to lose value in the future. Opportunity zone funds lower the barriers to diversifying into real estate assets and typically include a diversified mix of property types and geographies.

Reinvesting in long-neglected communities

Investing in opportunity zones allows investors to use their capital to inject much-needed investment in underprivileged and underserved areas of the country, helping spur job creation and economic growth.

Income

Once the properties in the fund are past the development phase and stabilized, opportunity zone fund investments may produce a reliable stream of long-term income.

Attractive alternative to 1031 exchange

Opportunity zone funds are similar to 1031 exchanges in that they both offer investors tax deferral on the sale of appreciated real estate assets. But opportunity zone funds also offer discounts on gains, and tax-free gains on the new investment if held at least 10 years. In addition, unlike a 1031, investors can exclude their cost basis from the original investment and invest any portion of the gain in an opportunity zone fund.

Estate planning

In some instances, investors using a limited partnership structure to gift assets to trusts or other estate planning vehicles may be able to take advantage of illiquidity discounts for real estate assets that aren’t available for equities or other liquid investments.

WHAT SHOULD YOU LOOK FOR IN AN OPPORTUNITY ZONE FUND MANAGER?

- Proper skill set: The ideal opportunity zone fund manager has a proven track record in development, stabilization, and property management.

- Uses a limited partnership (LP) structure: Many opportunity zone funds are structured as real estate investment trusts (REITs) because lower minimums and 1099 tax reporting makes them easier to sell. However, an LP structure provides a clear advantage in that certain expenses are passed through that may be deductible by the investors.

- Conservatively uses leverage: The ideal manager uses leverage strategically, but not recklessly or overly aggressively.

- Aligned interests: Look for fee structures that are fair to investors while providing performance incentives to the fund manager. These might include a preferred return structure where the manager doesn’t earn fees until a certain performance milestone is reached. We also prefer managers who are invested in their own funds, which helps ensure that returns will meet expectations.

- Dedication to compliance: The detailed and lengthy opportunity zone legislation is complicated from a compliance perspective. We look for managers who explicitly communicate how they will meet all the requirements, particularly a provision that specifies that by the completion of the project, the dollar value of the capital improvements must equal two times the original cost basis minus any land value.

Download the Opportunity Zone’s PDF here.

Opportunity Zones

(Photo left to right):

Paul D. Blatz, CFA®, Senior Vice President & Private Wealth Advisor, Investments

Dean Borland, CPA, CTFA, Senior Vice President & Private Wealth Advisor, Trust

Trust and investment services are not FDIC insured, are not guaranteed by the bank and may lose value.

The information contained herein is intended for educational purposes only, and should not be construed as investment, legal, insurance or tax advice or a recommendation for any security, investment strategy, or offer for trust or investment services. FineMark National Bank & Trust, and its associates do not provide tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors before engaging in any financial transaction. The information presented is not intended to make value judgments on the preferred outcome of any government decision. We believe the information contained in this material to be reliable and have sought to take reasonable care in its preparation; however, we do not represent or warrant its accuracy, reliability, or completeness. The views and opinions expressed in it constitute our judgement based on current market conditions and are subject to change without notice. We assume no duty to update any information in this material in the event that it changes.