Recent global impact the coronavirus (COVD-19) is having on both the economy and capital markets.

FineMark would like to share our views on the global impact the coronavirus (COVD-19) is having on both the economy and capital markets. This morning we learned the Federal Reserve took the extraordinary action of cutting the fed funds rate by 50 basis points (.50%). This action was a preemptive measure, in advance of weakening economic data. Our central bank has a dual mandate of providing stable prices and maximum employment and we see today’s cut as appropriate under the circumstances. The fundamentals of the US economy remain strong.

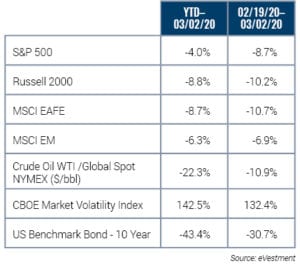

While we don’t know the final ramifications of the coronavirus, including the impact on the financial markets, we would like to share our reaction to the data thus far and what we think the future may hold. The fear over the virus has resulted in a significant sell off in risk assets over the past two weeks. To give you a sense of how far markets have moved, we have organized the data below on both a YTD basis, and since the sell-off began, through Monday, March 2. Monday marked a stark rebound after seven consecutive negative market sessions.

While the data may appear distressing, the pull back in the S&P takes us back to levels last experienced in the fourth quarter of 2019. We have had reservations about US equity market levels for some time, so the current sell off is not terribly bad from that vantage point. We had not been in a full risk on position when the coronavirus news was first reported. With this in mind, we are not currently recommending any changes to our client portfolio asset allocations.

While the data may appear distressing, the pull back in the S&P takes us back to levels last experienced in the fourth quarter of 2019. We have had reservations about US equity market levels for some time, so the current sell off is not terribly bad from that vantage point. We had not been in a full risk on position when the coronavirus news was first reported. With this in mind, we are not currently recommending any changes to our client portfolio asset allocations.

However, our expectation is that the news about the virus will get worse before it gets better. This may result in a continued sell off in equities. Clearly, we are not certain about either the timing or the severity, but at this juncture, we believe the diversified nature of our portfolios will sufficiently protect client assets. We are monitoring markets for an opportunity to buy risk assets at compelling prices and a reduction of market uncertainty.

As a result of the continued spread of the coronavirus, governments globally are urging people everywhere to alter their behavior, particularly as it relates to person-to-person contact. These modifications will affect the economy globally with a particularly severe impact on airlines, hotels, cruise lines, and restaurants. These actions are our primary concern as they relate to reduced economic activity. We are not forecasting an end to our current expansionary period in 2020.

Beyond the actions that the Fed took this morning, we believe the Fed will continue to provide liquidity to the market in the form of additional rate cuts and other monetary tools in an effort to provide market stability. We would expect other central banks to take similar action. Thus far, we have seen the Reserve Bank of Australia and the Malaysian central bank cut rates in response to the economic threat posed by the virus.

While this liquidity may not have a significant economic impact, we believe the effects of inaction could far outweigh the risk of a policy error for two primary reasons. First, the root cause of the demand destruction is linked to fear of contracting the illness, and second, global central banks are already in a very accommodative position so their ability to provide further market liquidity is limited.

We believe there is greater ability for governments to provide fiscal stimulus, that will likely have more positive effects on markets. For example, Hong Kong is removing a number of business taxes and they are giving all permanent residents 10,000 HKD (Hong Kong Dollar). We would expect to see other examples of fiscal stimulus in countries that have been most severely impacted such as China, South Korea, and Italy.

As we continue to watch the news unfold globally, we urge you to avoid being intimidated by the headlines. Remember, the media is in business to captivate viewers, not to provide sound investment advice. Should you have any questions about the current economic environment, or your portfolios, please contact your private wealth advisor at FineMark. We are here to help.