Congratulations on your decision to combine safety, access, to funds, and yields through IntraFi Cash Service, or ICS®. Rest easy knowing your funds are eligible for multi-million-dollar FDIC insurance. Enjoy the convenience of working directly with FineMark, a bank you know and trust.

It’s easy to get started.

Three simple steps.

- Designate an account. Identify a checking account or other transaction account to use with ICS. You may select an existing account or open a new one.

- Complete the paperwork. Sign the applicable Deposit Placement Agreement and a custodial agreement.

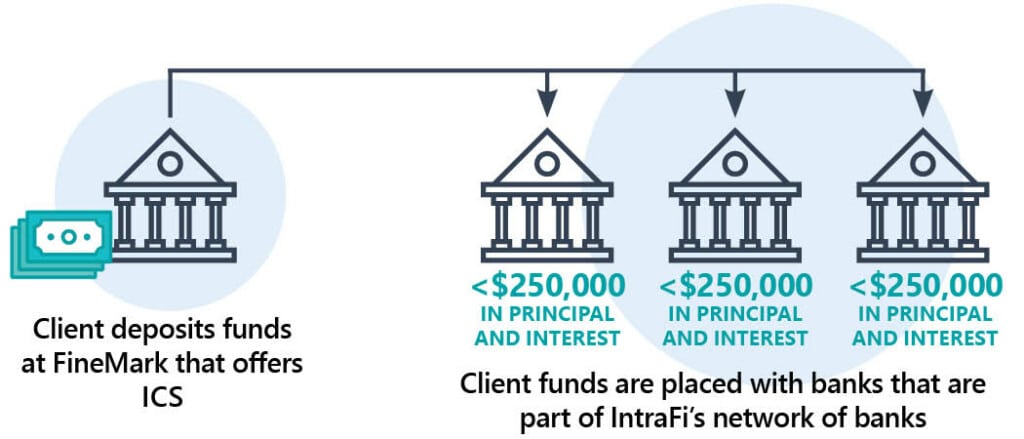

- Make your deposit. When placing funds through ICS, you work directly with just our bank. We do all the legwork. At your direction or based on triggering events outlined in the applicable Deposit Placement Agreement, funds will be sent from your transaction account at our bank to deposit accounts at other FDIC-insured institutions in increments below the FDIC insurance maximum of $250,000. This way both principal and interest are eligible for FDIC insurance.

What else do you need to know?

- Your money is always placed at regulated, FDIC-insured institutions.

- You’ll access FDIC insurance from many banks while working with just one―ours, a bank you know and trust.

- ICS provides transparent reporting― consolidated statements that list all your accounts together with balances, interest earned, and other details.

- You can check your balances online and see where your funds are at all times.

- In addition to statements, you will receive year-end tax forms, such as 1099 forms.

- As always, your confidential information remains protected.

Have questions? Contact your relationship banker or call your local office. We’re here to help.