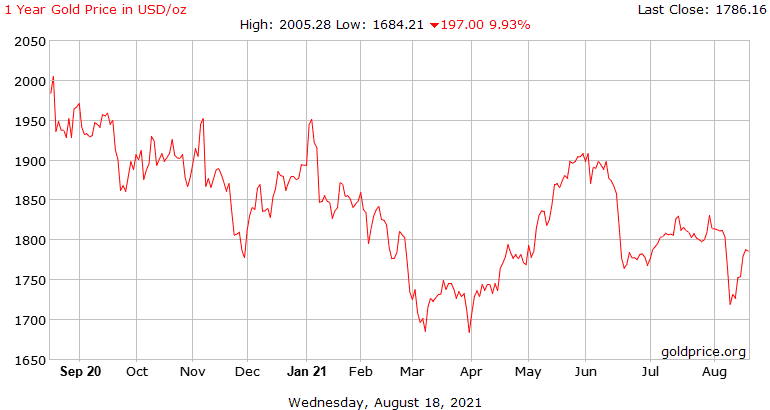

It’s been nearly a year since we added our tactical allocation to gold, and it has not gone as we had anticipated in terms of price action. The environment we experienced in these 12 months, particularly 0% rates on cash and increasing levels of inflation have led to an exacerbation of the negative rate condition which was the impetus for our original allocation.

Source: Gold Price® is a USA Registered Service Mark of GoldPrice.Org

https://goldprice.org/gold-price.html

As a reminder our research on gold has indicated that in negative real rate environments, when the rate of inflation outpaces the nominal returns in 10-year treasuries, gold tends to perform very well, far better than in more normalized periods.

Despite our view that the Fed will soon communicate its intention to taper, we believe the monetary policy is too accommodative for the current economic environment. We do not see the Fed becoming hawkish anytime soon. We see negative rates persisting for the foreseeable future, at least a year, and perhaps beyond that.

While we cannot be certain, part of the reason for the languishing price of gold may be the keen interest in cryptocurrencies. That interest has largely been driven by some of the very same factors we think make gold compelling today. Additionally, there is growing skepticism about fiat currency, and that has further fueled interest in cryptos. This flow of capital into crypto has redirected capital that may have been otherwise destined to purchase gold.

We believe we may be entering a period of greater government regulatory scrutiny for cryptos, both here in the US and abroad. As this develops, we may see a firmer bid under gold.

We see gold as a timeless store of value. We do not see that same characteristic in in cryptos.

Gold is just one piece of the portfolio allocation, not the centerpiece. Our recommendations are not driven by any delusion on our part that we can time markets in the short term, we can’t. Instead, the allocation is driven by a thoughtful interpretation of market influences, and how that interplay can affect other allocations within client portfolio allocations.