FINE POINTS, The Quarterly Trust and Investment Publication of FineMark National Bank & Trust

January 2017 | Volume 2 | Issue 1

“It’s tough to make predictions, especially about the future.” -Yogi Berra, Hall of Fame Yankee Catcher

2016 was seemingly the year where some of the most unlikely and unusual events came to pass. Events that not only would be unlikely to predict by anyone, but in some cases events that had not occurred in generations or ever:

- The Chicago Cubs won the World Series. This had not occurred since 1908. (If only investors were as patient as Cubs fans.)

- The Cubs beat the Cleveland Indians to win the World Series. The Indians had not been to a World Series since 1997 and had not won one since 1948 (second longest drought only bested by the Chicago Cubs).

- Fidel Castro, father of the Cuban Communist Revolution of 1959, and one of the last living vestiges of the Cold War died. However, his similarly minded brother Raúl remains firmly in power.

- Brexit: The United Kingdom voted in a referendum to leave the European Union.

- Donald Trump, a businessman who has never held any elected office was elected President of the United States.

Additionally, when he takes the oath of office on January 20th, he will also become the oldest man to have ever held the office at the age of 70. President Reagan previously held the record as the oldest president. He was 69 when he took the oath of office in 1981.

So why do we bother to highlight all of these events? Because we operate in an industry where so many practitioners make predictions with such a high degrees of certitude in a world where, in the short term, there really isn’t any.

“In the short run, the market is a voting machine, but in the long run, it is a weighing machine.” – Benjamin Graham, Father of Value Investing and Professor of Warren Buffett

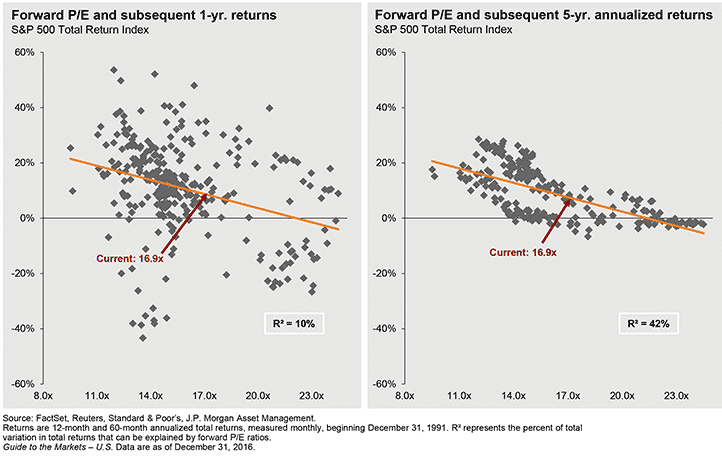

So what is an investor to do in the face of uncertainty? In our view, a long-term approach is required. Over full market cycles (bull & bear markets) there are well documented risk characteristics, correlations and returns associated with major asset classes (cash, equities and bonds). Investors receive a return premium for taking the risk of creating new equity capital. The same can be said for fixed income returns. Therefore, using long-term views driven by valuation, economic conditions, and monetary policy allow us to create portfolios that can exhibit certain risk and return characteristics over long periods of time. However, in the short term, these are not reliable. This concept is clearly demonstrated in Figure 1. Over a one-year time frame forward P/E (price-earnings) ratios have a low coefficient of determination (R² or goodness of fit) at just 10%. Over the short term, valuation is less meaningful, but over a 5-year time frame we can see a much higher coefficient of determination at 42%. The lesson, lower prices today mean higher returns in the future, but the future may not be next year. Another interesting observation from the chart is our current S&P 500 market multiple of 16.9x, not low by historical standards, but not overly high either.

Figure 1

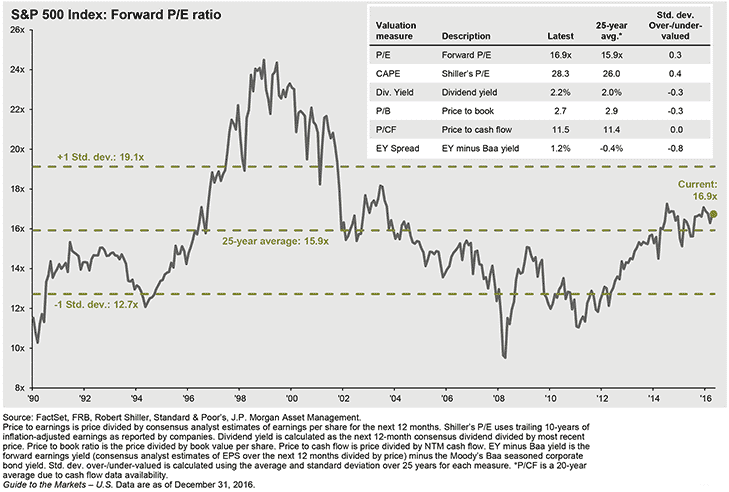

With that disclaimer, we will now opine a bit on the state of the markets. Since the US Presidential Election, we have seen what can be best described as a sugar-induced market rally, which we know will abate sooner or later. Market valuations have climbed significantly in just the past couple of months. This is clearly in anticipation of the business friendly policies the market is expecting from a Trump administration. However, we are reaching levels where a market pullback would not be surprising. The current forward S&P 500 P/E multiple is 16.9. As you can see in Figure 2 this is 1 full point above its historical average, but still less than 1 standard deviation from its historical average, and far below the nosebleed valuations we saw back in the late 90s.

Figure 2

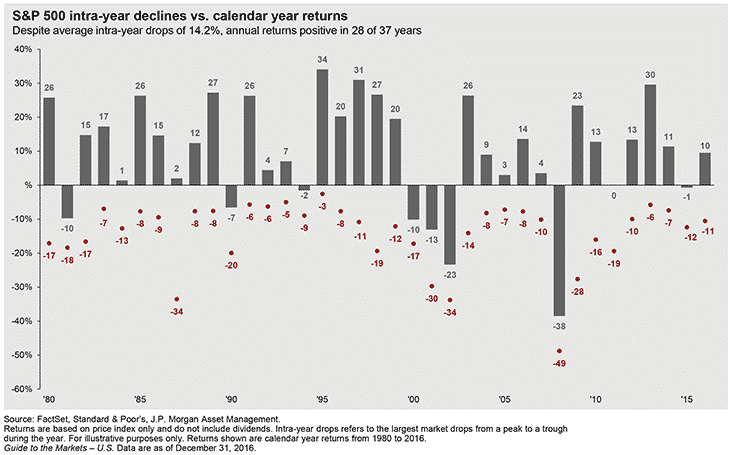

However as Figure 3 reminds us, drawdowns are normal and par for the course for equity market participants. Despite the fact that the S&P 500 has generated positive returns in 28 of the last 37 years, investors have had to endure average inter-year drawdowns of 14.2%. So the next time you watch market pundits talking about sell offs, remember that if the drawdown is not greater than 14% we have not even hit average!

Figure 3

“Those who cannot remember the past are condemned to repeat it.” – George Santayana, Spanish Philosopher

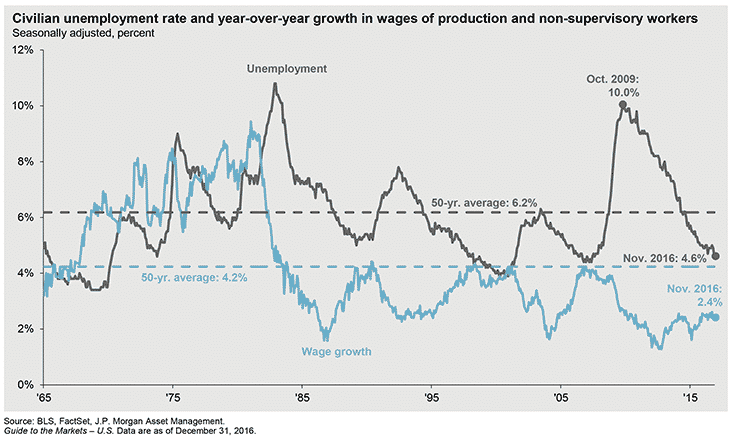

One risk we see on the horizon is the chance of wage inflation. As the unemployment rate has fallen from the highs of the financial crisis to sub 5% today, the labor market has become tighter. This is an indicator that the Fed is certainly watching and will be a harbinger for future Fed action. As you can see from Figure 4, typically labor inflation would manifest itself at this point in the cycle, however to date it has been quite benign.

Figure 4

Beyond equities, we continue to have a keen eye on fixed income markets, which were trounced in the 4th quarter losing 3% on average. Ten Year US Treasury note yields bottomed in July at 1.37% and got as high as 2.60% during December after settling back down to close the year at 2.45%. Our view on rates is that on the long end of the curve, we have likely seen the bulk of the upward movement for now. We are defining “for now” as until we see confirmation that the economy is growing at a higher rate and inflation is beginning to manifest itself in CPI (consumer price index) which remains significantly below its long term average. On the short end of the curve, we would expect the Federal Reserve to move the Fed Funds rate 2 to 3 times during the year after the first quarter. This will result in a flatter yield curve than we have currently. So while ultra-loose crisis type monetary policy has ended, we will remain in an accommodative monetary policy position for 2017. We would expect to see some help on the fiscal end through deficit spending on national infrastructure once the new administration has an opportunity to get their agenda moving. Both of these factors should contribute positively to overall economic activity in 2017.

By: Christopher Battifarano CFA®, CAIA

By: Christopher Battifarano CFA®, CAIA

Executive Vice President & Chief Investment Officer

Additional articles from this issue:

Tangible Personal Property & Estate Planning

Download Full Newsletter Here