Combating Check Fraud: Insights from Our Fraud Specialist

Check fraud poses a significant threat in today’s banking landscape, demanding vigilance from financial institutions. Our team examines every check that meets certain criteria for potential fraud, such as questionable endorsements or irregular signatures. When something is deemed suspicious, action is taking immediately to help thwart possible fraud.

Implications Beyond the Check

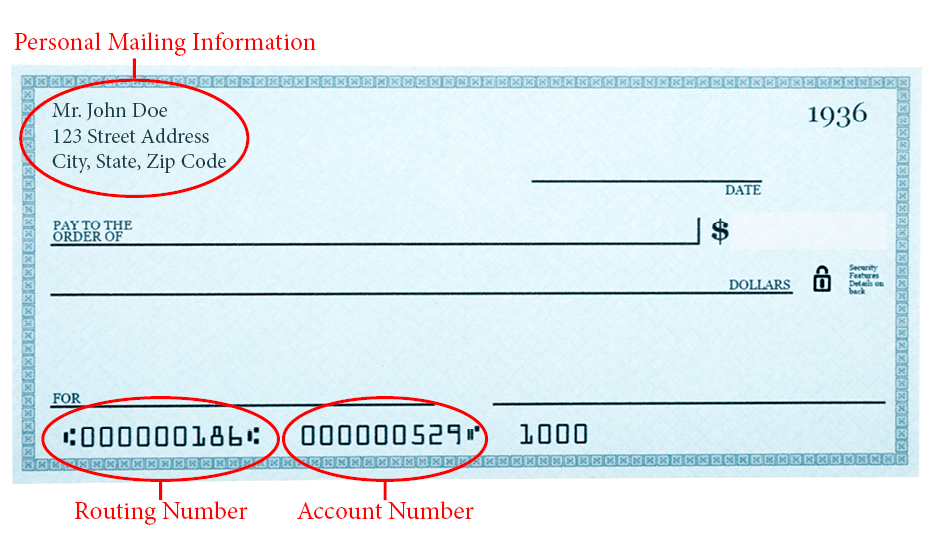

While the focus may initially be on a single check, the implications of check fraud extend far beyond that one piece of paper. Personal information contained on each check can be exploited for fraudulent purposes, underscoring the need for comprehensive protection measures.

Proactive Protection Measures

When FineMark’s fraud team discovers a suspicious check or wire transfer, we alert the banker to ensure our clients are shielded from possible losses or risks. By proactively reaching out and highlighting any discrepancies, we help clients understand the importance of safeguarding themselves against potential compromises.

The Role of Endorsements

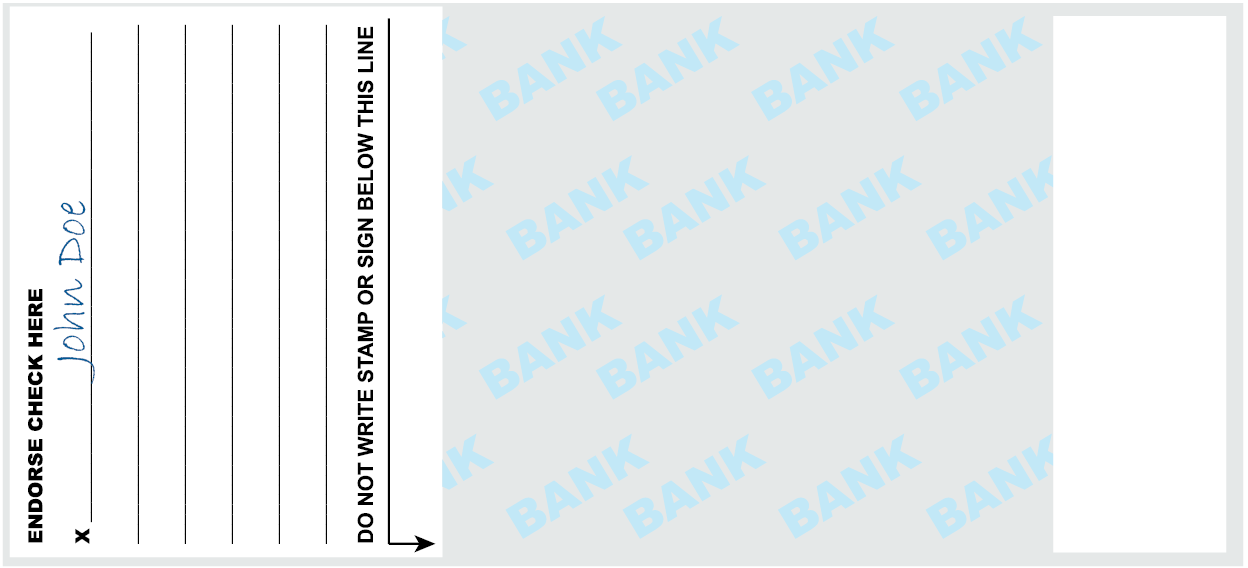

The significance of endorsements cannot be overstated, as they play a crucial role in verifying the credibility of a transaction. Without proper endorsements, checks can easily end up in the wrong hands, leading to unauthorized transactions.

In this example, the account consumer John Doe is endorsing the check.

Mitigating Risks

In cases where checks are intercepted or stolen, the risk is greater than a single incident. With personal information at risk, fraudsters can exploit data to create counterfeit checks and engage in further fraudulent activities. It is imperative to take proactive steps to mitigate potential risks.

Collaborative Security Measures

Communication and collaboration are key in combating check fraud. When approached by a banker regarding a check, view it as an additional layer of security aimed at safeguarding your financial well-being. By remaining informed and taking necessary precautions, you empower yourself to navigate the complexities of check security confidently.