Check fraud is making a major resurgence in this county, despite the fact fewer people are writing checks. According to the U.S. Treasury Department, nearly 700,000 cases of possible check fraud were reported in 2023, with billions of dollars in losses.

Thieves scour postal boxes and mailboxes looking to steal personal checks, business checks and checks related to government programs like social security. Business checks can be the most vulnerable since they are often well-funded, and it may take longer for the victim to discover something is amiss.

Once thieves have a check in hand, they employ a variety of methods to steal your money. Classic check fraud involves washing the check with chemicals to erase the amount and payee while keeping the original signature. Other criminals don’t go through the trouble and simply endorse the back of the check with a signature that doesn’t match the payee. They then deposit the check electronically, which often circumvents bank oversight. Using the information on your stolen check, thieves can also create counterfeit checks by purchasing blank checks and then adding your account and routing numbers. Regardless of the method, the criminal’s goal is always the same — to get your money.

So, what can you do? When possible, avoid using paper checks. Instead, consider making online payments, directly to the payee. Using a credit card adds more protection and you’re able to dispute questionable charges. If the payment is to an individual, Peer-to-Peer apps (e.g., Apple Pay®, Zelle®, Venmo®, Cash App®) are also a popular form of payment. We partner with Zelle at FineMark, and money can be sent directly from your checking account to the recipient’s personal account. You can also set up transaction alerts to keep track of what’s coming out of your checking account and to ensure the numbers are accurate.

If you absolutely have to send a check by mail, don’t use your mailbox at home. Take the check directly to the post office, bypassing blue mailboxes and mail carriers. You can also ask the recipient to notify you when the check is received. If too much time has passed and the check still hasn’t arrived, you can stop payment and reissue; this will prevent someone else from depositing the lost check. You can also write your checks with a black gel ink pen. The ink soaks into the paper, making it more difficult for criminals to erase your information. We are also taking significant precautions at FineMark to protect our clients. Our associates are continually trained to detect signs of fraud and we now offer high security checks, which have multiple layers of defense against fraud. However, we realize even with our best efforts fraud will happen, so it’s important to be vigilant. If you think you are a victim of check fraud, call us immediately so we can confirm the fraud and then work with you in an effort to recover your money.

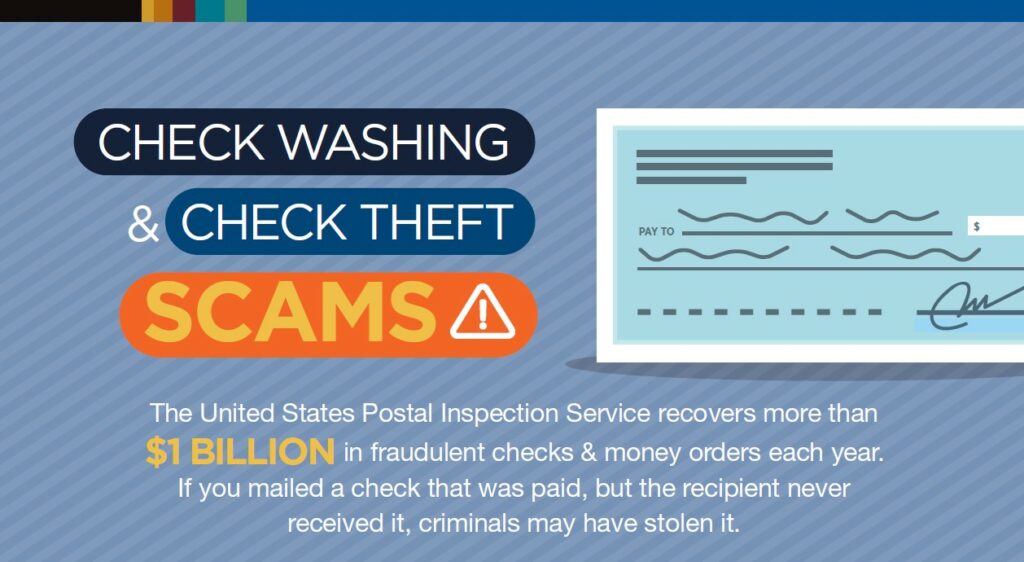

View the infographic created by the ABA and US Postal Inspection Service to educate about check fraud.

Interested in more topics on how to stay safe?

Check out our video library on Fraud Prevention.