FINE POINTS, The Quarterly Trust and Investment Publication of FineMark National Bank & Trust

Quarter 3, 2016 | Volume 1 | Issue 3

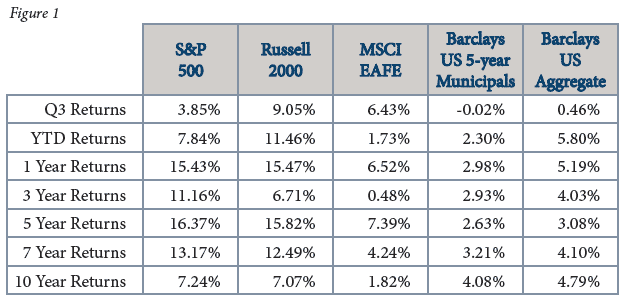

The third quarter was one of the most quiet, least volatile quarters in twenty years. While summers are typically quieter than the rest of the year, this was certainly more profound. Despite a flare up in volatility immediately following the UK’s vote to exit the European Union in June, markets have been very calm. For the quarter, the S&P 500 was up 3.85 percent, the strongest quarter for equities this year. Although, we are seeing weakness in domestic earnings, the market appears quite sound. The S&P 500 remained comfortably above its 200 day moving average for the entire period. As for bonds, their results have been solid all year, though, rates have been volatile as the on-again, off-again debate to increase the Fed funds rate continues.

Investors could feel a false sense of calm as a result of the low volatility environment. One cause for concern, however, is the market’s elevated gamma level (γ). In financial terms, gamma is defined as the rate of change. In laymen’s terms, it is how quickly markets can move from calm to stormy. While we believe there are a few factors causing volatility to change more rapidly than usual, one of the most profound is the quickness with which many of today’s market participants are willing to sell. The greater degree of sensitivity is likely a result of yield-starved investors purchasing more risky investments. Investors are moving away from traditional fixed income securities (bonds) to bond proxies such as master limited partnerships (MLPs), Real Estate Investment Trusts (REITs), and higher dividend yielding equities. While there is nothing inherently wrong with these types of securities, they exhibit higher levels of price volatility than traditional fixed income securities and holders may not be accustomed to their risk levels. When these bond proxies start to decline in value, the yield-starved investor is quicker to sell the investment which then creates a domino effect and increases the volatility. Furthermore, with more investors using ETFs (exchange traded funds) to purchase these bond proxies, any sell-off is increased exponentially due to the large number of underlying securities held by a single ETF.

While the earnings stability of high-dividend yielding equities typically results in outperformance during late-stage market cycles, we do not believe that this will be true in today’s environment. We believe that as rates rise high-dividend yielding equities will experience the greatest headwinds because they are already trading at elevated valuations due to yield-starved investors having already purchased these investments.

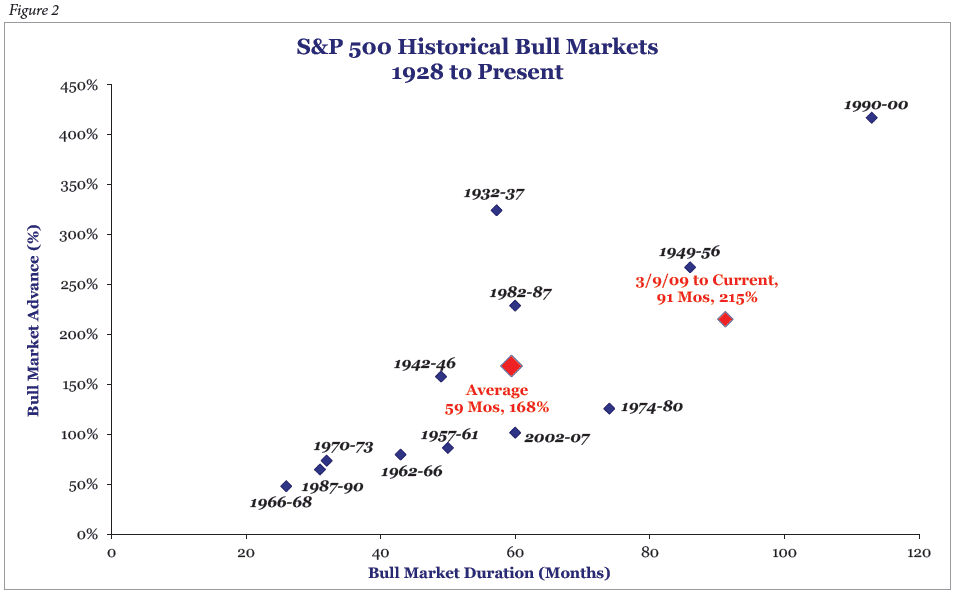

Figure 2 illustrates how the current bull market (born in March of 2009) compares to prior bull markets since 1928. As measured, in both time and percentage appreciation, today’s bull market is both significantly longer (91 months) than the average (59 months) and larger in total price appreciation (215 percent) than the average (168 percent). We would assert that we are in the latter stages of the current bull market although, this doesn’t mean we should panic. Some classic signs that normally indicate the end of a bull cycle are not apparent, such as widespread retail investor participation, increased merger & acquisition (M&A) activity, widening credit spreads, and a high degree of investor complacency. While one should never look to a single metric for determining market direction and health, retail investor participation has been a reliable method for doing so.

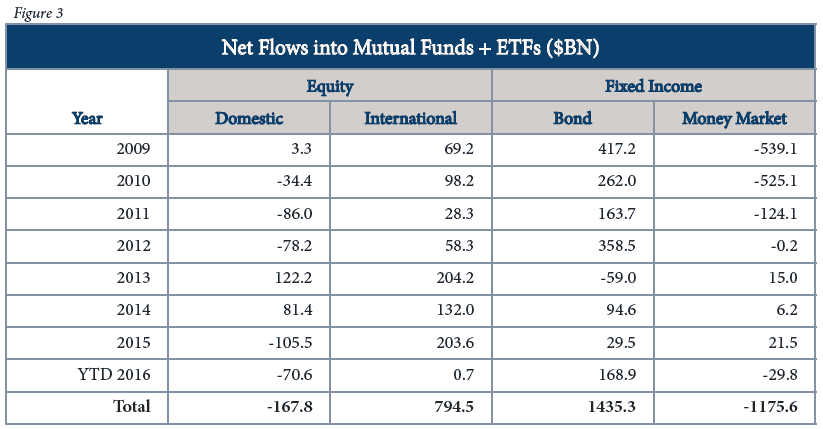

High retail investor participation in the equity market is when individuals put every last dollar they have in the stock market. Participation is measured through net inflows into equity ETFs and mutual funds. Figure 3 shows how investors have remained net sellers of domestic equity ETFs and mutual funds since the birth of the current equity bull market. While the current bull market historically ranks as one of the greatest of all time, in terms of duration and market price appreciation, most retail investor cash has flowed into fixed income, not equities. The average investor has remained skeptical of the market, and has not participated in its appreciation. Bull markets tend to end when retail investor enthusiasm is at a fever pitch. The following data set indicates that despite a higher than average valuation, duration and price appreciation, this current bull market still has legs.

The presidential debates of the third quarter reminded us that we are in the midst of a very heated presidential election year, and while Donald Trump and Hillary Clinton don’t seem to agree on much, they do agree on our nation’s need to strengthen its infrastructure. As we discussed in our last issue of Fine Points, the current economic recovery has been one of the most tepid on record. Furthermore, we believe we have reached the outer boundaries of what monetary policy can do to right our economic ship. Thus it is fiscal stimulus, not further monetary stimulus which appears to be in our future. The last major fiscal stimulus was the $787 billion plan that President Obama signed into law early in his administration. At the time, it was hoped that this Keynesian-style plan could have long-lasting effects. It ultimately turned out to be rather ineffective. This was largely because there was no clear plan for directing those funds into economically fruitful endeavors, later referred to as “shovel ready projects.” To put this point in more economic terms, there were simply not enough projects readily available with a high return on investment for which the government could invest the funds.

This go-around, our hope would be that projects such as improving our nation’s roads, airports, bridges and seaports could become a reality. Federal spending by borrowing at such historically low rates, and plowing funds into making America more competitive on a global scale could give the economy the jolt it needs to grow at a more robust level. Anyone who has traveled abroad recently can certainly see just how far behind our country has fallen in this regard versus Europe or Asia.

Looking ahead, we believe the Fed will continue its slow and deliberate path of tightening US monetary policy, which began with the Fed ending the bond buying program (also known as quantitative easing or QE) in 2014 and raising the Fed funds rate 25 basis points late last year. Unless we see data that significantly disrupts the path of improvements on both the employment and inflation fronts, we expect to see a 25 basis point increase in December 2016 and continued increases in the Fed funds rate in 2017. We suspect, though, this rate-hike cycle will be far slower than in prior economic recoveries.

We thank you for your time and attention in reading our newsletter. Should you have any questions or comments, please do not hesitate to reach out to your FineMark investment advisor. We deeply appreciate the confidence you have placed in FineMark and endeavor to continue to earn that confidence in the future. We wish you and your families a pleasant and joyful holiday season.

By Christopher Battifarano CFA®, CAIA

By Christopher Battifarano CFA®, CAIA

Executive Vice President & Chief Investment Officer

Additional articles from this issue:

Year-End Financial Planning Tips

Download Full Newsletter Here