“It’s tough to make predictions, especially about the future.”

—Lorenzo Pietro “Yogi” Berra, American Major League Baseball Catcher, Coach, and Manager (1925-2015)

Born to Italian immigrant parents, Yogi Berra served in the U.S. Navy during World War II before making his 1946 debut as the catcher for the New York Yankees. Throughout 19 seasons, he became one of baseball’s most enduring figures. After retiring as a player in 1963, Berra coached and managed the New York Mets and the New York Yankees and bench coached for the Houston Astros, appearing in 21 World Series and contributing to 13 series championship wins. Well known for his unique humor and wisdom, Berra’s “Yogi-isms” earned him recognition far beyond the ballpark!

In recognition of America’s favorite pastime, and the start of the 2025 baseball season, we believe it’s fitting to begin this quarter’s letter with a nod to Yogi Berra’s most iconic observation (quoted above). We agree with his tongue-in-cheek assessment of prediction and acknowledge that his words may have particular relevance in today’s economic and political environment.

President Trump’s return to the White House and his stated desire to implement sweeping policy changes (often without providing much detail) have reintroduced uncertainty into the markets, increasing volatility. As investment professionals, we’re accustomed to operating in environments where the future is unclear. In response to any uncertainty, we rely on two core principles: diversification and margin of safety.* While these tenets may not capture headlines, they are essential to preserving and growing wealth across generations.

*Margin of safety is a principle used to safeguard investments by purchasing assets at a price below their estimated true value. The concept aims to protect investors from potential losses by providing a cushion against unexpected market downturns or errors in valuation.

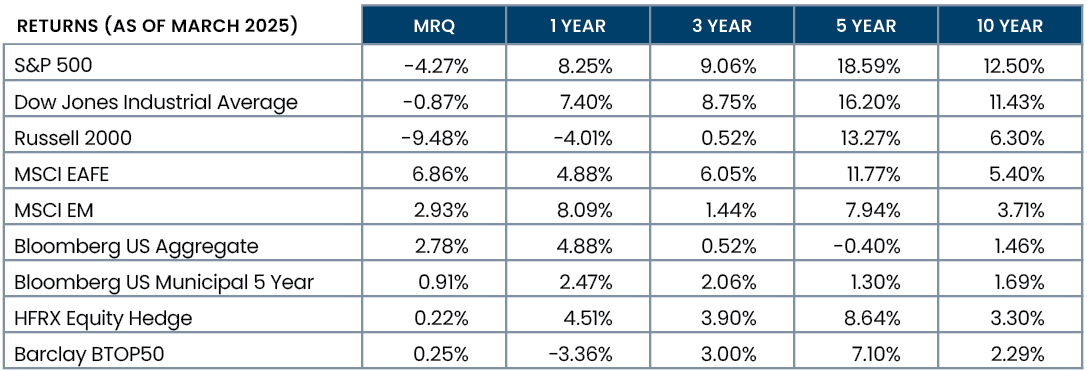

FIGURE 1

Quarter Highlights

First quarter 2025 saw considerable sector rotation and a reversal of fortunes across major asset classes. At year’s end, you may recall, we were cautious of large-cap U.S. equity markets. This wariness came on the heels of two consecutive years of outsized returns (over 26% in 2023 and over 25% in 2024).

Following President Trump’s election victory (and driven by the expectation of tax cuts and deregulation intended to reignite animal spirits*), market sentiment became increasingly optimistic. While these policies may still be forthcoming, the administration focused initially on actions (such as executive orders and tariff implementation, which can be executed unilaterally) rather than through the legislative process.

Elevated equity valuations and ambitious expectations for continued above-trend earnings growth created a fragile setup where even minor downward earnings outlook revisions could trigger a notable re-rating in share prices. The risk that formed the basis for our cautious positioning has largely unfolded.

This scenario led to a reversal of U.S. equity market dominance with losses in the S&P 500, the Dow, and the Russell 2000 during the quarter (all indices tracked regularly in this letter). Conversely, international developed and emerging markets rebounded from fourth quarter losses, posting gains in first quarter 2025. These gains were further supported by a weakening U.S. dollar, which provided a tailwind to international returns.

Bonds followed a similar pattern. After ending the year selling off and delivering only modest full-year returns, fixed income markets rallied in the first quarter as investors sought safety amid growing uncertainty.

*“Animal spirits,” a term coined in 1936 by British economist John Maynard Keynes to refer to the ways human emotion can drive financial decision-making in uncertain and volatile times, comes from the Latin spiritus animalis: “The breath that awakens the human mind.”

“Magnificent Seven” Impacts

Another key factor worth highlighting is the continued effect of the “Magnificent Seven,” a group of dominant technology companies consisting of Alphabet (GOOGL), Amazon (AMZN), Apple (AAPL), Meta Platforms (META), Microsoft (MSFT), NVIDIA (NVDA), and Tesla (TSLA). Since late 2022, these seven firms have been the primary drivers of S&P 500 performance and now represent an outsized portion (approximately 31%) of the index. In 2023, they accounted for an astonishing 63% of the S&P 500’s total return; in 2024, that number decreased to roughly 50%.

In 2025, however, the Magnificent Seven are down approximately 16% year-to-date. In contrast, the equal-weighted version of the S&P 500—where each constituent has the same impact regardless of market cap—is lower by less than 2% on the year. This divergence highlights the growing concentration risk embedded in traditional cap-weighted benchmarks and supports our continued emphasis on diversification across styles and structures.

Within alternative investments, long/short equity strategies faced challenges even as they outperformed long-only equity approaches. The first quarter saw significant risk reduction and deleveraging, particularly as market volatility spiked, rising from the low teens in early January and increasing to nearly 27 by March, as measured by the CBOE VI (VIX). For many investment managers, this climb led to tighter positioning and limited upside capture.

Managed futures also struggled, primarily due to sharp reversals in currency markets. Numerous trend-following strategies entered the year positioned long on the U.S. dollar versus a basket of major currencies; a stance that reversed sharply and triggered losses. While gains in precious metals—particularly gold—provided some offset, they weren’t enough to fully counter losses incurred in foreign exchange trading. They finished approximately flat on the quarter.

Trump 2.0

A new era was ushered into Washington, D.C., with the inauguration of Donald J. Trump. Although it’s technically his second term, this administration already resembles a second firstterm led by a president committed to advancing his ‘America First’ agenda.

There are two developments of particular interest to markets: 1) the emerging tariff regime and 2) the creation of the Department of Government Efficiency (DOGE). So far, the administration’s approach to tariffs has been inconsistent. A start-and-stop dynamic of announcements and reversals has kept the markets guessing about which policies will ultimately develop.

Currently, President Trump seems to be deploying tariffs as a multi-purpose tool aimed at addressing certain economic and geopolitical concerns. Chief among them: the protection of U.S. industries and key sectors deemed strategically or nationally important (i.e., steel and aluminum production and pharmaceutical manufacturing).

He also appears to be using tariffs to encourage previously offshored manufacturing activity in a wider array of industries to now reshore to the U.S. Ultimately, product value-add combined with the severity of the tariff will determine whether companies are convinced to return to the U.S. or decide to remain abroad.

Trump’s final and largest area of focus will be trade negotiations, particularly with countries where the U.S. runs a trade deficit. His approach seems to rely on strategic ambiguity. He remains intentionally unclear about what he seeks and/or what levels of tariff he may impose. Typically, Trump will prompt the other party to make the first move, leaving him in a position to either accept the offer or push for additional concessions. In effect, the counterparty ends up negotiating against itself.

In this area, Trump’s objectives appear to be opportunistic and transactional, marking a distinct departure from past administrations. He aims to strike deals that benefit the U.S. while simultaneously taking advantage of every available point of leverage. For example, amidst the ongoing Russian invasion, Trump withheld further aid and intelligence from Ukraine while pressing the country for future mineral rights through a revenue-sharing agreement. Similarly, Trump is attempting to hold Canada, China, and Mexico accountable for their role in illicit drug and human smuggling across the U.S. border.

Again, part of this strategy involves keeping negotiating partners off balance, a tactic that’s working so well that the markets are showing signs of confusion—or even paralysis—in response. On March 19, Federal Reserve Chairman Jerome Powell reflected on this growing unease when he mentioned “remarkably high levels of economic uncertainty.”

Echoing these concerns are industry bellwethers. FedEx lowered its earnings guidance due to “uncertainty in the U.S. industrial economy” and Delta Airlines, the world’s largest airline by revenue, issued a similar downgrade citing “macro uncertainty.”

The Deficit and DOGE

Less concerned with specific cuts being made by DOGE, the markets are focused on the administration’s broader fiscal intent: to shift from unsustainable spending to a more normalized trajectory.

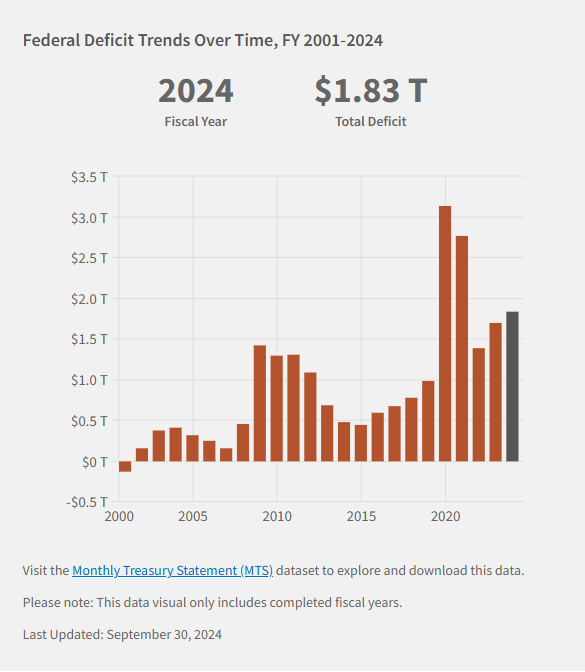

The COVID-19 pandemic triggered an unprecedented wave of stimulus designed to offset the economic impact of voluntary and mandated shutdowns. These efforts began under President Trump and continued through the Biden administration. As a result, the federal budget deficit surged from under $1 trillion in 2019 to over $3 trillion in 2020.

While the deficit has declined in subsequent years, falling to $2.7 trillion in 2021 and $1.4 trillion in 2022, it has remained well above pre-pandemic levels (see Figure 2). Note: This spending surge occurred despite rising federal revenues, which grew from $4.26 trillion in 2019 to $4.92 trillion in 2024. In other words, the U.S. doesn’t have a revenue problem, it has a spending problem.

FIGURE 2

Source: The U.S. Treasury

Other than during times of war or deep recession, neither of which characterized the 2019–2024 period, this lengthy timeframe of outsized deficit spending is without historical precedent. With government expenditures increasing at a pace that is outstripping economic growth, it feels appropriate to label the current path of spending “fiscally unstable.” Nonetheless, we do see the nation’s finances moving toward a more sustainable path.

Newly minted Secretary of the Treasury Scott Bessent has set a goal to reduce the federal budget deficit to 3% of Gross Domestic Product (GDP). On March 5, President Trump went even further when he floated the idea of a balanced budget during his address to a joint session of Congress.

In our view, the exact number is less important than the direction. The shift from an era of persistently large deficits to one of greater fiscal restraint marks an important policy transition. This change will likely introduce a period of economic adjustment as the economy adapts to reduced levels of government spending. Although the journey from large fiscal deficits to smaller ones may be unpleasant, we’re hopeful and clear-eyed about the risk management we’ve built into our clients’ portfolios.

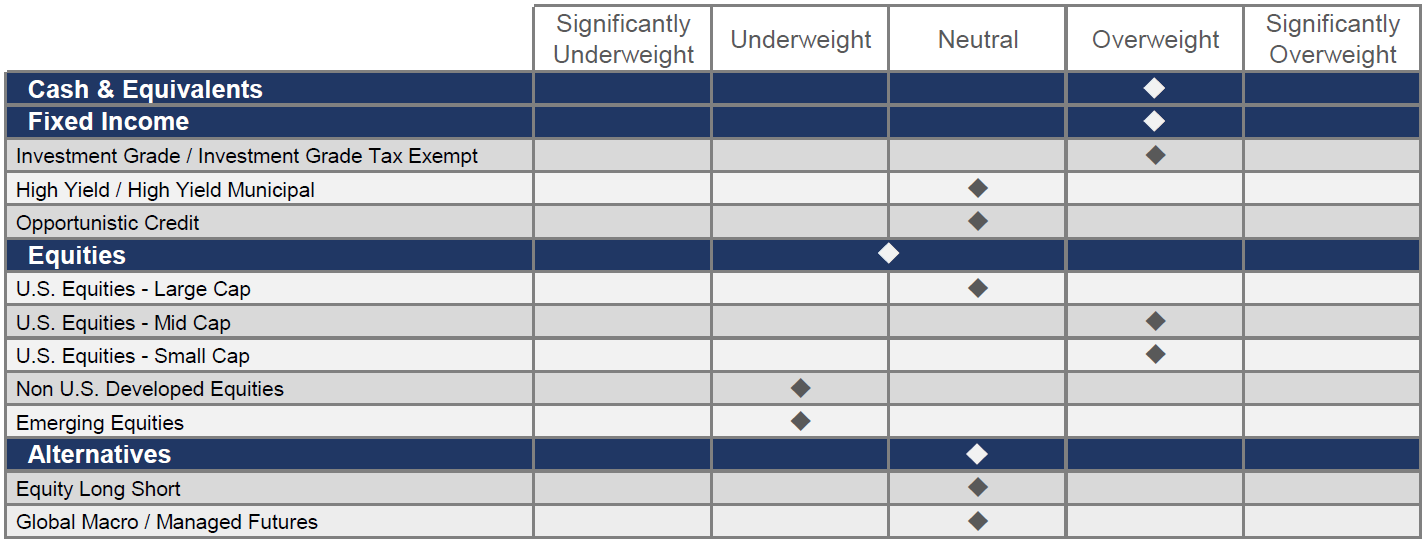

Our Asset Class Views

Given the degree of regulatory and legislative uncertainty introduced by the new administration, we continue to believe that maintaining an overweight position in both investment-grade fixed income and cash is prudent.

Despite recent pullback in large-cap equities, valuation levels don’t justify moving beyond a neutral weight allocation. With that said, we remain constructive on small- and mid-cap equities as we believe these segments stand to benefit from a lighter regulatory environment and a probable uptick in mergers and acquisitions.

While international equities are attracting renewed attention (something we haven’t seen in quite some time), we remain wary. Though increased defense spending in Europe may boost certain segments of economic activity, we would caution that military expenditures aren’t inherently productive even if they contribute to GDP growth.

For years, Europe benefited from the security umbrella provided by the United States, allowing greater spending on social priorities like education and healthcare. That dynamic is now at risk. With the U.S. commitment to the North Atlantic Treaty Organization (NATO) in question, European nations may be forced to redirect funds away from domestic programs and toward rearmament, presenting long-term fiscal and political challenges.

FIGURE 3

Source: FineMark National Bank & Trust

Note: These are our current, broad views on the major asset classes employed in family allocations. Due to the high degree of customization FineMark provides, these views won’t be uniformly expressed in every portfolio.

Thank You for Your Unwavering Confidence

At FineMark, we understand that heightened market volatility often brings uncertainty and discomfort. Rest assured, our team is well-equipped to steer every portfolio through periods of change and instability; we’ve navigated challenging environments like this before.

In this rapidly evolving environment, we’ve increased the frequency of our communications to help provide context and clarity around unfolding developments. We delight in our conversations with you, welcome your questions, and remain committed to helping you make informed, confident decisions. If there’s anything you’d like to discuss, please reach out any time. We’re always here to help.

2025 First Review and Commentary

By Christopher Battifarano, CFA®, CAIA

Executive Vice President & Chief Investment Officer

Articles In This Issue:

Estate Planning for Young Families

Download 2025 Q1 Newsletter Here