“In this business, it’s easy to confuse luck with brains.”

—James Harris Simons, hedge fund founder, mathematician, and philanthropist (1938-2024)

In 1988, Jim Simons founded Renaissance Technologies, one of the world’s most successful quantitative hedge funds. Between 1988 and 2018, when it closed to outside investors, the fund’s flagship strategy, Medallion, generated an average net return of 39.1%. When Jim passed away, his estimated net worth was $31.4 billion, making him the 55th richest person in the world.

In May 2024, the world lost one of its greatest mathematical minds, Jim Simons. During the Cold War, after earning a bachelor’s degree in mathematics from the Massachusetts Institute of Technology and a PhD in mathematics from the University of California, Berkeley, Jim worked as a code breaker for the National Security Agency. Later, he used his ingenuity to develop highly successful trading algorithms, and applied quantitative trading strategies across various markets, eventually creating the most successful hedge fund strategy in the world: The Medallion Fund at Renaissance Technologies. Clearly, Jim understood markets and trading better than just about anybody. As he passed away in 2024, we wanted to remember his wisdom, and thought the past two years, where the S&P 500 has generated a cumulative return of nearly 60% a timely moment. Historically, this gain is approximately three times what market returns have typically been over similar two-year spans.

We believe it’s sensible to heed Jim’s words and advise our clients not to confuse the fortunes of this robust market-return period with intellect. When anomalous market events develop, we encourage our clients to take the profits, pay the taxes owed, and rebalance their portfolios. This type of discipline is key to successful risk management, preventing portfolios from becoming over concentrated or falling prey to outsized volatility risks.

While we can’t pinpoint exactly when it will happen, we know this bull market run will eventually end—they all do. When the bear market reemerges on Wall Street, those who haven’t rebalanced proactively will endure deeper portfolio losses. Savvy investors know that waiting until a bear market appears before recalibrating can cause permanent capital losses.

This serves as a reminder of prudence towards risk management and should not be misinterpreted as our having a gloomy outlook for the coming year. Looking at history back to 1879, this is the tenth instance we’ve seen consecutive annual returns greater than 20%. On those previous occasions, the third year was positive more often than not, however there can be no assurance of a positive year three return. We simply recognize the last two years as an extraordinary period in U.S. equities—after all, we’re in the business of capitalizing on opportunities, not ignoring them!

2024: The Fourth Quarter and the Year

When compared to historical norms, U.S. equity investors will remember fondly the fourth quarter of 2024, the entire year, and in fact the two-year period beginning in January of 2023, as periods of outsized returns. Any uncertainty the market had regarding the 2024 presidential election quickly dissipated: president-elect Donald Trump garnered more popularity at the ballot box this year than he did during his two previous bids. Anticipating his promise of lower corporate taxes along with a reduced regulatory framework, the markets celebrated his return to the White House.

In both bond markets and international equity markets, Trump’s return was met with caution as he vowed to follow through on his promises to enact sweeping global tariffs. While China received most of his ire, he also has targeted Canada, the European Union and Mexico, America’s largest trading partners and the world’s largest economies. As this situation develops market participants will anxiously observe.

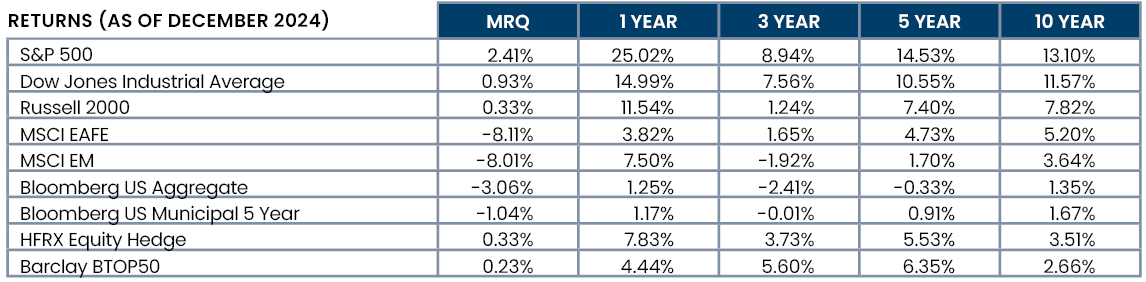

Within our alternatives solution set, both commodity trading advisors and long/short equity performed well, generating modest profits for the period. While the total returns weren’t standouts, we’re reminded of the correlation and diversification that these solutions bring to portfolios (see Figure 1, below).

FIGURE 1

Source: eVestments

Review & Outlook

In hindsight, some might use the Wall Street saying “The easy money has already been made” to characterize equity market performance over the past two calendar years. This phrase is one we detest because there’s no such thing as “easy money.” During this same two-year period, the Federal Reserve and central banks around the world embarked upon a ferocious pace of rate hikes to try and control historic post-Covid inflation rates. * These actions had economists and market prognosticators convinced that a recession was imminent.

Instead, the U.S. experienced a prolonged period of historically low unemployment along with well-above-average economic expansion rates. Additionally, equity markets hit new highs as they followed the upward trajectory of corporate earnings. Welcome to economic soft-landing nirvana!

Now, at the onset of 2025, a different group of circumstances lies before us, one with several governments set to experience transfers of political power. Many elections were held worldwide in 2024, and the common theme among them was incumbents losing. Some examples included France, Japan, the United Kingdom, and the United States. Within the next nine months, new elections will take hold in the major economies of Australia, Canada, Germany, and South Korea, with the trend of incumbent losses expected to persist.

The issues causing voters to revolt against incumbent parties are similar regardless of geography. Inflationary pressures are eroding consumers’ purchasing power worldwide as wage growth is outpaced by the rising costs of daily life. Additionally, people see the social safety net of government entitlement programs likely reneged upon as baby boomers retire and begin to collect on those promises, thus shifting the burden of obligations to a smaller base of taxpayers who feel maligned. The global populist movement that we believe got underway in 2016 with the UK vote to Brexit continues to this day, and in some cases, is accelerating.

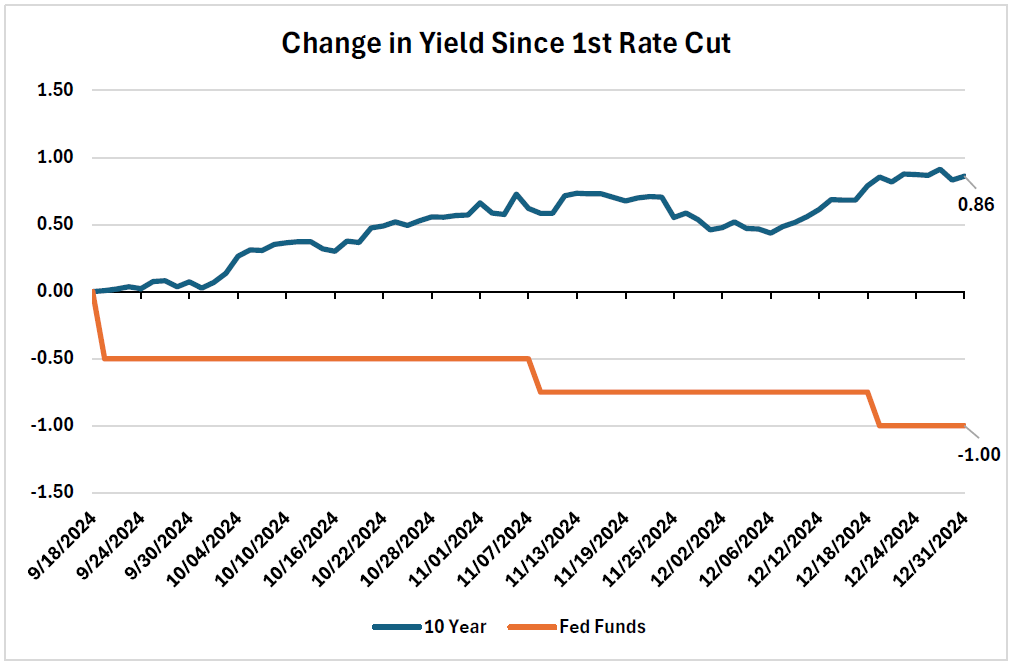

Outside of politics, we see the Fed moving toward a more moderate rate cutting pace (if not halting cuts entirely). Beginning in September 2024, the Fed made consecutive cuts to the Fed Funds rate, reaching a cumulative total of 100 basis points (1%) thus far. Data that showed the rate of inflation slowing and moving toward the Fed’s 2% long-term target, combined with modest weakness in labor markets, drove the Fed’s decision.

Though not widely discussed in the public domain, we believe another driver to the Fed cutting rates was their desire to normalize the yield curve, which had been inverted for nearly two years. This abnormal economic condition, wherein short-term rates are higher than long-term rates, upended traditional-spread lending models (where banks borrow short and lend long) rendered them unprofitable.

Consequently, a more capital-constrained environment materialized as bank debt became harder to obtain. The recent shift in rates has rectified this condition; we’ve seen a re-rating in bank shares as a result (e.g., the KBW Bank Index rose more than 22% within the past six months). It’s important to note, however, that such a reduction in debt capital will slow economic growth and new business formation. The Fed’s cuts combined with the bond market selloff have normalized the yield curve to reflect a positive term structure of rates.

As you may recall, during 2022-23, bonds were under severe price pressure as rates rose. Since then, they’ve rallied as the Fed pivoted and finally cut rates in September (see Figure 2, below). Still, the inflationary impacts that new tariffs could bring are troubling to the bond market as such effects may require the Fed to adjust monetary policy accordingly. The bond market is pricing in higher long-term rates as a result.

FIGURE 2

Source: FactSet

This scenario helps answer a frequently asked question: “Why are mortgage rates higher when the Fed is simultaneously cutting rates?” The answer: Mortgages, which are long-term obligations, are priced off of long-term reference rates, not overnight rates.

Recent data suggests the economy is on stable footing, with Gross Domestic Product (GDP) having grown at 3% for the past several quarters (and on track to do so again in Q4), significantly ahead of the long-term U.S. trend growth of 2%. The labor market, while not as strong as it had been due to the recent rise in unemployment, remains healthy. Risks of a recession in the near term have abated and S&P earnings growth expectations for the coming year are running in the mid-teens, about double the historical, normal expectations of growth.

*History suggests that high inflationary periods are generally preceded by echo waves, and initial efforts to quell inflation typically don’t vanquish it from the system.

Rekindled Inflation Risk

There’s renewed risk around how a new set of tariffs introduced against our largest trading partners could impact the economy. Given the large trade deficit the U.S. runs with its partners, imported goods could become more costly. These costs, of course, would be borne by American consumers, who comprise nearly 65% of our economy. Headwinds faced by that cohort could have broad, negative ramifications.

These risks could also be fueled by the rapid rise in risk asset prices. This scenario applies to equities and other areas of the market that have experienced speculative excess. The most obvious of these is cryptocurrency.

Bitcoin, the most prominent and recognized digital currency, rose well over 100% in the last year, its adoption pace accelerated by the Securities and Exchange Commission (SEC)’s approval of several spot Bitcoin exchange-traded funds (ETFs) earlier in 2024. A new audience of investors preferring the ownership ease of ETFs over cumbersome digital wallets. Many also viewed the SEC’s approval of these ETFs as a tacit endorsement of cryptocurrency writ large.

According to a recent report by Henley & Partners, more than 172,000 individuals globally now hold over $1MM USD in crypto assets. This newfound wealth will undoubtedly lead these newly-minted millionaires to spend at higher rates. Further gains in cryptocurrencies don’t seem far-fetched when we consider the comment made by president-elect and newly named TIME 2024 Person of the Year Donald Trump to CNBC’s Jim Cramer at the New York Stock Exchange in December: “We’re gonna do something great with crypto….”

Beyond typical election-year political promises, the incoming administration’s cabinet picks view crypto more favorably than the incumbents’ holders of these posts. Trump’s future cabinet members include Scott Bessent, a pro-crypto hedge fund manager and Treasury Secretary designee; Paul Atkins, a strong backer of crypto who’s been tasked to lead the SEC; and David Sacks, PayPal’s former Chief Operating Officer and crypto evangelist, whose advisory role (he’s been dubbed the “White House Artificial Intelligence and Crypto Czar”) essentially makes him responsible for reshaping U.S. policy on digital currency.

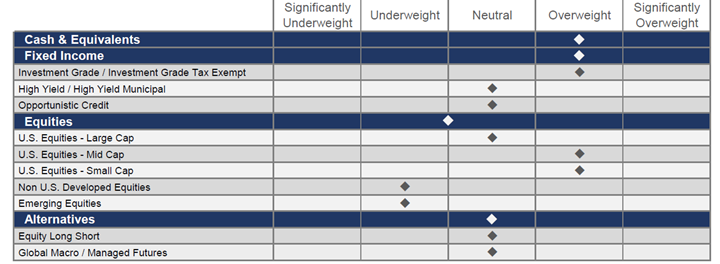

Our Current Tactical Positioning

While our positioning hasn’t changed since last quarter’s letter, many of our previously-held views have grown in conviction. Most notable are our overweight positions in both U.S. small-cap and mid-cap equities.

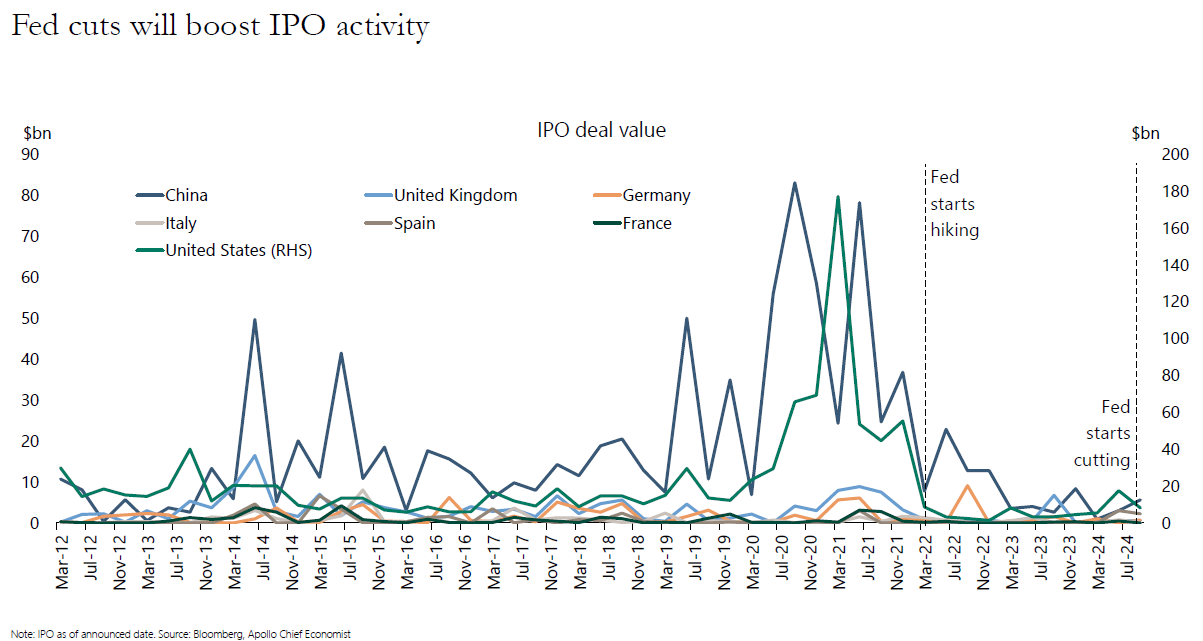

In our view, the Fed rate reductions, could bolster the value of asset prices, which will reopen the window for Initial Public Offerings (IPOs), also encouraging more mergers and acquisitions activity. Note: The IPO market has essentially been closed since the Fed started hiking rates in 2022. (See Figure 3, below.)

FIGURE 3

Source: Strategas Securities, LLC

Our positive view on these asset classes is further buttressed by the expectation that Trump’s administration will take a more laissez faire approach to regulation. Clearly, the pendulum had swayed too far toward disallowing such pursuits, particularly in the areas of commercial aviation and “accessible luxury” handbags. * While this regulation was carried out under the guise of consumer protection, it’s unclear whether American consumers reaped any real benefits. Perhaps, the newly created Department of Government Efficiency (DOGE no we can’t believe the name either) could contribute to a more pro-business environment, where government resources are directed in an economically sensible way, something both Democrats and Republicans should view as a positive development.

*Notably, the nixed proposed mergers between JetBlue Airways and Spirit Airlines, and luxury fashion groups Tapestry, Inc., and Capri Holdings Limited.

Elsewhere in our asset allocations guidance, our underweight position in non-US developed market equities is long held. While this positioning has been correct, our conviction in this view continues despite the prolonged outperformance of U.S. markets over international peers and more attractive pricing abroad than at home. We perceive headwinds such as those faced by the German economy to be challenging to overcome, despite historically attractive valuations.

Many years before the 2022 Ukraine invasion, Germany, an industrial powerhouse and the growth engine of the European economy, ignored clear signs that partnering with a Putin-led Russia would be disastrous, and foolishly decided to rely mainly on Russian oil and gas for its energy. Then, following Japan’s 2011 Fukushima Daiichi nuclear disaster, this choice was exacerbated when Germany shuttered its nuclear power generation capacity in the name of public safety.*

Compounding matters, Germany’s export-led economy is heavily dependent on China as an end market for its finished goods. This worked well as the Chinese economy was growing at a blistering pace during the early 2000s. However, post-Covid, the Chinese economy has sputtered. On top of it all, the matter of renewed tariffs could make German-produced exports (largely automobiles) unattractive compared to American-produced products, further harming the German economy.

Potentially aggravating the situation further is Trump’s demand that Europe increase its national defense spending in an effort to distribute cost burdens more equitably among member states, or risk the U.S. pulling out of the NATO security agreement. Trump, and prior US presidents have surfaced this issue in the past, and we would suspect he will do so again in his second term. In light of these many uncertainties, we continue to advocate for an underweight position in developed market equities.

Overall, we’re optimistic about the U.S. and its prospects. Although, we view the lifted valuations in the large-cap segment of the market to be a risk, where even small misses in growth expectations could lead to outsized price losses due to higher-than-normal price-to-earnings (P/E) multiples.

* In evaluating this decision, it’s important to note that while Japan is highly susceptible to seismic activity, Germany’s earthquake risk is little to none. The accident at Fukushima Daiichi was caused by a 9.1 magnitude earthquake, which subsequently created a tsunami, producing a 40-foot wave that inundated the nuclear facility.

FIGURE 4

Source: FineMark National Bank & Trust

Note: These are our current, broad views on the major asset classes employed in family allocations. Due to the high degree of customization FineMark provides, these views won’t be uniformly expressed in every portfolio.

Happy New Year

As we enter January, we wish all our clients and friends a happy and healthy 2025. In the coming months, we’ve scheduled several office events and look forward to seeing you there! As always, we’re grateful for the trust you place in us, are honored to act as the steward of your assets, and endeavor to earn that trust every day. Thank you for your continued support and faith in FineMark.

2024 Fourth Review and Commentary

By Christopher Battifarano, CFA®, CAIA

Executive Vice President & Chief Investment Officer

Articles In This Issue:

How Do I Leave my Bitcoin (or other cryptocurrencies) to my Heirs?

Download 2024 Q4 Newsletter Here