—Ray Dalio, founder and Co-Chief Investment Officer of Bridgewater Associates. Started in 1975, Bridgewater operates one of the largest hedge funds in the world. Over its history, the fund has produced strong returns not correlated with the broad equity market, serving Dalio and his clients well. Currently, Dalio’s estimated net worth is more than $14 billion.

Ray Dalio’s wise observation in the quote above resonates with us at FineMark and aligns perfectly with our viewpoints around wealth management. As you know, our investment philosophy focuses on building portfolios for the long-term rather than playing the senseless Wall Street game of foretelling market movements and earnings reports. To accomplish this, we scour the world to find compelling investment strategies, searching across a range of geographies, asset classes, and methodologies. Next, we follow the practice that has become our hallmark: after getting to know you through a series of authentic conversations, we work with you to define your goals and develop a plan to achieve them, making note of your ability and willingness to bear risk. Then, we combine these active and passive strategies in a manner that matches your unique risk tolerance.

The strategies we bring to our personalized portfolio design process have varying degrees of correlation to one another. When these various strategies are ultimately combined, the resultant portfolios are not reliant on any singular binary event. Instead, their risk profiles are robust, resilient, and capable of delivering returns across various market conditions. As markets evolve, we continually adapt our strategies based on market and economic realities. We leave the prognostications to Wall Street.

We’re in the Home Stretch

Despite falling far short of the market’s rate cut expectations for 2024, the Federal Reserve cut rates by 50 basis points (one half of a percent) in September, ending their pause, which began in July of 2023. While more cuts are likely to come in the fourth quarter, the market’s expectation of six to eight cuts in 2024 (made at the onset of the year) will clearly fall short.

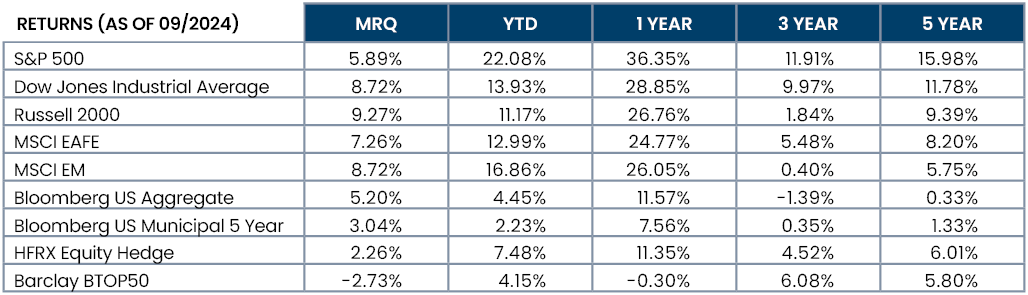

Despite this considerable shortfall, we continue to see strong equity market performance in our domestic market and abroad. Domestically, this is evidenced by the S&P 500 Index rising over 22% in just nine months.

While results are not as eye-popping abroad, they’re still strong. Even China, which has suffered three consecutive negative years in its equity markets, has finally become a positive contributor to returns in 2024, up nearly 30% this year. This increase comes on the heels of another massive government-led stimulus program meant to jumpstart China’s languishing economy. While we don’t currently believe these actions will help overcome the profound structural issues China is facing, in the near term it’s startled the market, driving prices higher.

Since spring we’ve seen relief in bonds, a welcome sight for investors. Bond prices, which suffered through the rate hiking phase begun in 2021, finally rose following the anticipated rate shift. We believe bonds will continue to represent good value. While significant appreciation has occurred, clients who begin taking more duration risk will be well served as cash yields drop. Additionally, we do not expect a return to the zero interest rate regime that existed from 2007 to 2022, however, current level cash rates still have room to fall.

Similarly, our alternatives continue to execute well. While their inclusion in portfolios may feel less compelling in such an ebullient equity market, the outsized performance seen in equities since January 2023 (with the S&P 500 Index up over 54%) isn’t a permanent condition. We must be prepared for a mean reversion at some point.

FIGURE 1

Source: eVestment

National Debt and the U.S. Economy

Based on the questions we’ve received most often from clients; two topics are top-of-mind: the U.S. national debt and the state of the U.S. economy. We’ll attempt to tackle both subjects succinctly in the next few pages of this newsletter.

The Growth of the National Debt

The United States deficit spending is running at approximately 6.3% of Gross Domestic Product (GDP), a pace that’s obviously unsustainable over any extended period of time as it significantly outstrips our long-term economic growth rate. Given that both sides of the political aisle have a proclivity for spending taxpayers’ money, we expect this trajectory to continue for the foreseeable future.

In Washington, D.C., deficit hawks are an endangered species, and the real-world impacts of this behavior are coming into view. As rates have risen, so has the cost of servicing the debt. Federal interest costs as a percentage of GDP are estimated to hit a record 3.2%.

FIGURE 2

Source: OpenAI. (2023). ChatGPT (Mar 14 version) [Large language model] .

We believe some of these potential cuts will be positioned as changes to entitlement programs such as Medicare and Social Security. Revamping the programs by possibly raising age eligibility requirements and cutting benefit eligibility for certain individuals may be used, as well as other methods that will make these programs less generous than they are today. To limit negative blowback from the public, such actions will be targeted toward younger Americans who are years away from eligibility.

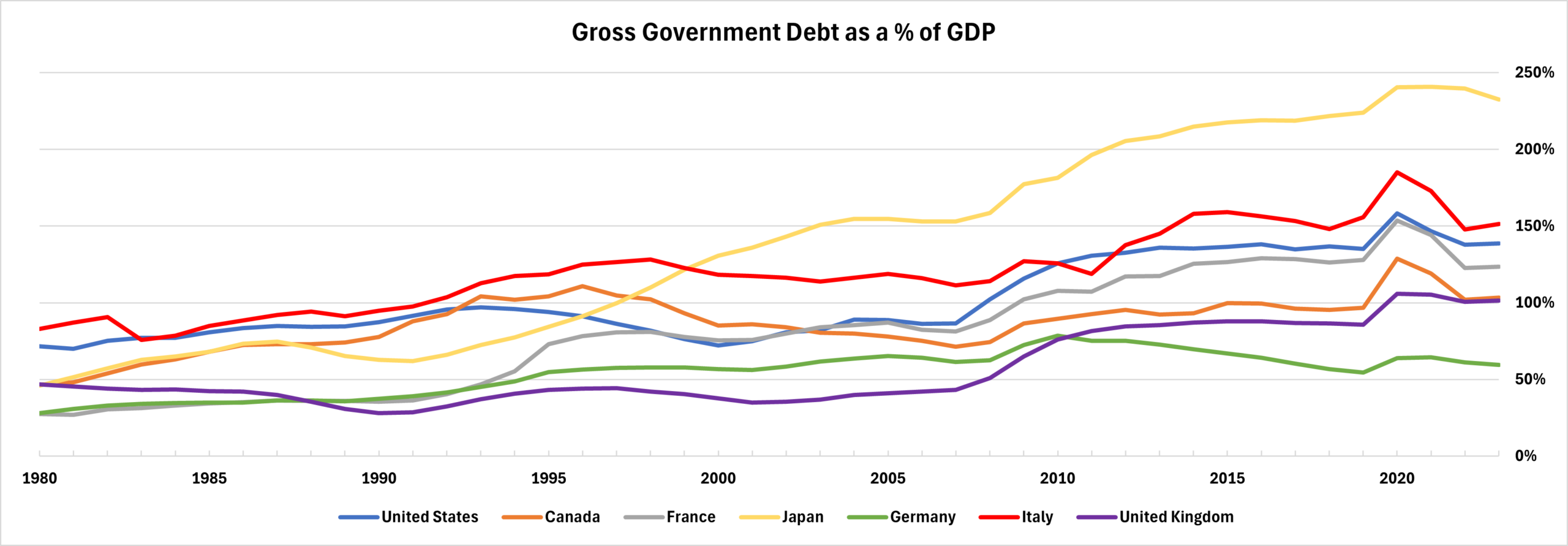

Figure 3, below, compares the United States’ debt to the debt of other major economic global powers. Roughly, we’re in line with the rest of the world, however far less indebted than Japan. Keeping in mind that the U.S. is the world’s reserve currency (a byproduct of being the largest economy in the world), our nation has a greater ability to finance its economy than other nations.

FIGURE 3

Source: Oxford Economics

While it’s a fact that the U.S. has a debt problem, it’s not drastically worse than the rest of the industrialized world. Our nation’s debt could easily continue for a decade at current deficit rates. While we can’t predict what precisely may happen, envisioning the occurrence of a debt crisis in either the European or Japanese markets seems realistic within that same 10-year timeframe.

If such a crisis does happen, the U.S. will become an even greater safe haven to the globe’s capital than it is today. Furthermore, a byproduct of that potential future event will be a massive capital flight benefiting the United States as foreign investors would buy our debt, thus making it cheaper to finance America’s debt. In summary, while our debt situation isn’t good, it’s likely to carry on for a long time before Congress finally addresses it.

State of the Economy

Overall, the U.S. economy is in good shape today, and the often touted “soft landing” may be at hand. While we doubt we will see a group photo of Fed presidents standing in front of a banner that reads “Mission Accomplished” anytime soon, thus far on balance, it appears they may have stuck the landing (pardon the pun).

As students of history, we believe that the inflationary pressures we just lived through could reappear in the future. Historical precedence in U.S. and developed economies globally shows that a large inflationary wave is typically followed by subsequent echo waves. Our macro research providers at Strategas Research Partners, have looked at inflationary patterns in two dozen countries over the past century and have found a high incidence (9 out of 10 times) of a second wave.

One area where both sides of the political aisle agree is that our nation’s reliance on China as an export partner must be reduced, particularly on goods that have a national security component (e.g., pharmaceuticals, certain high-value semiconductors, and certain minerals). During this election season, both Trump and Harris have made competition with China a core component of their stump speeches, and the American public seems to understand their rationale.

Essentially, the policy proposes that the U.S. pivot away from optimizing only for low cost on the production of goods, thus ending the migration of a significant component of American manufacturing capacity to China that has occurred over the past 30 years. This pivot began with a series of tariffs placed on China by President Trump. President Biden has continued this policy, and used this reasoning for the passage of recent legislation, including the CHIPS and Science Act of 2022.

Our sense is that this plan, which is part of our long-held deglobalization theme, will be inflationary by its very nature. In fact, we suspect it could sow the seeds of a future inflationary flare-up, and believe most Americans are unaware of this knock-on impact.

The process of deglobalization will not only drive a renaissance in American manufacturing, but also a newly minted term, friendshoring (e.g., increasing trade with our friendly neighbors, Mexico and Canada). The push for more trade there will be for lower value goods than those that will migrate to the US. The costs of diversifying our supply chain and bolstering national security will be significant. In essence, within the U.S. we need to replicate the means of production that already exists abroad. By its very nature that action is inflationary.

As the market generally doesn’t agree with this idea of an echo wave of inflation today, we consider this notion of a second wave of inflation to be a “non-consensus view.” The upshot: the process of the Fed moving from a restrictive to a neutral policy could be interrupted, leading to higher than currently forecasted interest rates.

Other Inflationary Impacts

United States demographics are another factor that could contribute to a second inflationary wave. Currently, the U.S. is in the midst of a massive retirement surge as its largest, most productive, highest earning, and highest saving generation, the baby boomers, leave the workforce. This migration, underway since approximately 2012, will be largely complete within six years. As a result, this population will stop being large taxpayers and become new recipients of entitlement programs such as Medicare and Social Security.

Additionally, this retirement wave will be followed by the smaller Generation X, leading to a lack of skilled labor in the future. If the demand for workers grows (which it undoubtedly will), this condition will be further exacerbated through deglobalization and the need for more domestically supplied skilled labor.

Does this mean hope is lost? Thankfully, not in the U.S., as boomers gave birth to the millennial generation. However, the skills gap between retiring boomers and the lesser-skilled millennials is problematic. Over time, however, this issue will be resolved, and immigration will help if it’s done right.

Unfortunately, that’s not the case for China, Europe, Japan, the United Kingdom, and the rest of the developed world. Once their boomers retire, they won’t have a large enough replacement generation, leaving these nations in a greater structural population decline.

Additional Economic Data Points

As mentioned earlier, the Fed started moving off its restrictive policy posture with a reduction of the Fed Funds rate by 50 basis points, moving toward a neutral policy. Unlike prior periods, where rates were cut as policy makers saw an economy in contraction, this cut was driven by both a reduction in inflation and a modest softening of the labor market owing to significant immigration. We believe there’s more action to come. Ultimately, to arrive at a neutral policy rate, the Fed Funds rate will fall to between 3-3.5% in the next 12 to 18 months.

In August, the Personal Consumption Expenditures (PCE) Index, a measure the Fed focuses on to gauge the cost of goods and services, fell to 2.2%. You may recall that the Fed targets a 2% level, which they define as “stable prices.” At its peak, PCE was running at 7%, indicating considerable progress has been made in the effort to lower inflation.

Meanwhile, the economy grew by an annualized rate of 3% in the second quarter and is currently tracking at 2.5% according to the Atlanta Fed’s GDPNow forecasting model. These are impressive growth numbers and are above the U.S. economy’s long-term growth rate.

One negative issue we’ve observed, and subsequently discussed at our most recent Investment Policy Committee meeting, is a dynamic indicating a bifurcation in the U.S. economy. This bifurcation exists between those who’ve benefitted from the rise in asset prices (including financial assets such as stocks and bonds, as well as real estate) and those who have not. Those benefitting from asset price appreciation have continued to spend. In contrast, those who haven’t benefitted are beginning to significantly slow spending on discretionary items such as dining out and retail expenditures. However, the reduction in rates will lower the cost of borrowing for American consumers and should provide this latter group with a boost.

While the job market remains strong, unemployment has ticked up modestly to 4.2% today. While this number is low by historical measures, it’s higher than it’s been in the recent past.

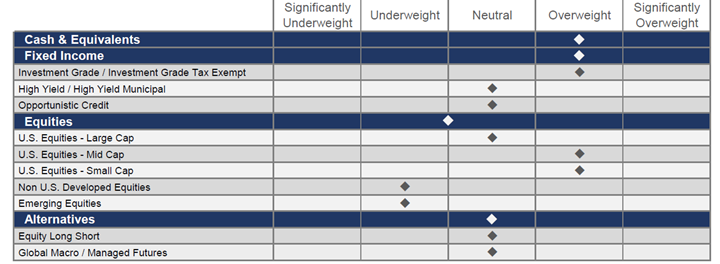

Our Current Tactical Positioning

When recently reviewing our asset class guidance, our Investment Policy Committee determined that cash and investment grade fixed income continue to be attractive due to the elevated yields available. Given our expectation that cash yields will continue to fall over the next four to six quarters, we’re moving some of our cash allocation into our investment grade fixed income allocation, essentially extending its duration to safeguard against the risk of falling short-term rates in the future. We also remain cautionary on international equities, as elevated macroeconomic and geopolitical risks abroad lead us to limit our exposure there. While valuations are markedly lower than those observed in our domestic market, some of the valuation discrepancy is justified by lower growth rates and lower returns on equity.

FIGURE 4

Source: FineMark National Bank & Trust

Note: These are our current, broad views on the major asset classes employed in family allocations. Due to the high degree of customization FineMark provides, these views won’t be uniformly expressed in every portfolio.

The Year is Coming to a Close…

As autumn leaves begin to fall, we look forward to welcoming many of you back home. We’ll be hosting several events at our offices this season and we’d love for you to join us! As always, we’re grateful for the trust you place in FineMark, are honored to act as the steward of your assets, and endeavor to earn that trust every day. Thank you for your continued support and faith in us.

2024 Third Quarter Review and Commentary

By Christopher Battifarano, CFA®, CAIA

Executive Vice President & Chief Investment Officer

Articles In This Issue:

Download 2024 Q3 Newsletter Here