— Former professional tennis player Roger Federer delivering a recent commencement speech to Dartmouth College graduates. Having won 20 Grand Slam singles titles before retiring in 2022, Federer is one of the world’s all-time greatest tennis players.

The Roger Federer quote above, taken from his June 2024 commencement speech in Hanover, New Hampshire, is sound advice for investors as well as recent college graduates. His words remind us not to let momentary setbacks steer us away from our long-term objectives.

In today’s hyper speed, 24-hour news cycle, market events are continually highlighted. Positive and negative short-term market movements are noted throughout each day, becoming more pronounced in election years such as this one. Research shows that investors who react to these daily gyrations by impulsively buying or selling are likely to do more harm than good to long-term portfolio results. As Federer noted in his speech, you can’t dwell on losing the last point. Instead, it’s important to remain focused on the task at hand: winning the next point, the next game, and eventually, the match.

Wise investors regularly heed this advice and don’t worry about that latest market gyration. They concentrate instead on their broader goals and objectives. They don’t let short-lived negative news or price actions distract them from the big picture. They focus on maintaining a portfolio that’s built to last, that is diverse in its factor exposures and contains multiple risk drivers that will generate results regardless of how the market fluctuates.

At FineMark, this is exactly the approach we take. When building each customized portfolio, we consider our clients’ unique needs and wishes. Our process isn’t “easy” or designed to be “one-size-fits-all.” We know that successful investing requires skilled professionals who will take time to understand our family’s needs, as well as their individual concerns, values and time horizons.

We’re Halfway There

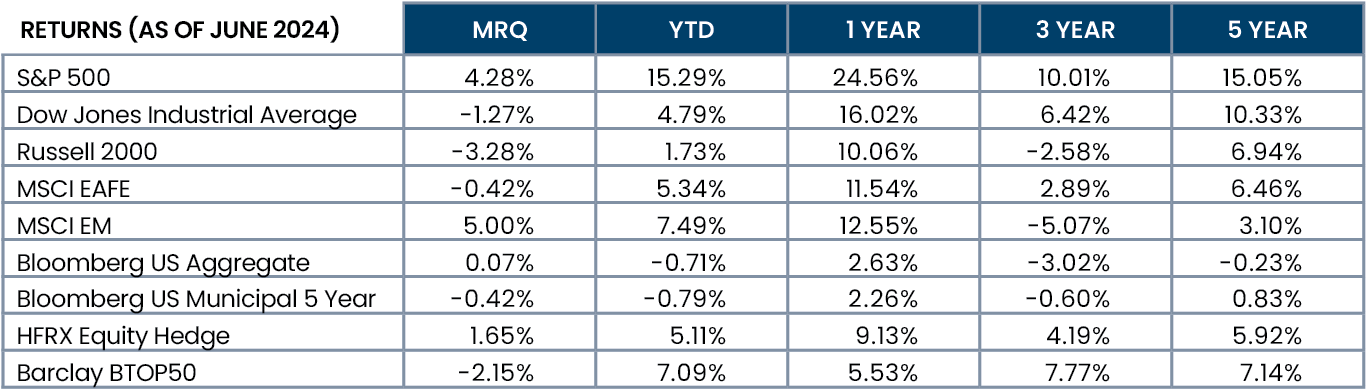

Price appreciation and consistent performance have continued, maintaining the tone set in the first quarter of 2024. To date, we’ve seen little equity market volatility and, in terms of price action, a nearly uninterrupted strong upward trend (most notably in large cap equities), with the S&P 500 Index appreciating over 15% YTD. Despite lagging significantly, small cap equities posted positive performance and the Russell 2000 small-cap index rose 1.73% over the same period.

Outside the United States, both emerging and developed international markets posted strong positive performance as well. With that said, developed international markets did experience selling pressure toward quarter’s end, largely due to the unexpected outcome of the European Parliament elections and French President Emmanuel Macron’s subsequent call for snap national elections.

In fixed income, the market seems to be digesting the big price run-up that occurred at the end of 2023 (following the Fed’s October pivot). The first few months of 2024 were challenging. Recently, however, the market has begun to improve. While higher bond coupon rates bring relief to fixed-income investors who endured a long spell of zero interest rate policy, this upward move also introduced a period of painful adjustment. As noted in our previous letter, we considered the market’s views on Fed cuts to be overly optimistic. However, those expectations were gradually throttled back given the persistent inflationary pressures and the cautious tone articulated by the Fed.

Within alternatives, commodity trading advisors (CTAs) lost some ground following a big first quarter. These losses were driven by short positions in bonds, which recovered toward the end of Q2. Meanwhile, long/short equity continued to perform well. In fact, we’re seeing significantly greater return attribution from short positions than we have in recent memory.

FIGURE 1

Source: eVestments

Mid-Year Views and Beyond

Coming into 2024, our views on rate cuts were far less aggressive. While the markets were pricing in six-to-seven rate cuts, we were in a two-to-four range with a bias toward the low side of that range. During the quarter, our Investment Policy Committee further trimmed that expectation based on factors that continue to evolve, such as a low and steady unemployment rate (which currently sits at 4.1%) and inflation.

We would have expected the unemployment rate to have risen over the course of this rate hiking cycle. However, that low number has held strong, giving the Fed breathing room from would be labor market criticism of their tightening policy.

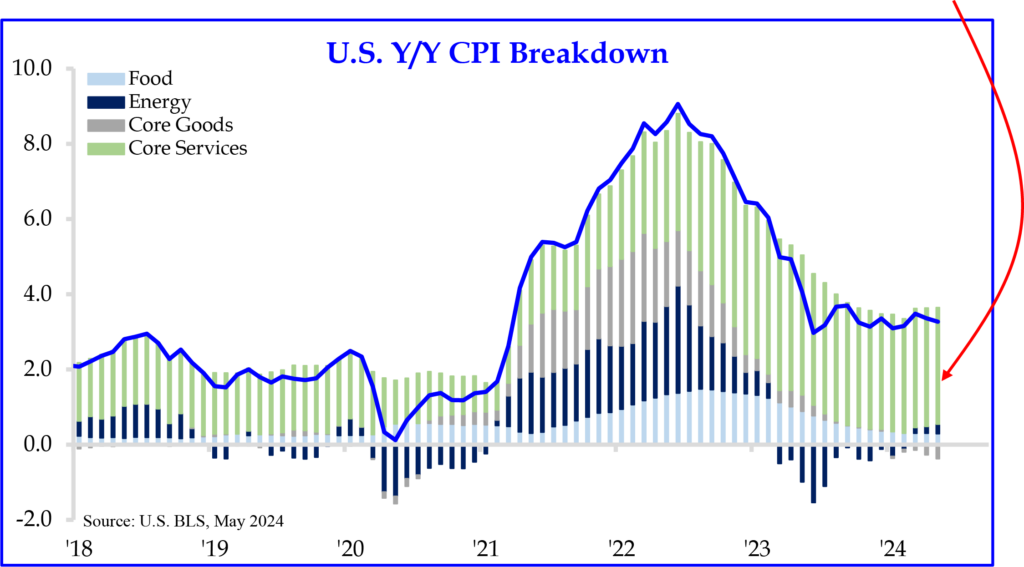

FIGURE 2 – U.S. INFLATION PRIMARILY CONCENTRATED IN SERVICES NOW (Red arrow indicates 07/01/24)

Source: Strategas Securities LLC

As shown in Figure 2 above, the Fed has made meaningful progress reducing inflation. In fact, of the four inflation components (Food, Energy, Core Goods, and Core Services), three have almost completely abated.

The one persistent element, Core Services, is largely driven by the cost of housing. This unwaveringly high reading combined with the breathing room afforded by a low unemployment rate, means the Fed won’t cut rates before it is firmly convinced inflation is retreating (ideally toward the Fed’s 2% target) and not rebounding. Further, we do believe that housing costs will ultimately abate. However, in the face of higher rates, two key factors have buoyed prices more than expected.

First, most mortgage-holding Americans locked in low fixed-rate pricing long ago. Therefore, even if moving into a smaller home suits a family’s needs (in the case of empty nesters, for example), such a move would likely result in a higher mortgage payment at the current rates. This scenario has created a limited selling inventory for homes that otherwise might be on the market. Second, the rental data relied on by the Fed is clearly lagging when compared to real-time data gleaned from providers such as Zillow. Even though rental rates are declining in real time, the Fed data appears latent.

Digging Into Investment Themes

Deglobalization, nearshoring, and the implications of artificial intelligence (AI) on the economy—investment themes we’ve articulated previously—are still unfolding in their early stages. We continue to see evidence that AI will pervade the global economy over the next few years and believe its impact could be on par with revolutionary historical advancements such as the invention of electricity and the telephone. Businesses unprepared to adopt and implement AI solutions will face growing technological and operational disadvantages too great to overcome long-term.

The deglobalization efforts in effect over the past several years show no signs of stopping. While President Biden and former President Trump don’t agree on much, they seem aligned on this topic. With regards to global trade, they both assert that China has prevented America from competing on a level playing field by engaging in unfair and illegal trade practices such as dumping and violating intellectual property rights. Trump and Biden both support using public policy, legislation, and their bully pulpits to address and remedy the situation. When it comes to remedying weaknesses uncovered during the COVID crisis (e.g., vulnerable supply chains), these two ardent nationalists seem determined to out-do each other.

The Election and Your Portfolio

As the U.S. presidential election approaches, the question we’re asked most often is, “How will election results (specifically, whoever is named our next president) influence the market?” While we can’t foresee election outcomes, if the past is prologue, it will be a very close race.

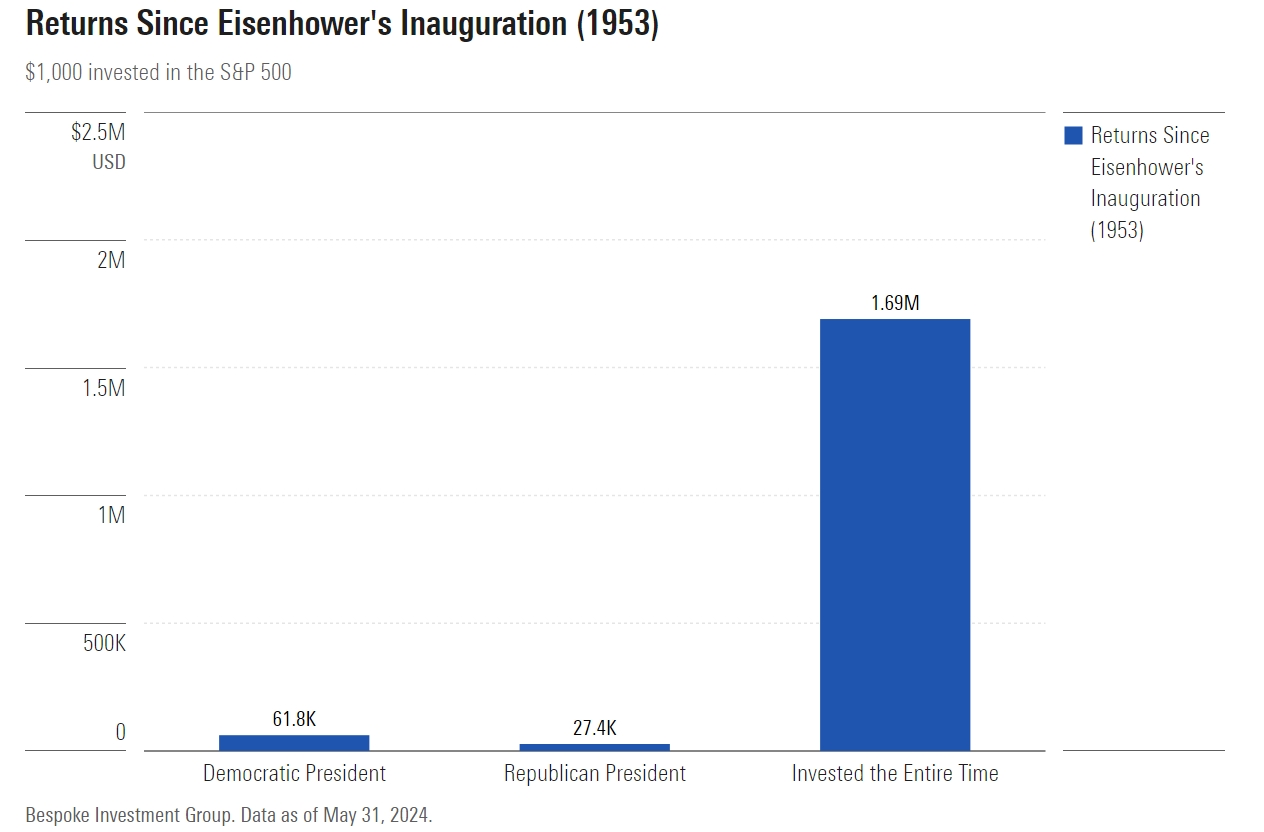

As our regular readers know, we find value in looking to the past for answers about the future. To that end, we found a study that examined 70 years of historical return data, beginning in 1953.

Using $1,000 as the initial investment amount, the study first analyzed what happened when the money was invested in the S&P 500 during a Republican presidency. The investment was sold and held as cash when a Democrat subsequently took office. Then, they conducted the same analysis starting with a Democratic president. The same amount was invested in the S&P 500, then sold for cash when a Republican later took office. Finally, these two scenarios were compared to a third scenario: investing the same $1,000 in the S&P 500 over the entire 70-year period, but never moving to cash. The results are shown in Figure 3, below.

FIGURE 3

Source: Morningstar

As you can see, allowing politics to influence investment decisions can be costly—some might even say foolish—historically.

Leaving the $1000 invested over the entire 70-year span analyzed by the study would have resulted in a portfolio value of nearly $1.7 million! Comparatively, following either of the politically-driven models would have yielded only a small fraction of that sum. Clearly, the wise investor never lets politics drive their investment decisions.

Our Current Tactical Positioning

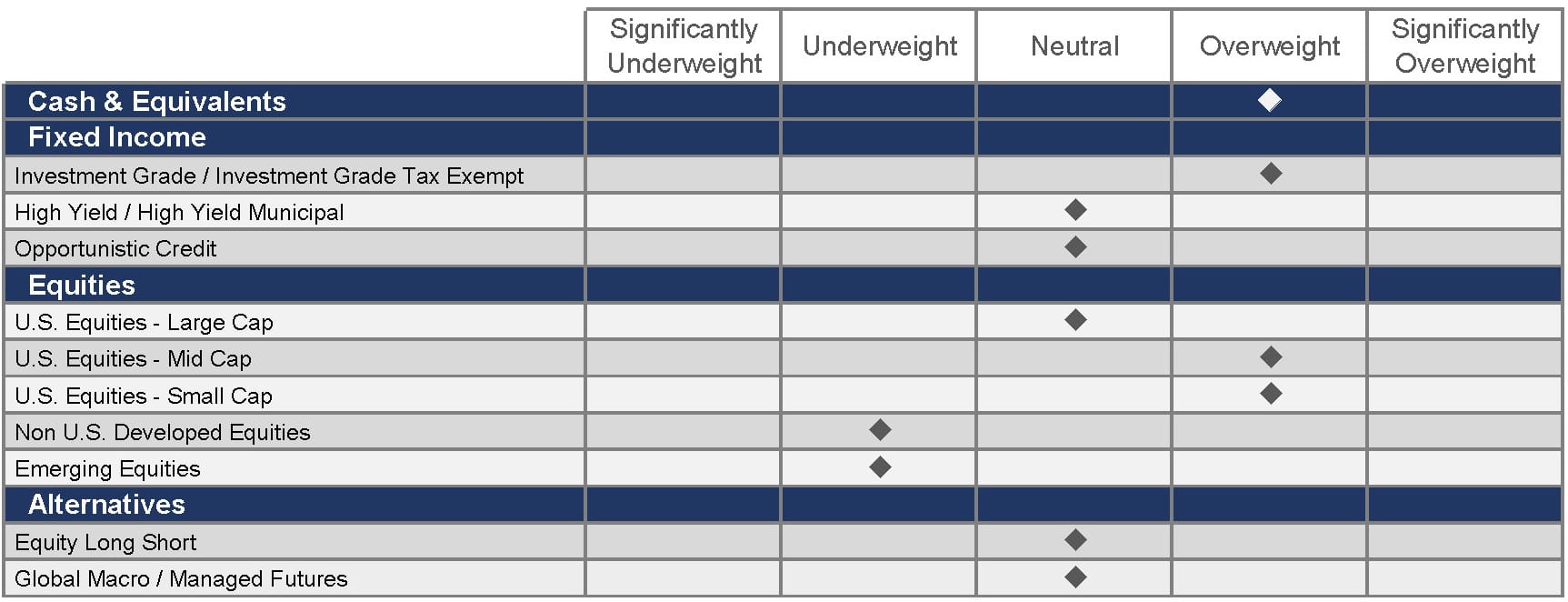

When recently reviewing our asset class guidance, our Investment Policy Committee determined that cash and investment-grade fixed income continue to be attractive due to the elevated yields available. We also remain cautionary on international equities, as elevated macroeconomic and geopolitical risks abroad lead us to limit our exposure there. While valuations are markedly lower than those observed in our domestic market, we don’t find them sufficiently so at current levels.

Additionally, as we’ve identified differentiated opportunities that are generally driven by market anomalies, we continue to advocate the inclusion of alternative assets. Leveraging our unique strengths and experience, we’re able to source and vet these opportunities as they manifest within the marketplace. Note: Before considering these options, clients must be willing to bear the unique risks that accompany these types of investments.

FIGURE 4

Source: FineMark National Bank & Trust

Note: These are our current, broad views on the major asset classes employed in family allocations. Due to the high degree of customization FineMark provides, these views won’t be uniformly expressed in every portfolio.

Have a Great Summer

The Fourth of July marks the mid-way point of summer, with many of you reading this letter from cooler, northerly outposts. As you enjoy the pleasures that summer affords, please remember we’re always available to answer your questions or address any concerns you may have. We welcome the opportunity to serve you and your loved ones whenever needed, and consider it a privilege to do so. Thank you for your continued confidence and trust in us.

2024 Second Quarter Review and Commentary

By Christopher Battifarano, CFA®, CAIA

Executive Vice President & Chief Investment Officer

Articles In This Issue:

Do You Know Who is Inheriting Your Assets?

Download 2024 Q2 Newsletter Here

This material is provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Information is obtained from sources deemed reliable, but there is no representation or warranty as to its accuracy, completeness or reliability. All information is current as of the date of this material and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole. FineMark National Bank & Trust services might not be available in all jurisdictions or to all client types.