We believe the comments quoted above by Poland’s prime minister, Donald Tusk, will prove prescient. Unlike our peers, who have characterized the environment we’re entering as “unprecedented,” we believe this environment, considered with the end of the zero-interest rate regime, indicates the return to a world we’ve previously known: a world where risk bears a cost, be it economical or geopolitical.

While many in our industry have grown complacent to risk, lulled into a false sense of security by a prolonged period of tranquility, at FineMark, we’re keenly aware of its hazards and keep them in mind as we manage and safeguard your wealth. When building portfolios that will stand the test of time, we believe being cognizant of history—and its impacts on capital markets—can be advantageous.

Second Verse, Same as the First

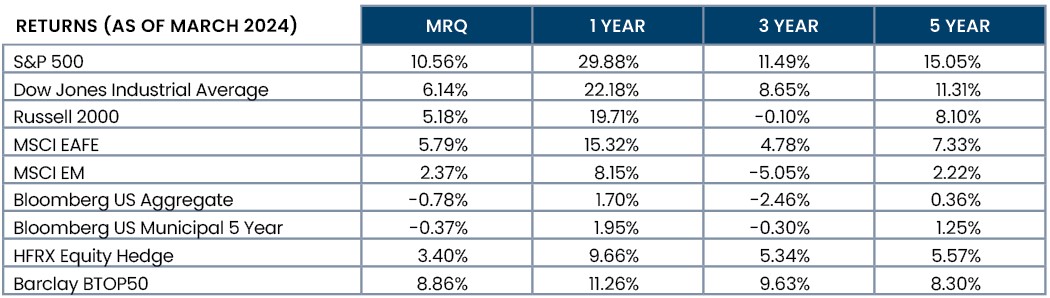

The new year began in a strong, risk-on orientation, a path set forward last fall when the U.S. Federal Reserve pivoted off its 18-month rate-hiking campaign. U.S. equity markets soared to new all-time highs, with the S&P 500 posting a staggering 10.6% return, following the fourth quarter’s impressive 11.7% gains.

Markets are forward-looking mechanisms; the prospect of lower rates translates into lower borrowing costs, a benefit to American consumers. Lower rates would also reduce yields on both cash and bonds, making equities a relatively more attractive asset class.

Across the spectrum, equity market returns were broadly positive, albeit to a lesser degree. U.S. small cap issues (as measured by the Russell 2000) were up over 5%. Outside the United States, international developed and emerging markets were up 5.8% and 2.4% respectively.

After their big year-end rally, bonds took a breather, posting modest losses for both taxable and municipal issues. In keeping with our perspective that higher rates are in the rearview mirror, we’re more constructive on fixed income. We believe this quarter’s showings largely resulted from excessive enthusiasm surrounding rate cuts at the end of 2023, and were not a continuation of the recent bond bear market. As a reminder, the Bloomberg US Aggregate Bond Index rose more than 6.8%, its largest quarterly gain in 34 years.

Within alternative strategies, both long/short equity and commodity trading advisors (CTAs) posted strong positive results. CTAs had an exceptionally solid first quarter, a striking contrast to the weakness they experienced previously.

Gains were also fueled by a massive increase in cocoa prices, which more than tripled in the past twelve months. Spurred by significant supply disruptions in western Africa, home to a lion’s share of the world’s cocoa production, these price hikes brought a boon to commodity traders while simultaneously breaking the hearts of chocolate lovers everywhere.

Figure 1

Source: eVestment

Prepare for Landing

Markets predicted the unfolding of a dovish policy for the new year, setting an expectation of six or seven rate cuts beginning in March. At our Investment Policy Committee meeting in December, we discussed this prediction and determined it did not support economic reality or comments made by the Fed (specifically, remarks surrounding the narrative of “not repeating mistakes of the past” and “re-emerging inflation caused by cutting rates too soon.”).

In contrast, our view anticipated two to four rate cuts beginning in the second half of 2024. We currently maintain that view with a bias toward the lower end of that estimate.

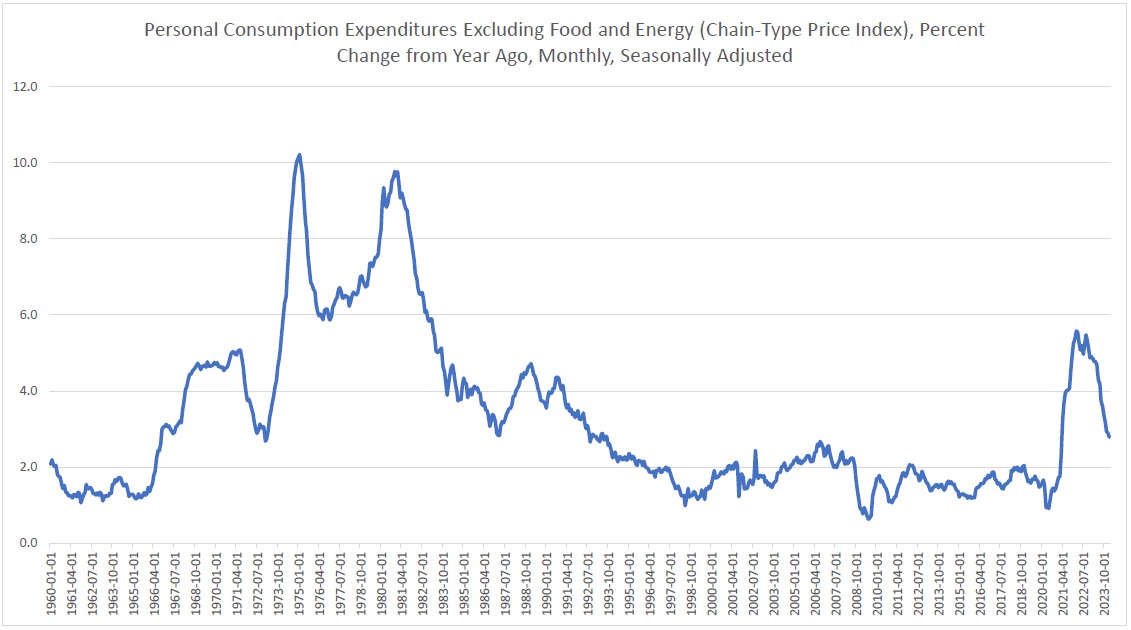

Economic growth, or gross domestic product (GDP), continues to outstrip expectations while the labor market remains resilient and the unemployment rate holds at a low 3.9%. While some inflation indicators have reasserted themselves, Personal Consumption Expenditures (PCE), the Federal Reserve’s preferred mechanism for gauging how much earned U.S. household income is being spent on goods and services, fell from 2.9% in January to 2.8% in February, inching closer to the Fed’s stated 2% objective. This data does buttress the current case; however, whether the ethereal soft-landing scenario the Fed hopes to orchestrate comes true remains to be seen.

Figure 2

Source: FRED Graph Observations

Market Breadth

In 2023, we spent considerable time discussing narrow market leadership. Performance of the market-cap-weighted S&P 500 and the equal-weighted construction of that same index diverged significantly as the Magnificent 7 (a group of technology issues comprised of Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia, and Tesla) vastly outperformed the broader market.

Through the first quarter, however, we began to see chinks in this armor. For example, both Apple (AAPL) and Tesla (TSLA) were lower by 7% and 29% respectively. Meanwhile, other issues continued to achieve impressive gains; most notably, AI chipmaker Nvidia (NVDA) rose over 80%. Other sectors also began contributing to index performance, particularly energy, which was up nearly 14% for the period.

Soon, we expect the Magnificent 7 moniker will be retired, following the direction of its predecessors including the FAANG (which featured U.S. technology giants Facebook, Amazon, Apple, Netflix, and Google) and the Nifty Fifty.1

Can’t Fight This Feeling

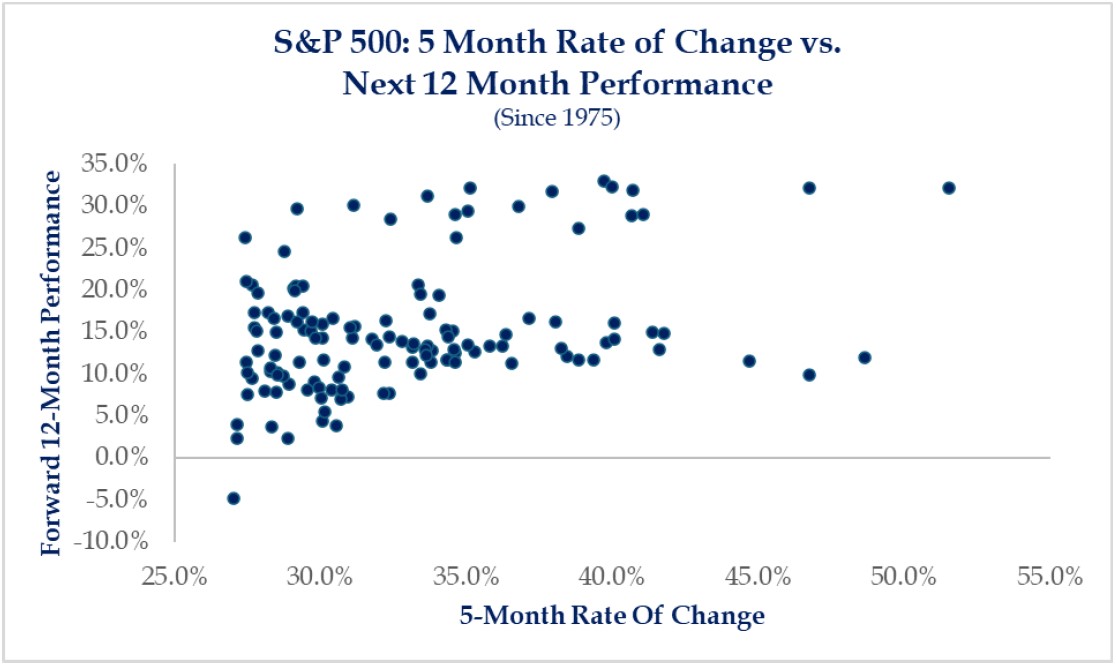

At the end of first quarter 2024, the S&P 500 was up 28% since reaching its lows in October. While this appreciation within just five months is significant, history tells us to expect more upside in the months ahead.

Since 1975, 130 prior occasions have occurred where the market posted a return of 27% or more within five months, as depicted in Figure 3, below. On average, the benchmark index 12 months later was 15% higher. Even more surprising, only once during those 130 observations did the index post a return that was negative 12 months later.

Of course, this time could be different. Historically, however, “animal spirits”2 are a powerful and persistent factor.

Figure 3

Source: Strategas Securities LLC

Lifting the Recession Watch

Our longtime readers are familiar with FineMark’s investment themes, as we frequently review them in these letters. Last year, we asserted that increasing costs of capital fueled by Fed rate hikes had placed the U.S. economy at an elevated risk of recession. Several leading economic indicators (such as an inverted yield curve) contributed to the development of this viewpoint.

Despite these harbingers, and in contrast to other developed market economies (including several Group of Seven (G7) countries Finland, Germany, Ireland, Japan, Sweden and the U.K.)3 that are currently experiencing recessions, the U.S. economy grew by 2.5% in 2023. As a result, the U.S. finds itself in a notably better position than its G7 peers.

At our mid-March FineMark Investment Policy Committee meeting, we revisited this theme and concluded that the U.S. is no longer at an elevated risk of recession. While this doesn’t mean such a scenario couldn’t unfold, we believe the risks have reverted to normalized levels.

Note: This was the only update made to the themes we shared in the fourth quarter.

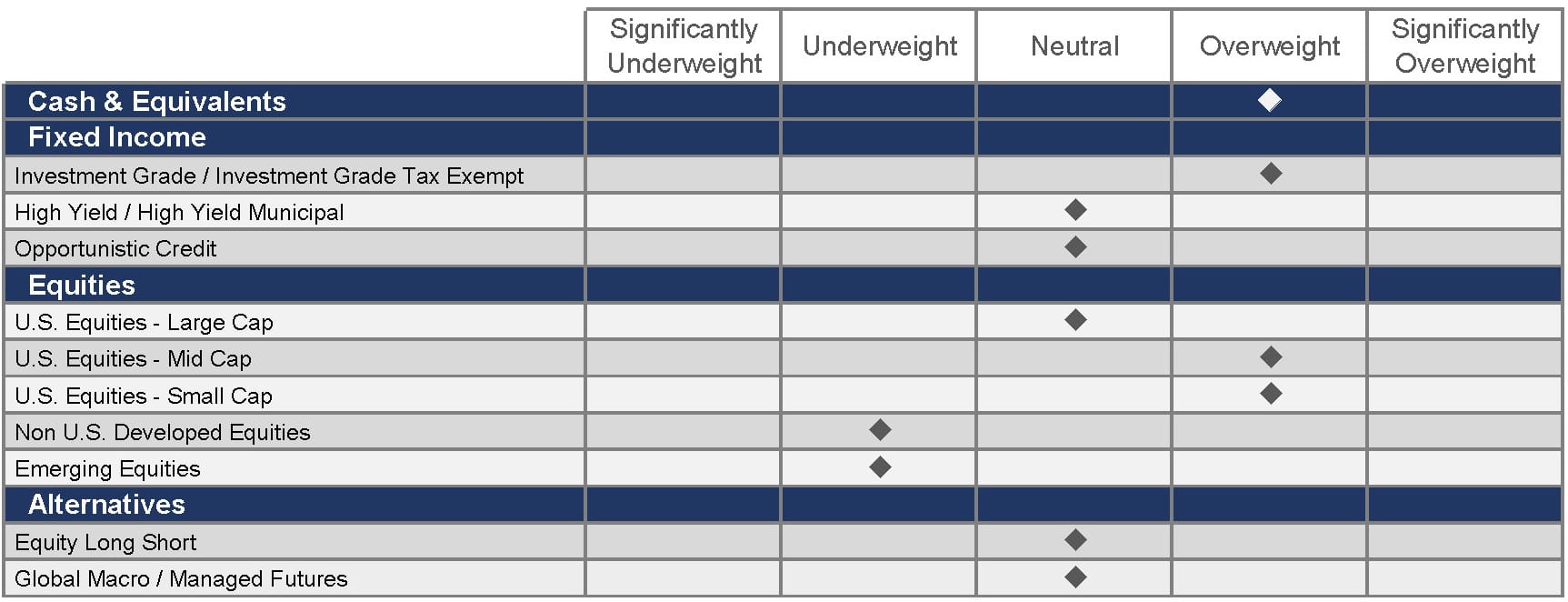

Our Current Tactical Positioning

Since our last letter, our Investment Policy Committee hasn’t made any asset allocation changes. Due to today’s significantly higher yield potential, we continue to be attracted to both cash and investment-grade fixed income.

We also remain cautious on international equities, as these assets are driven largely by both macroeconomic and geopolitical risks that we believe will remain elevated. Valuations are markedly lower than those observed in our domestic market, though we don’t find them sufficiently so.

We believe gaining exposure to unique risk factors (such as the rapid ascent of cocoa) can help build more robust portfolio diversification. To that end, we continue to advocate the inclusion of alternative assets in the portfolios of clients who are willing and able to participate in non-traditional investment options.

Figure 4

Source: FineMark National Bank & Trust

Note: These are our current, broad views on the major asset classes employed in family allocations. Due to the high degree of customization Finemark provides, these views won’t be uniformly expressed in every portfolio.

Spring Has Sprung

As we welcome longer days and adjust to higher temperatures, we’re all looking forward to the lazy days of summer. Many of you will soon head north to rest and relax in cooler climates. Though we aren’t able to join you as you lounge on the porch or doze in a lakeside hammock, please remember we’re only a phone call away if you need us. We wish you safe springtime travels and thank you for your continued trust in us. Enjoy the blooms and beauty of spring!

2024 First Quarter Review and Commentary

By Christopher Battifarano, CFA®, CAIA

Executive Vice President & Chief Investment Officer

Articles In This Issue:

Why Wealth Management at FineMark transcends Stock Picking

Download 2024 Q1 Newsletter Here

1In the 1960s and 1970s, a group of 50 large-cap stocks on the New York Stock Exchange known as the “Nifty Fifty” were favored by institutional investors. Similar to today’s blue-chip stocks, investment in these top 50 stocks is said to have propelled the American economy to its 1970s bull market. Companies in this group were usually characterized by consistent earnings growth and high P/E ratios.

2“Animal spirits,” a term coined in 1936 by British economist John Maynard Keynes to refer to the ways human emotion can drive financial decision-making in uncertain and volatile times, comes from the Latin spiritus animalis: “The breath that awakens the human mind.”

3The G7, an informal grouping of advanced democracies, meets annually to coordinate global economic policy and address other transnational issues.

This material is provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Information is obtained from sources deemed reliable, but there is no representation or warranty as to its accuracy, completeness or reliability. All information is current as of the date of this material and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole. FineMark National Bank & Trust services might not be available in all jurisdictions or to all client types.