As the quote from Warren Buffett above suggests, we share his view on the utility of short-term market forecasts. Rather than trying to predict the future, we prefer to construct solid portfolios, focus on longer-term investable themes, and identify third-party manager talent with demonstrable (and persistent) alpha-generation ability.

Equities and the S&P 500

At the onset of each new year, like clockwork, we’re asked for our near-term view. This year was no different.

For 2023, we were cautious, citing a low single-digit return expectation for the U.S. benchmark equity index, the S&P 500.

Our view was shaped by our perspective that the Fed still had work to do to combat elevated inflation. At the time, this view conflicted with Wall Street’s “pivot” mantra. We also saw a raised risk for recession, which hasn’t yet occurred.

What we didn’t anticipate was the government liquidity cannons firing in response to three bank failures: Signature, Silicon Valley Bank, and First Republic. In direct response to the averted crisis, the Bank Term Funding Program (BTFP) added $300 billion to the Federal balance sheet in just three weeks.

Additionally, the Strategic Petroleum Reserve (SPR) was drained to tamp down high energy prices, an action that is, effectively, a transfer payment provided by the government. Consequently, by the end of July 2023, the S&P was up more than 20% for the year.

July also marked a high for the equity market, as shown in Figure 1, below. Both bonds and stocks reversed course for the remainder of the quarter, posting losses for the period. Repeating last year’s behavior, stocks and bonds correlated positively again in Q3, thus denying the traditional 60/40 investor any diversification benefits. Fortunately, the FineMark playbook includes alternative investments that, with their low correlation to traditional asset classes, have proved their value as portfolio diversifiers.

FIGURE 1

Source: eVestments

Labor and the Balance of Power

The number of unionized labor organizations in the U.S. has been in secular decline at least 40 years. Their recent rise in prominence through a series of actual and threatened strikes, however, has dominated headlines. The elevated inflationary period experienced in 2022, combined with challenging demographics faced by our nation, have contributed to this uptick.

Impacted industry labor groups include Hollywood screenwriters, Teamsters, and auto workers (the latter’s strike activity successfully hobbled America’s Big Three auto manufacturers: General Motors, Stellantis (formerly known as Fiat Chrysler), and Ford Motor Company. Although unionized labor is now a smaller component of the American workforce, the effect of such disputes still spills into the broader labor market.

Currently, we’re also witnessing the en masse entrance into retirement of the largest and most productive group in the American labor force: the Baby Boomers. While this exodus began a few years ago, it’s now in an irreversible full swing, prompting a shift in power from corporations to labor. Thus, a persistent labor inflation rate is being fueled as workers recognize their bargaining power in a dwindling labor pool.

Strategies to attract and retain labor have expanded beyond compensation rate increases. Considerations now include the nature of work and a greater effort to support work/life balance, a condition the Millennial generation values significantly. Examples include greater adoption of hybrid work arrangements, improved childcare assistance, expanded (or even unlimited) PTO, and substantive wellness programs. While this temporary condition will likely reverse course in a recession, we see it persisting for a time as businesses realize that good employees are difficult to find.

A Steepening Yield Curve

Early in the rate-hiking cycle, as short rates rose, longer-term rates moved higher to a lower degree. This quarter, that condition changed as the market began to price in the possibility that rates could remain elevated for a prolonged period.

In July, the Fed raised policy rates by 25 basis points (bps). However, the 10-year rate moved higher by 76 bps and the 30-year rate rose even more, by 85 bps over the quarter. This move upward in yields indicates recognition by the market that the notion of returning to a zero-interest-rate regime may be misguided.

Faithful readers of this newsletter know we’ve been talking about the end of the zero interest rate policy (ZIRP) for quite some time. In fact, at our most recent Investment Policy Committee meeting, we decided it was time to declare “Victory!” and abandon that theme as it has now become a consensus view.

Looking ahead, we believe history will regard the 2007-2021 time period as anomalous. Though it’s been difficult for market participants to accept, this current regime is actually normal from a historical standpoint. Several factors are driving this move, including the U.S. budget deficit and its upcoming substantial debt repayment, which will require refinancing in the next three years and expand the size of current Treasury auctions.

The quantitative tightening (QT) pace maintained by the Fed seems likely to continue even if the policy rate reaches a stopping point. We also anticipate that China will recycle fewer dollars into Treasuries as a result of falling exports to the United States. These actions will likely contribute to downward pressure on longer-term bonds thus driving longer yields upward.

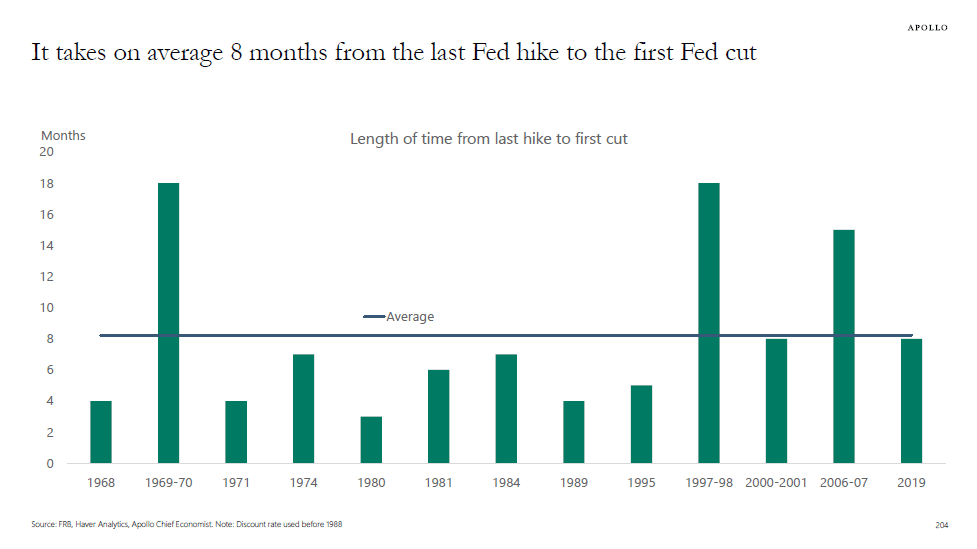

In keeping with historical norms, it’s possible the Fed will cut rates in 2024, though the notion of moving back to ZIRP isn’t on our radar today. If July turns out to be the last hike for this cycle, a pivot toward lower policy rates in spring 2024 may occur. While history might not repeat itself in this case, we believe Figure 2, below, provides a good historical guidepost.

FIGURE 2

Source: FRB, Haver Analytics, Apollo Chief Economist. Note: Discount Rate used before 1988.

Headwinds in a Buoyant Economy

Households spending down their COVID savings, the restart of student loan payments, rising credit card and auto delinquencies, the severe curtailing of credit creation by banks, and slowdowns in major economies (such as Germany and China) are all possible headwinds to the U.S. economy. Though helping to further dampen inflation, these elements also put pressure on the Fed to move away from its current restrictive monetary policy and toward a more neutral plan.

As a result of the significant rise in rates, we might have expected the U.S. economy to slow down faster. However, we believe a number of factors have kept it afloat.

First, the lengthy pandemic era left consumers flush with stimulant-payment cash and the urge to travel.

Second, both consumers and corporate borrowers have been able to insulate themselves from rate hikes in the near term. Consumers have done so through the use of 30-year, fixed-rate mortgages (whereas during the previous cycle, floating-rate mortgages were more popular). Corporate borrowers have also leveraged longer-term borrowings.

Lastly, the impact of fiscal stimulus through the CHIPS Act and the Inflation Reduction Act (IRA) created a boom in manufacturing spending. We believe many of these counter balances are nearing an end, and the economic impacts of the Fed’s policy, which are always felt on a lagged basis, will begin to manifest on Main Street soon.

Our Deglobalization Theme

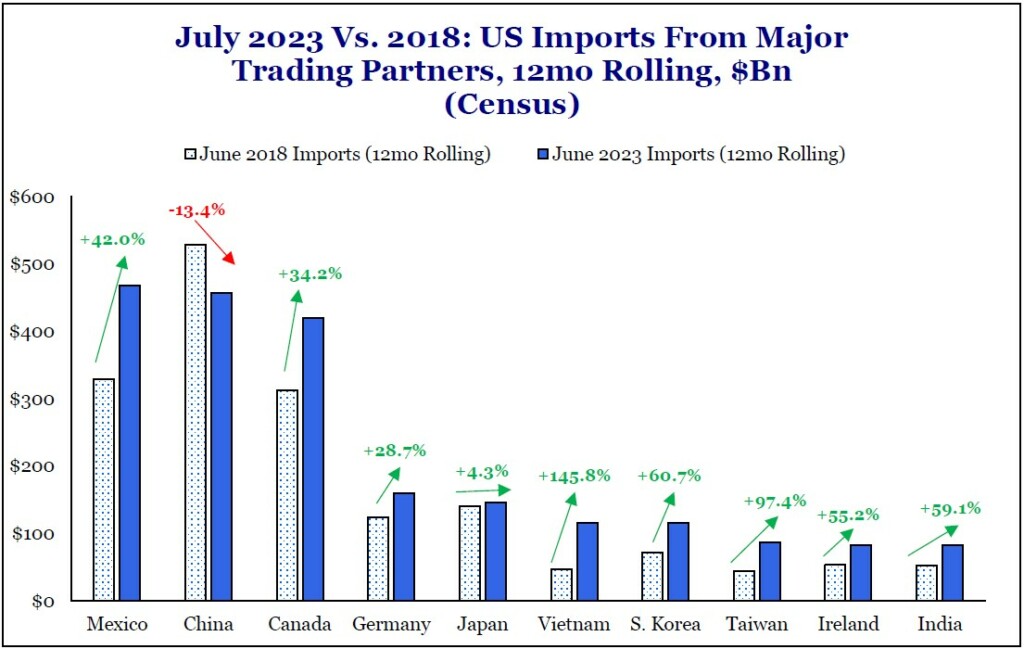

In the past, we’ve spent considerable time discussing the theme of deglobalization. We revisited this topic during our recent Investment Policy Committee meeting, and believe this theme will persist in driving corporate and policymakers’ decisions. To put a finer point on this long-term theme, our team added a minor twist by including the concept of nearshoring (the practice of transferring business operations to a nearby country).

While private industry and the U.S. federal government have pushed to reconfigure supply chains to enable more production domestically, it isn’t commercially viable to produce certain lower-value-add products on U.S. shores. In these cases, moving manufacturing nearer to the United States (e.g., to Mexico and Canada) makes better sense.

As shown below in Figure 3, over the past five years both Mexico and Canada have disproportionately benefitted from our reduced trade with China. As a result, Mexico—not China—is now America’s largest trading partner.

FIGURE 3

Source: Strategas Securities LLC

Our Current Tactical Positioning

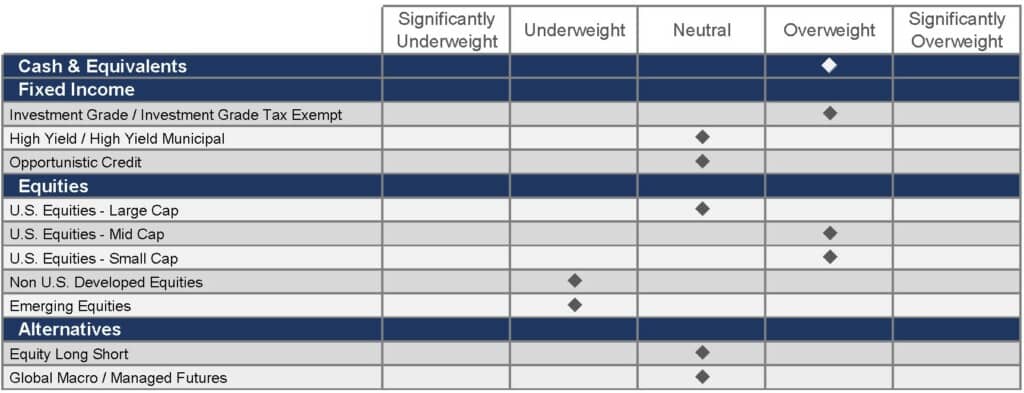

As you review our current positioning in Figure 4, below, you’ll notice our perspective hasn’t changed since our last letter. With the risk of a recession still looming, we remain defensive when considering market valuations and our outlook for a deteriorating macro view.

Our decision to reduce large cap equity exposure in April looks smarter today than it did last quarter. Clearly, the rise in rates has been painful for fixed income investors. Our ability to lock in yields higher than those seen in the last 15 years is easing some of that angst. To secure that higher income for the future, we’ve begun to extend portfolio duration.

FIGURE 4

Source: FineMark National Bank & Trust

Note: These are our current, broad views on the major asset classes employed in family allocations. Due to the high degree of customization FineMark provides, these views won’t be uniformly expressed in every portfolio.

Just As the Swallows Come Back to Capistrano…

In autumn, the annual migration back to the sunbelt begins for many of our clients. As the sweltering summer of 2023 mercifully comes to an end, we look forward to seeing many of you back inside FineMark’s offices for the litany of events we’ve planned. Special times like these are to be treasured. We’re excited to meet again and spend time with each of you. Please keep an eye on your email for your invitation!

As always, we appreciate and thank you for your trust in us as the stewards of your capital. If there’s anything we can assist you with, please reach out. We’re always happy to help!

2023 Third Quarter Review and Commentary

By Christopher Battifarano, CFA®, CAIA

Executive Vice President & Chief Investment Officer

Articles In This Issue:

New Federal Beneficial Ownership Reporting Requirements in 2024

Download 2023 Q3 Newsletter Here

This material is provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Information is obtained from sources deemed reliable, but there is no representation or warranty as to its accuracy, completeness or reliability. All information is current as of the date of this material and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole. FineMark National Bank & Trust services might not be available in all jurisdictions or to all client types.