Napoleon’s quote acknowledges that a conflict’s outcome is often decided by a misstep made on one side versus the other. In investing, we see clear corollaries to this statement.

Lately, the hand-wringing over what could go wrong in the economy seems endless, with Wall Street analysts constantly updating their forecasts on near-term market performance. We believe this behavior should be ignored by long-term investors. Equity markets are justifiably high risk investments, given the historically high returns they afford investors over long investment horizons.

As asset allocators, studying the past helps us see the investment landscape for what it is—not what we wish it to be. By referencing history, we gain perspective, which ensures we don’t “lose our minds” (in the words of Napoleon). We believe staying focused on the long-term is the best way to help our families grow and protect their wealth.

Walking a Narrow Path Toward Victory

This quarter, equity markets continued their positive ascent, maintaining the trend established during the first quarter. The rash of bank insolvencies we saw in Q1 came to a halt, likely due to the Bank Term Funding Program announced in March by the Federal Reserve. This lifeline, designed to assist banks with liquidity needs, stood in contrast to the Fed’s decision to hike the fed funds rate once again.

While we believe the risk of bank runs has been addressed (taking the chance of systematic bank contagion off the table), a difficult industry environment remains as stricter regulation looms and an inverted yield curve seems likely to result in a credit contraction. This scenario would largely impact small-to-medium-sized businesses that rely on regional bank lending for their capital needs.

Nevertheless, the annual stress test results released by the Fed in June solidly demonstrated the soundness and resiliency of the U.S. banking system. All 23 of the tested banks passed the exam’s draconian scenarios, which included a 40% decline in commercial real estate values, an increase of the unemployment rate to 10% (6.4% higher than today’s actual rate), and a 10% concurrent fall in gross domestic product (GDP).

FIGURE 1

Source: eVestment

As shown in Figure 1, above, equity performance has been strong, and the markets are reclaiming last year’s losses. The stark differences in index performance, specifically the effects of mega-cap technology listings and their disproportionately large weights in the S&P 500, are also worth highlighting.

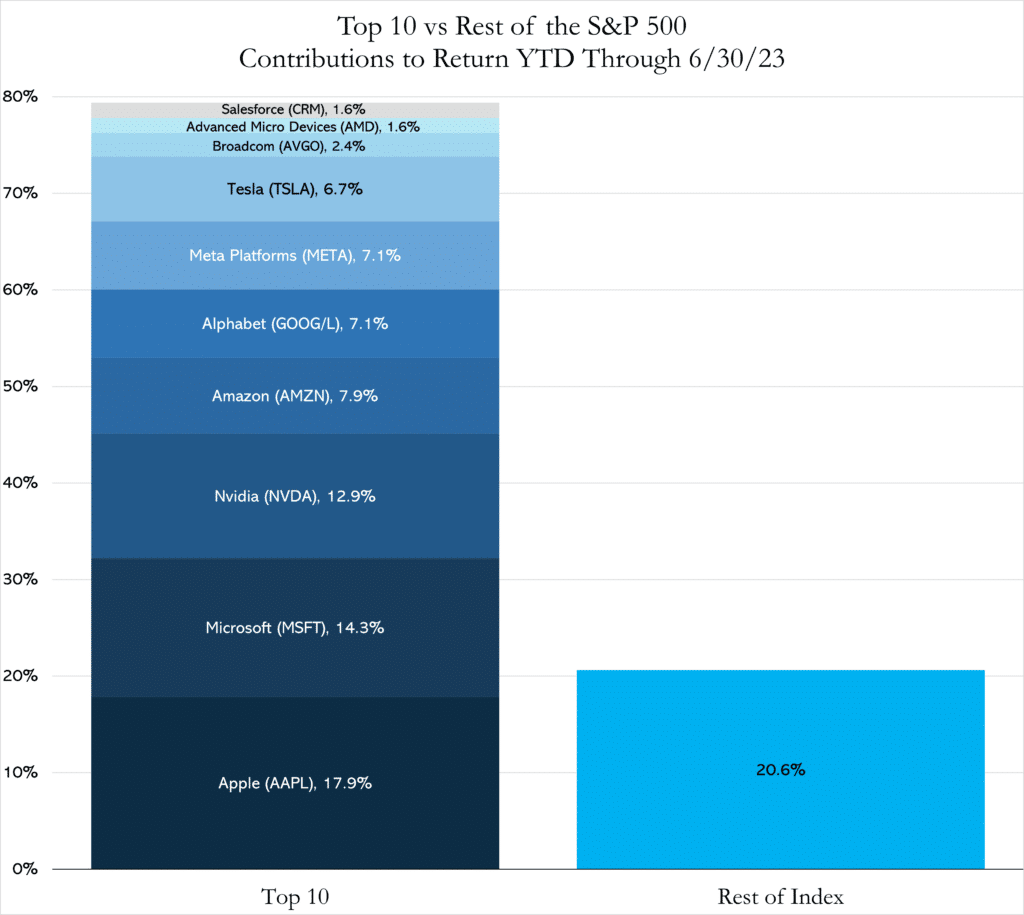

This year’s market performance has been narrow, emphasizing the top-heavy nature of the benchmark index. Some of this weightiness can be seen in the performance disparity to date between the S&P 500 and the Dow Jones Industrial Average. To quantify this precisely, 10 specific issues out of the S&P 500* have generated nearly 80% of the index’s returns thus far for 2023. We’ve created two graphics to illustrate this situation.

Figure 2, below, breaks down the influences of these top 10 contributors in relation to the remaining 491 issues in the benchmark index. Obviously, it’s very lopsided.

* Today, despite the number 500 in its name, the benchmark index is actually composed of 501 components.

FIGURE 2

Source: Fact Set

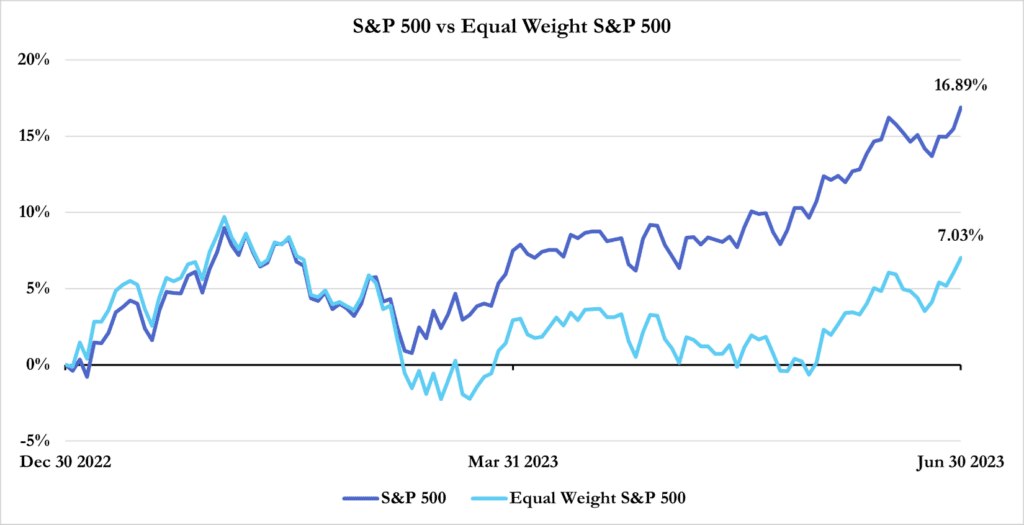

Figure 3, below, showcases the divergence between the S&P 500® Equal Weight Index and the standard S&P 500® Index, which is weighted based on market capitalization. Here, we see the effects caused by large-return contributors versus those in an equally-weighted variation. This type of market bifurcation has made it challenging for active equity management to add value.

FIGURE 3

Source: Fact Set

Artificial Intelligence and Market Implications

In our previous newsletter, we introduced a new investment theme: the implications of artificial intelligence (AI) on the global economy. In our view, AI has the potential to reshape our world, and its effects are already being noticed. While these technological developments are exciting, we believe some of the share re-rating that’s occurred could be overdone. Over the next few years, we expect AI to be a significant deflationary force.

Additionally, many of the S&P 500 components we noted above as generating outsized returns are beneficiaries of AI, either directly or indirectly. Note: FineMark has direct exposure to these impacts through our own proprietary equity solutions and also through our external investment managers.

Meanwhile, a rapidly-evolving geopolitical landscape is emerging around highly-advanced AI chips, along with a global interest in containing their export. As reported in the June 27, 2023, Wall Street Journal article entitled, “U.S. Considers New Curbs on AI Chip Exports to China” the Biden administration is considering new restrictions on the export of these chips to China. The Netherlands, home to ASML, the largest technology company in Europe and a key equipment supplier to advanced chip makers, has also taken action. The Dutch government recently announced a similar export-restricting initiative.

Monetary Policy and Macro Reality

In earlier letters, we shared our expectation that the Federal Reserve would stop hiking rates during the second quarter. This came to pass in June as the Fed paused its rate-hiking cadence, which began in March 2022.

Given the economic data, the Fed also had a more hawkish rate-tightening outlook than expected. From our vantage point, the inflationary dragon that Chairman Powell and the Fed sought to slay last year appears to be in retreat. We’re seeing this manifest through a variety of inflationary indicators including wages, rents, shipping container freight rates, service and commodity prices and, most importantly, energy costs.

If current trends reversed at this juncture, we believe the lion’s share of this rate-hiking campaign would move into the rearview mirror. In large measure, the hawkish tone of the Fed is driven by moral suasion and, to a lesser degree, recent economic data.

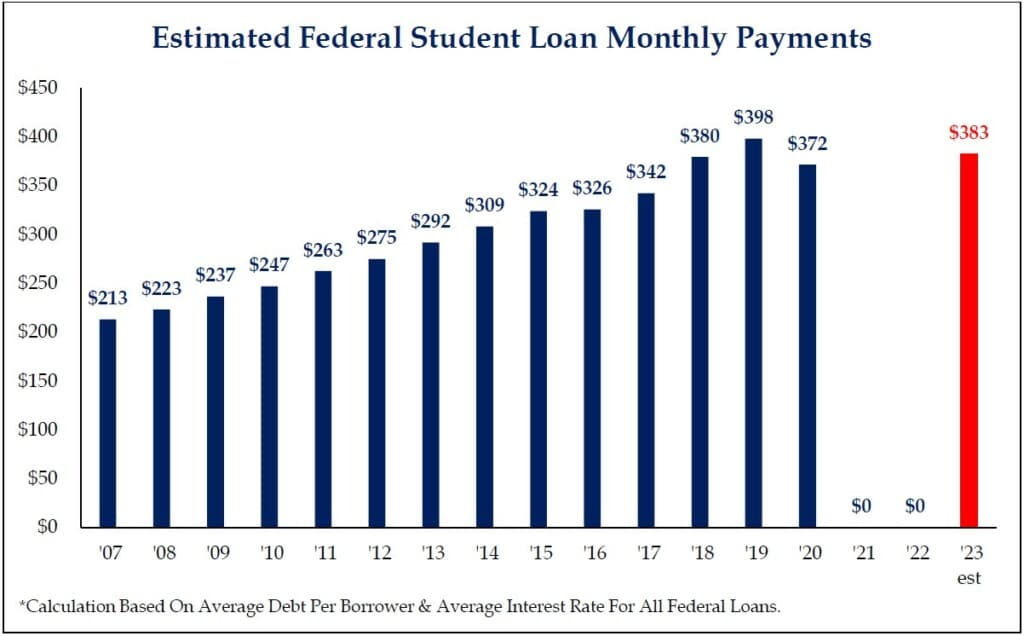

Another deflationary force on the horizon is the resumption of student loan payments, scheduled to occur in the fourth quarter. In March 2020, at the onset of Covid in the U.S., these payments were suspended to provide financial relief to borrowers. At the time, interest rates were also set to zero.

This past May, President Biden signed a federal spending bill that ended the student loan pause. Though Biden’s administration sought to forgive up to $20,000 each for millions of borrowers, the U.S. Supreme Court ruled against this plan in late June. Now, the administration is attempting to help through the Department of Education. While we can’t predict the outcome of this effort, restarting payments without assistance from the administration would result in payments of approximately $383 a month for an estimated 30 million borrowers. If this occurs, we believe consumer spending will be negatively impacted, particularly among younger consumers who have fueled travel-related spending post-pandemic.

FIGURE 4

Source: Strategas Securities LLC

Our Current Tactical Positioning

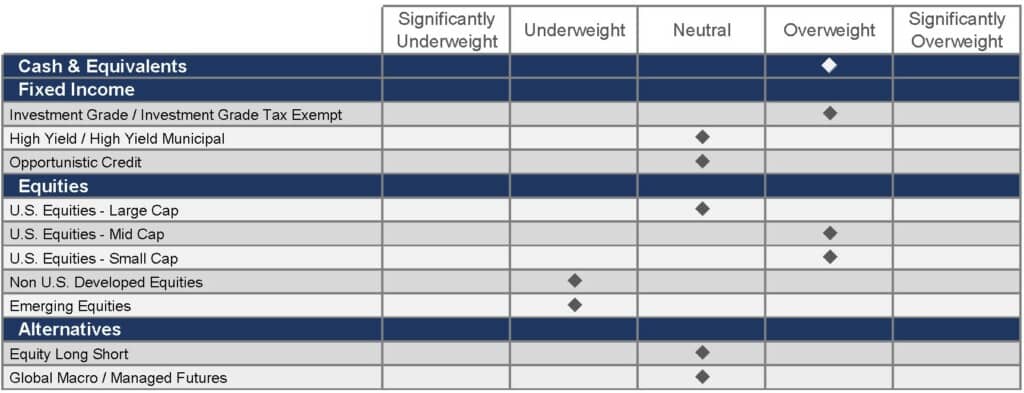

Our current views are expressed in Figure 5, below. You’ll notice our positioning hasn’t changed since our last letter. With the risk of a recession still looming, we remain defensive when considering market valuations and our outlook for a deteriorating macro view.

Additionally, rising rates on cash have made allocations there more attractive as real rates (those adjusted for the effects of inflation) become positive. Note: While these views won’t be uniformly expressed in every portfolio due to the high degree of customization FineMark provides, these are our current, broad views on the major asset classes employed in family allocations.

FIGURE 5

Source: FineMark National Bank & Trust

Finding Respite from Summer Swelter

As we close this letter, summer is at its peak and unprecedented heatwaves are moving across the United States. Whether you’re at the shore or in the mountains, we hope you’ll be able to unplug and cool off throughout the season. Wherever your travels take you, please know we’re always available to offer guidance and support.

Thank you for your continued confidence and trust in us. We look forward to serving you and your family whenever needed, now and in the future.

2023 Second Quarter Review and Commentary

By Christopher Battifarano, CFA®, CAIA

Executive Vice President & Chief Investment Officer

Articles In This Issue:

How Sophisticated Have Online Scams Become?

Download 2023 Q2 Newsletter Here

This material is provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Information is obtained from sources deemed reliable, but there is no representation or warranty as to its accuracy, completeness or reliability. All information is current as of the date of this material and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole. FineMark National Bank & Trust services might not be available in all jurisdictions or to all client types.