Warren Buffett is one of the world’s foremost investors. He was born in and still resides in Omaha, Nebraska with an approximate net worth $104 billion, making him the fifth wealthiest person in the world.

Bank Failures, Rate Hikes and Market Mean Reverts

As investment practitioners, we regularly encourage our clients to remain calm when reacting to unfavorable media reports about the economy or geopolitics. The first quarter of 2023’s equity market performance (shown in Figure 1, below) exemplifies why such scenarios — and their accompanying dire reports — don’t necessarily beget lower market prices nor should they cause an overreaction.

Figure 1

Source: eVestment

As the year began, we witnessed the failure of two U.S. banks: Silicon Valley Bank (SVB) of Santa Clara, CA and Signature Bank of New York City. At the time of receivership, SVB had $209 billion in assets and Signature Bank had $110 billion. SVB is the second-largest bank failure in U.S. history and the largest since Washington Mutual collapsed in 2008 — during the Global Financial Crisis — at $307 billion in assets. Interestingly, throughout 2021 and 2022, there were no U.S. bank failures.

Outside of the U.S., the 167-year-old Swiss bank, Credit Suisse, also suffered a crisis of confidence. In March, it was purchased by rival Swiss bank, UBS, in an emergency sale brokered by Swiss banking regulators.

As if the uncertainty brought to the banking industry by these failures wasn’t enough, the market struggled to come to grips with the Federal Reserve’s reluctance to pivot (despite Wall Street’s hopes) after tightening 450 basis points last year. Instead, the Fed delivered two additional 25 basis-point rate hikes during the first quarter, along with comments that guided markets toward further restrictive monetary policy.

As we wrote in our Q4 2022 newsletter, we believe that the Fed will stop raising rates during the second quarter of 2023. The negative inflation data that began manifesting at the time is now obvious. Inflation appears to be abating quickly, demonstrating that the tighter monetary policy initiated by the Fed just over a year ago is having its desired effect.

Thus far, this stricter policy has not resulted in higher unemployment rates, the commonly associated adverse effect of higher rates. Instead, unemployment sits at 3.6% (virtually unchanged over the past year), a historically low level compared to the 5.73% average displayed since 1948. This current Goldilocks scenario, where the Fed can combat inflation without suffering the negative consequences in the labor markets, allows the Fed to remain hawkish for longer. The current Fed board is aware of the miscues by their predecessors of the 1970s and does not want to end up in a stop and go policy scenario which occurred then. This resulted in the Fed prematurely cutting rates, only to be forced to redouble their efforts and begin hiking again as the inflation menace was not vanquished during their initial hiking salvo. The current Fed wants convincing evidence that inflation is moving toward their 2% target before they relent.

Global Impacts

On the geopolitical front, matters felt even more dour as February marked the one-year anniversary of the Russian invasion of Ukraine with no resolution in sight. In fact, the conflict appears to be worsening as Western allies (including Canada, Germany, Poland, Portugal, Spain, UK, US, and others) agreed to send hundreds of battle tanks for Ukrainian defense. Meanwhile, a Chinese spy balloon detected over US airspace was shot down off the South Carolina coast, precipitating the cancellation of a previously scheduled visit to China by US Secretary of State, Antony Blinken.

Amid this bluster and consternation, the equity markets here and abroad posted high rates of return for the quarter. Although owning equity is not for the faint of heart, once again we’re seeing it’s impossible to know when positive performance will manifest, thus keeping emotions in check when making investment decisions is the largest determining factor in successful equity investing.

While market tones have calmed since the two U.S. bank failures in March, ramifications continue. We expect further regulatory scrutiny to occur in the industry soon and, unlike many issues today, this matter appears to have bipartisan support.

While we don’t know what additional regulatory measures may be put in place, when combined with the existing tighter monetary policy (which has put downward pressure on bank profit margins and resulted in deposits leaving in search of higher cash yields), a credit contraction is likely.

This scenario will have a disproportionate, negative effect on both commercial real estate borrowers and small-to-medium-sized businesses that aren’t large enough to access the public debt markets. To take advantage of this condition, we’ve sourced investment opportunities with private credit managers and non-bank lenders who can fill this void. Note: These investments are suitable for clients with both significant financial wherewithal and an ability to bear illiquidity risk.

Investment Themes

In our prior letter, we reviewed investment themes including deglobalization, the end of zero-interest-rate policies, tepid economic growth, and the end of the current rate-hiking cycle. Since then, none of these themes have materially changed, so we will not spill more ink about them today. (If you missed our previous coverage, you can read our Q4 2022 newsletter here: https://www.finemarkbank.com/2022-q4-fine-points/.)

Today, we’re adding one more theme to our current stable: the implications of artificial intelligence (AI) on the economy. The technological progressions we’ve witnessed in AI are staggering; we’re entering a world where machine-created content will be indistinguishable from human-created content. As this technology achieves commercial viability, the labor market will face disruption as tasks currently completed by humans are replaced by machines.

According to the March 26, 2023, white paper entitled, “The Potentially Large Effects of Artificial Intelligence on Economic Growth,” published by Goldman Sachs, generative AI could expose 300 million full-time jobs to automation. However, we don’t believe this translates to 300 million people becoming completely redundant. Instead, as has occurred historically with other technological advancements, we expect that the nature of work will become more productive and will give rise to new occupations. Just as the dawning of the Internet created new careers (such as web design and digital marketing), AI will have a similar impact. Its economic effect will also be deflationary.

AI automation is likely to be used with administrative or clerical roles in corporate and legal environments rather than jobs requiring physical, outdoor work in the agriculture or construction industries. Broadly, we see it having a more significant impact on developed versus emerging markets given both the cost and structure of labor markets (though emerging markets will certainly be impacted, albeit to a lesser degree).

The timing of this development is fortuitous as most advanced economies, such as the US, but many others as well, are facing the same reality: a rapidly aging and shrinking workforce. Typically, the demographics in industrialized nations display fertility rates that fall below replacement levels. In the coming years, AI could offer a solution to a potentially massive labor shortage.

Further, we expect AI adoption analogs similar to those seen in personal computing following the advent of the graphical user interface, which utilized clickable on-screen windows, menus, and icons. This intuitive design style allowed users to see what they wanted and click on it versus typing commands in arcane computer languages. As a result, computers became accessible, enabling people to leverage the PC as a tool for increased productivity and paving the way for a technology fueled increase in productivity.

AI technology functions the way humans naturally communicate, through speech. Combined with its ability to include both video and audio, it is even simpler to adopt by the masses than even the graphical user interface. Tasks such as image classification and the ability of AI to comprehend and respond to highly complex questions make AI a significant advancement to current solutions.

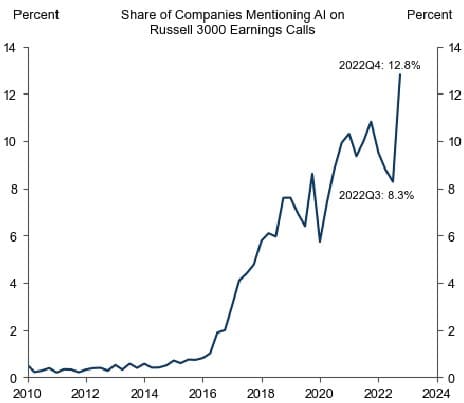

Goldman Sachs estimates that AI could drive an annual increase of 7% (or $7 trillion) in global gross domestic product (GDP). The number of companies discussing AI’s impact on business has risen sharply, with nearly 13% of companies reporting its effects in their Q4 earnings calls (see Figure 2). Companies are also actively trying to incorporate AI into their products and services.

For example, Intuit (INTU), creator of the tax preparation software Turbo Tax, is exploring ways AI can make their product more powerful. Soon, tax filers may be able to snap digital photos of their tax documents and AI technology will compile the return. The ability to complete high-value tasks (such as interpreting the 80,000-page U.S. Tax Code using an algorithm to determine whether a filer should use standard or itemized deductions) and then quickly prepare an individual’s tax return will revolutionize the economy.

Figure 2

Data Source: Joseph Briggs and Devesh Kodnani, “The Potentially Large Effects of Artificial Intelligence on Economic Growth,” Goldman Sachs, 3/26/2023.

While the timing of this labor productivity boom is difficult to predict, its positive effects will likely be long-lasting. The rate of adoption will influence the speed of the productivity boost. ChatGPT, a chatbot developed by OpenAI, eclipsed 1 million users in just five days — the fastest a company has ever reached this milestone.

To best leverage AI, this investment theme will be implemented within our clients’ portfolios as appropriate. Much like our investment platform, our approach will take various forms designed to meet each client’s specific goals and objectives.

Our Current Positioning

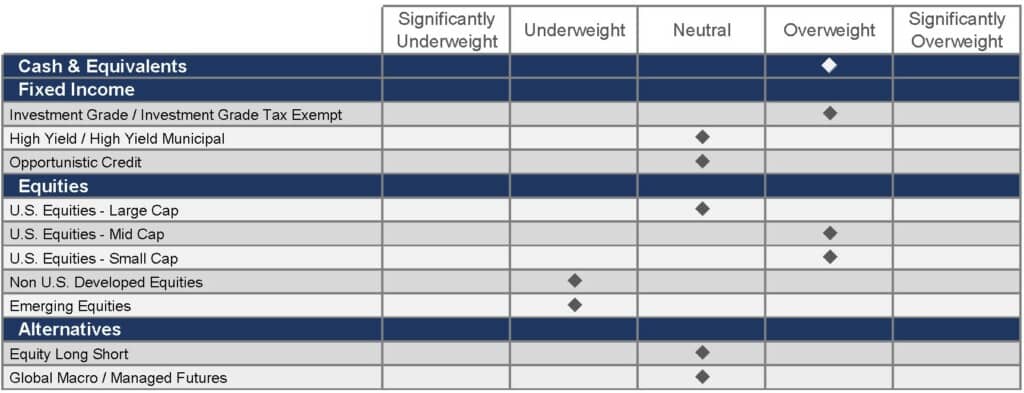

Taking these themes and views into consideration, we’ve formulated our current tactical market perspective, as expressed in Figure 3, below. The only change in this positioning from our last quarterly letter was our decision to cut our overweight position in large cap US equities to neutral weight. This was done owning to both the run up in prices we saw both this quarter and last quarter and the headwinds we see for near term earnings. These two factors paint a valuation picture that is less attractive than it had been. Again, it’s important to note that FineMark client portfolios are customized to suit each unique financial situation; therefore, these views may not be implemented in every portfolio in the same way.

Figure 3

Source: FineMark National Bank & Trust

Springtime Blooms

As winter turns to spring, we know many of our seasonal clients will begin their annual journey to their northern homes. We wish you safe travels and remind you that, no matter where you may be, we’re here to serve and support you. We appreciate the opportunity to assist you and thank you for your continued trust and confidence.

2023 First Quarter Review and Commentary

By Christopher Battifarano, CFA®, CAIA

Executive Vice President & Chief Investment Officer

Articles In This Issue:

Common Financial Scams and How to Avoid Them

Download 2023 Q1 Newsletter Here

This material is provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Information is obtained from sources deemed reliable, but there is no representation or warranty as to its accuracy, completeness or reliability. All information is current as of the date of this material and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole. FineMark National Bank & Trust services might not be available in all jurisdictions or to all client types.