As 2022 draws to a close, our investment team has spent considerable time thinking about the year ahead and specifically about investment themes and portfolio positioning. In advance of our year end investment newsletter, which will include more depth on these topics, we wanted to share our latest thoughts for 2023 and beyond.

One of the major themes that we’ve spoken about in the past, and we think will continue to play out in the new year is deglobalization. This phenomenon is essentially the reversal of the multi decade effect of globalization, which took hold as a result of heightened global collaboration, post cold war, and saw the migration of the manufacturing of many products from high cost to low-cost regions, largely to Asia. This created a strong deflationary tailwind for many years. The process of deglobalization has been advanced by an increased focus on strategic national interest in the US and elsewhere. This is most clearly evidenced through the recently passed Chips and Science Act. We believe there are certainly other examples of this new paradigm shift as well.

Increased geopolitical tensions, which spiked after Russia’s invasion of Ukraine in February, is a theme that we expect to persist into 2023 and beyond. Evidence that Russia may be targeting other neighbors to its east is well documented and has not gone unnoticed. Both Finland and Sweden have joined NATO to safeguard themselves preemptively against such a strike. And Europe is not alone to growing geopolitical risk. We also see this theme in Asia between North Korea and its neighbors, as well as the increasingly tenuous relationship between China and Taiwan.

High inflation will be remembered as the theme that most clearly dominated headlines in 2022 as it reached 40-year highs earlier this year. We see the rate of inflation abating in 2023, and in fact, believe there is already evidence of this occurring in the most recent inflation reports. Surely, this is owning to the significant double-barreled action on both the fiscal and monetary front to combat this silent tax on wealth.

Lastly, we believe corporations, both within in the US and abroad, will struggle to grow earnings in 2023 as compared to 2022. Obviously, there will be exceptions to this rule, and we are speaking in broad generalities. Unfortunately, one of the side effects of efforts by the US Fed to quell inflation is dampening business activity as the cost of capital rises. While this is part of the capitalist business model, recessionary cycles are painful, and business leaders will be forced to make hard decisions while navigating.

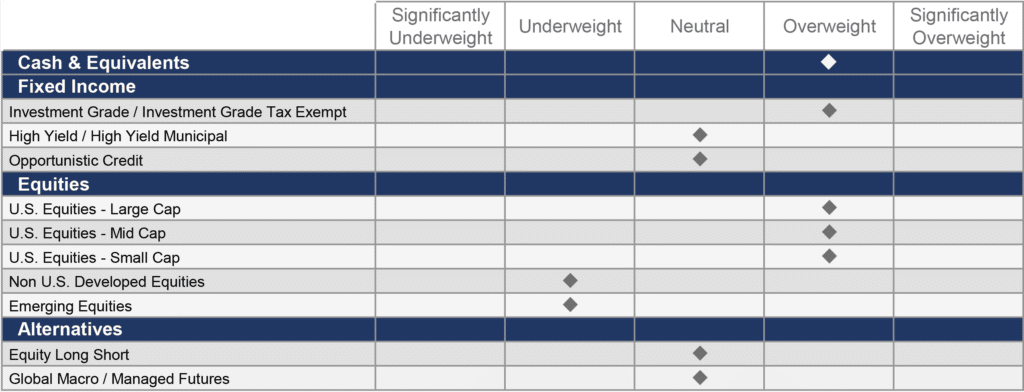

In light of these broad themes and our teams view on the forward-looking opportunity set, portfolio allocations are expressed in the table below.

FineMark National Bank & Trust©

We remain overweight cash, owning to that higher-than-normal degree of uncertainty. Within fixed income, we are overweight investment grade credit as higher rates have given way to a more asymmetric risk/reward opportunity set.

Within equities, we are overweight across the board in the US. Outside the US, we are less enthusiastic and are underweight in those markets. Within alternatives, specifically equity long, short and CTA/macro, we are neutral weighted. Those allocations have proven to be a valuable source of diversification in 2022, a year that has proven to be challenging for both equities and fixed income instruments.

Please reach out to your advisor here at FineMark with any questions or concerns. In the meantime, we wish you a very happy holiday season and a wonderful New Year.

We look forward to working with you in 2023.