“Stability leads to instability. The more stable things become and the longer things are stable, the more unstable they will be when the crisis hits.”Hyman Minsky, American Economist (1919-1996)

Hyman Minsky proposed theories linking market fragility and the normal economic cycle with speculative bubbles innate to financial markets. He theorized that prolonged periods of stability breed complacency and lead to unpredictable behavior, which can worsen the eventual bust cycle. These periods are now known as “Minsky Moments.”

2022: One for the Record Books

These days, words such as “unprecedented” or “extraordinary” seem overused in our daily vernacular, however, they do feel appropriate when describing 2022. Several events, including those listed below, defined the year, interrupting long-held expectations and disrupting deep-rooted stability akin to those described by Minsky.

- Seventy years of peace in Europe were shattered as Russia invaded Ukraine in February 2022. According to a speech delivered in November by U.S. Chairman of the Joint Chiefs of Staff, General Mark A. Milley, the number of soldiers killed or wounded on the Russian side alone is estimated at 100,000. Ukrainian losses are estimated to be of a similar magnitude. Comparatively, the United States lost approximately 58,220 servicemembers during the Vietnam War, which lasted 12 years.

- U.S. inflation hit levels not seen in 40 years, which caused the central bank to leap into action to combat this silent confiscator of wealth.

- By the year’s end, the Federal Reserve abandoned quantitative easing and embarked on a rate hiking path that originated from the zero bound — where we started 2022 — to finish 2022 at 4.50%. This action reversed a 35-year-long bull market in bonds and resulted in historic losses. Note: The pace of these rate hikes is the fastest the United States has experienced since Paul Volcker chaired the Fed in the late ‘70s and through most of the ‘80s.

- The bubble of cryptocurrency burst, resulting in economic losses of approximately $2 trillion. To put this in perspective, that figure is roughly equivalent to the size of Italy’s total economy, the ninth largest in the world. Unlike many historical bubbles, cryptocurrency is a less institutionally accepted asset class; yet it’s well-owned among individual investors. Thus, the fallout will be seen more substantially in the consumer economy.

After three consecutive quarters of simultaneous losses in both equity and fixed income markets, investors received a reprieve during the fourth quarter. However, the gains weren’t enough to climb out of the deep drawdown inflicted by prior losses, as shown by the one-year return data in Figure 1, below.

FIGURE 1

Source: eVestment

For a longer-term perspective on market returns, Figure 1 also depicts the past three years of returns on an annualized basis. The two-front assault faced by traditional 60% equity and 40% fixed income (60/40) portfolios in 2022 was one of the most severe on record, and the worst seen in many years. Under more normalized circumstances, bond and equity returns do not correlate. Generally, this is due to market participants seeking the relative safety of bonds during equity bear market periods. However, because the Fed tightened rates so swiftly in 2022, bond investors incurred losses for the year. As a result, this normally stabilizing counterbalance, instead contributed to additional portfolio losses.

Observing data over periods more relevant financially for long-term investors reminds us of the importance of building diverse portfolios. While we can’t predict which asset class will perform best during specific time periods, we do know that a diversified portfolio will generate more favorable risk-adjusted returns over the long term.

Views and Investment Themes for 2023 and Beyond

While the ability to predict market moves in the near term isn’t possible for anyone, we are able to identify themes that present risks and opportunities. These views help us determine how to tactically shape and allocate our clients’ portfolios.

Deglobalization

The world is moving into a period where national security is taking precedence over economic growth. This trend is clearly evidenced in the United States by the passage of the Chips and Science Act in August 2022, a policy that advances domestic manufacturing of semiconductors. Surprisingly, both sides of the political aisle share common ground around this theme. The phenomenon is likely to play out over several years with various ramifications, including valuations.

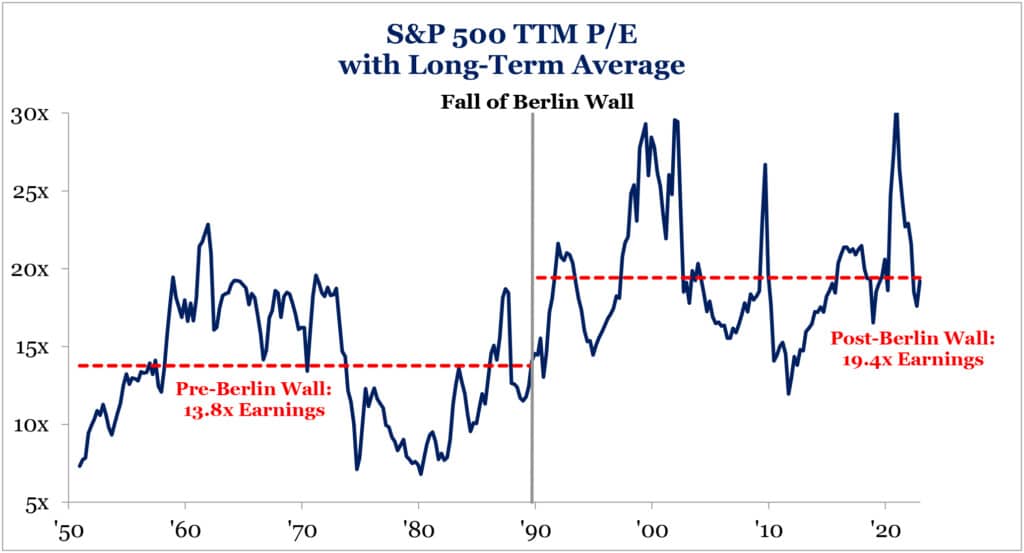

The Cold War and post-Cold War periods offer interesting comparisons of these distinct orientations. As shown in Figure 3, below, from 1950 through 1989 (a period that was also less globalized and national interest and security were more heavily considered), equity valuations were expectedly lower. On the other hand, due to a greater trust among nations, the post-Iron Curtain period (1989-present*) resulted in more globalization and fostered increased economic prosperity.

* The Berlin Wall fell on November 9, 1989, and represented the beginning of the end of for the USSR.

FIGURE 2

Source: Strategas Securities, LLC

The Zero Interest Rate Policy Ends

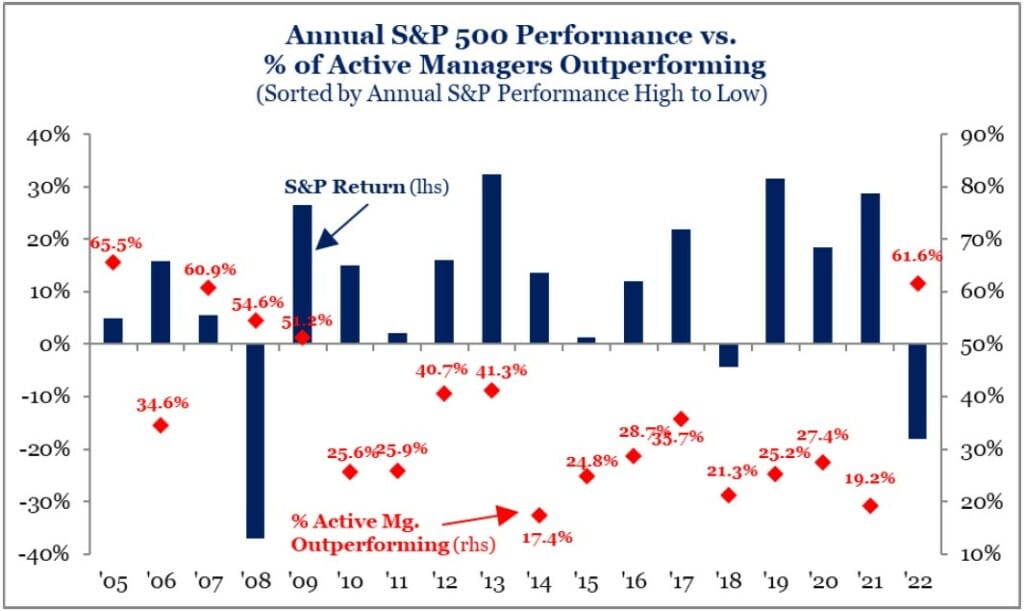

During quantitative easing (QE), where rates essentially sat at zero for nearly 14 years, savers looking for returns had no alternative but to buy riskier assets, such as equities. As we exit this period and enter a more normalized rate regime, we believe active management will outperform passive indexing. We saw this manifest in 2022 and we believe it’s the beginning of a multiyear trend.

As shown in Figure 3, below, quantitative easing rendered active management less effective. As a result of a normalization of monetary policy and thus a return to a real cost of capital, there will be a greater dichotomy between winners and losers. Specifically, we think a focus on fundamentals and valuation will be a stronger determining factor in generating greater risk-adjusted returns.

FIGURE 3

Source: Strategas Securities, LLC

Weak Economic Growth in 2023

Due to the rapid tightening of monetary policy and its chilling effect on economic growth, an economic recession is likely in 2023. At this point, the recession call is a consensus assessment, and thus likely baked into most market participants’ expectations. We’re beginning to see ramifications of this view as some companies announce hiring freezes and layoffs. While investors need to be aware of this factor, we don’t think it’s the most important element for them to be attuned to. Instead, they should be more focused on how markets function as forward-looking discounting mechanisms. So, while it is possible that asset prices dip further from current levels, it’s critical that investors not become more bearish in the face of lower prices. Instead, they should become more bullish. Traditionally, markets bottom out prior to GDP. There’s no reason to believe this time will be different. Thus, the deteriorating economic news will get priced into securities prices long before they’re detected by various economic indicators or become press release headlines. While it might become more uncomfortable to own equities in a deteriorating economy, the risk/reward asymmetry will grow in the favor of risk takers.

The Beginning of the End

With clear signs that inflation is abating, the blistering pace of hikes implemented by the U.S. Federal Reserve, which began in March, are likely to end in the second quarter of this year. It’s important to note that desired effects generated by this tightening always occur on a lagged basis. As the debate around high inflation continues, we see reasons to be optimistic that the policy is working despite persistently high Consumer Price Index (CPI) prints.

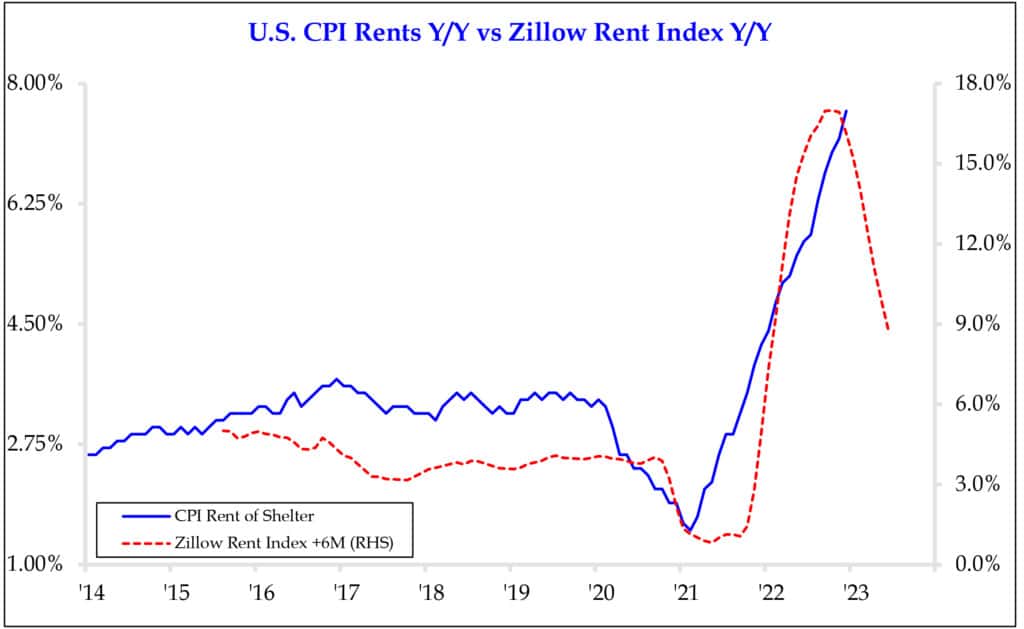

We contend that CPI may not be the best real-time metric for measuring inflation changes. Owners’ equivalent rent (OER), the method used to measure CPI’s largest component, housing, calculates how much a property owner would pay in rental rates — not an estimated value of the property. Without delving deeply into its nuances, we’ll simply highlight that OER is a lagging indicator. The chart in Figure 4, below, depicts CPI rent data versus real-time rental rate data gathered by Zillow.

FIGURE 4

Source: Strategas Securities, LLC

Further to our view that home price inflation and rent is abating, the US is seeing the largest percentage increase in multifamily units coming to market in 40 years (U.S. Census Bureau). This housing supply should significantly dampen rental price appreciation. Other signs that corroborate our view that rate hikes have begun to quell high inflation are falling used car prices, commodity prices, and abating wage inflation pressures. All of these factors foreshadow falling inflation, indicating we’re closer to the end of this hiking cycle.

Our Current Positioning

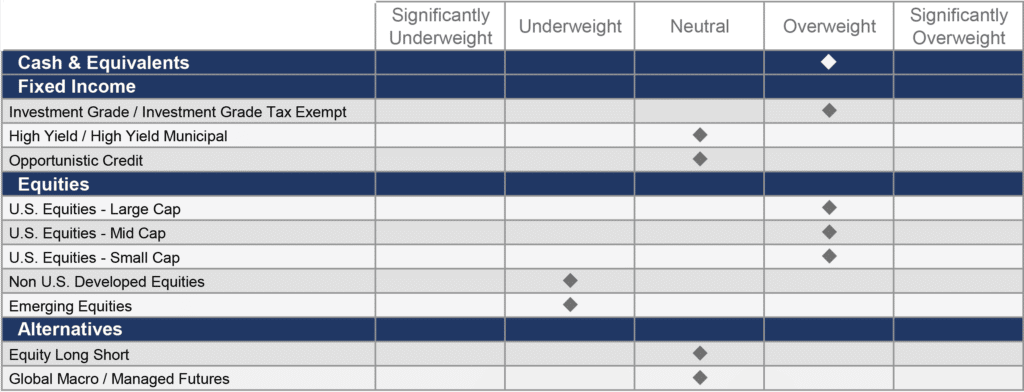

These themes and views have helped us formulate our current tactical market views, which are expressed in Figure 5, below. Note: FineMark client portfolios are customized to suit each unique financial situation; therefore, these views may not be implemented in every portfolio in the same way.

FIGURE 5

FineMark National Bank & Trust©

Happy New Year

Looking back on the past year, we find many reasons to express our gratitude. We’re grateful for the dedication and resilience our associates have shown in the face of adversity.

We’re grateful to you, our wonderful clients, for allowing us to be the stewards of your wealth. We hold this duty sacrosanct and are humbled by your continued trust in our ability to grow and safeguard your financial assets. Although we experienced our fair share of “Minsky Moments” in 2022, we’re hopeful that the New Year will bring a more positive outcome for all.

2022 Fourth Quarter Review and Commentary

By Christopher Battifarano, CFA®, CAIA

Executive Vice President & Chief Investment Officer

Articles In This Issue:

How Secure Act 2.0 Could Impact your Retirement Plans and IRAs

Download 2022 Q4 Newsletter Here