Born in Winchester, TN, Sir John Templeton was one of the most successful investors of the twentieth century. After graduating near the top of his class at Yale University, he was named a Rhodes Scholar to Balliol College at Oxford where he earned a law degree. In 1938, he began his Wall Street career and went on to pioneer the use of mutual funds, founding the Templeton Growth Fund in 1954. In 1987, he was created a Knight Bachelor by Queen Elizabeth II for his many philanthropic accomplishments. He was also a Chartered Financial Analyst charterholder.

Markets are Rational…Usually

Throughout 2022, global financial markets have experienced exceptional levels of high volatility. While it’s normal to anticipate some turbulence in a given year, the activity seen thus far has been extreme, causing us to think about behavioral finance and the effects of emotional decision-making.

Behavioral finance, the study of psychological influences on investors and financial markets, is used to identify and explain inefficiency and mispricing in financial markets. It also shines a light on the fact that humans and financial markets aren’t always rational. Frequently, decisions that investors make during periods of market instability can be flawed.

At the core of behavioral finance is the human condition. The way that an individual is innately wired can make a person more or less apt to be a good investor. When it comes to market volatility, a key factor working against most people is emotion. Reacting impulsively to changes occurring in a turbulent market can have disastrous effects, getting the best of even the most seasoned investor. Note: To learn more, watch the FineMark video series, “Behavioral Finance Explained,” featuring Paul Blatz, Senior Vice President & Private Wealth Advisor in our Palm Beach and Jupiter offices.

Keeping behavioral finance in mind, let’s consider the function of the market. Public markets are forward-looking discounting mechanisms that attempt to determine the value of securities based on the current worth of the future stream of cash flows for those securities. The two primary factors considered when making these determinations are: 1) the certainty and the amount of future cash flows and 2) the rate by which the securities are discounted (higher discount rates yield lower present values).

If the current equity bear market selling were to increase in ferocity, many market participants may become emotional about their portfolios. As stress levels rise and eventually peak, these investors may reach an emotional state known as despondency. This human tendency is understandable in the face of uncertainty, yet it doesn’t change the hard mathematical reality of the forward-looking discounting mechanism. During periods of market insecurity, when individuals may become more emotional and behave less rationally, markets tend to overshoot to both the positive and the negative.

Understanding this, we believe that a market overshoot may occur in the near future. Frequently, great assets can be acquired at attractive prices during such events. This is why we highlighted Sir John Templeton, one of the world’s greatest investors, in our opening quote. He rose to fame living by this seemingly simple advice: buy assets when the markets reach emotionally irrational states. Following his sage advice, however, requires discipline and tenacity.

Market Performance Overview

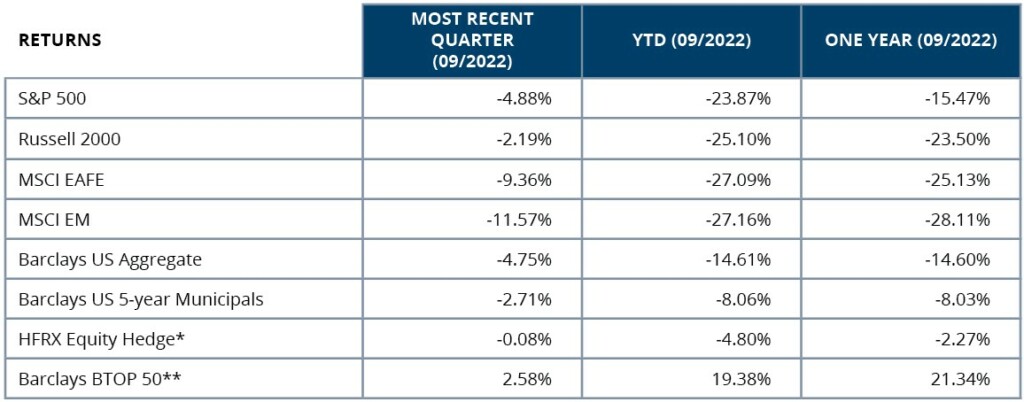

During the third quarter, U.S., international developed, and emerging markets exhibited large price declines across the board. Continued losses in major bond market indices, normally an area that can offset losses during equity bear markets, were also experienced. However, alternatives provided some solace: the HFRX Equity Hedge Index was down by just eight basis points and the Barclay BTOP50 Index was up by 2.58%.

Figure 1

Source: eVestment

*The HFRX Equity Hedge Index is an index of long-short equity managers, most of whom maintain a long bias, which clearly harmed returns for the period.

**The Barclay BTOP50 Index is a broad index of alternative managers (commodity trading advisors) who trade a variety of futures contracts across different markets in a bidirectional manner.

For the period, market activity was driven largely by the actions of the Federal Reserve. The commitment of the Fed and its Chairman, Jerome Powell, to combating inflation was demonstrated through two 75 basis-point hikes in the federal funds rate, one occurring in July and the other in September. This brought the benchmark policy rate to its current target range of 3-3.25%.

In our observation, the Fed’s conviction around reverting inflation to its prescribed 2% level seems high, and the notion that the Fed could pivot away from this view without data confirming that trajectory is slim. While we might argue that some of the data the Fed is attuned to, appears to contain a degree of backward-looking influence, we’re resigned to accepting the world as it is, not as we wish it could be.

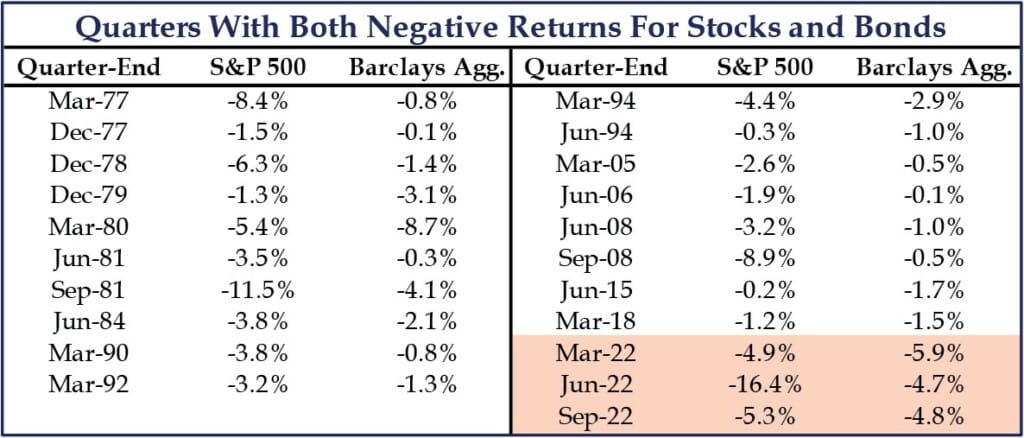

For the Third Consecutive Quarter, Negative Returns for Both Stocks & Bonds

Using the S&P 500 and the Bloomberg U.S. Aggregate Index as benchmarks, a third consecutive quarterly loss in value was experienced in the U.S. equity market and investment grade bonds. In the history of the Bloomberg Index, which dates back to 1976 (providing 187 quarters of historical data), simultaneous declines in value of these two benchmarks for three consecutive quarters has never occurred.

Unfortunately, this unprecedented bear market scenario has been particularly painful for investors. In prior bear markets, fixed-income holdings have acted as a ballast of value, because in most portfolios, they’re typically the primary risk offset.

Figure 2

Source: Strategas Strategies, LLC

How Far Will the Fed Go?

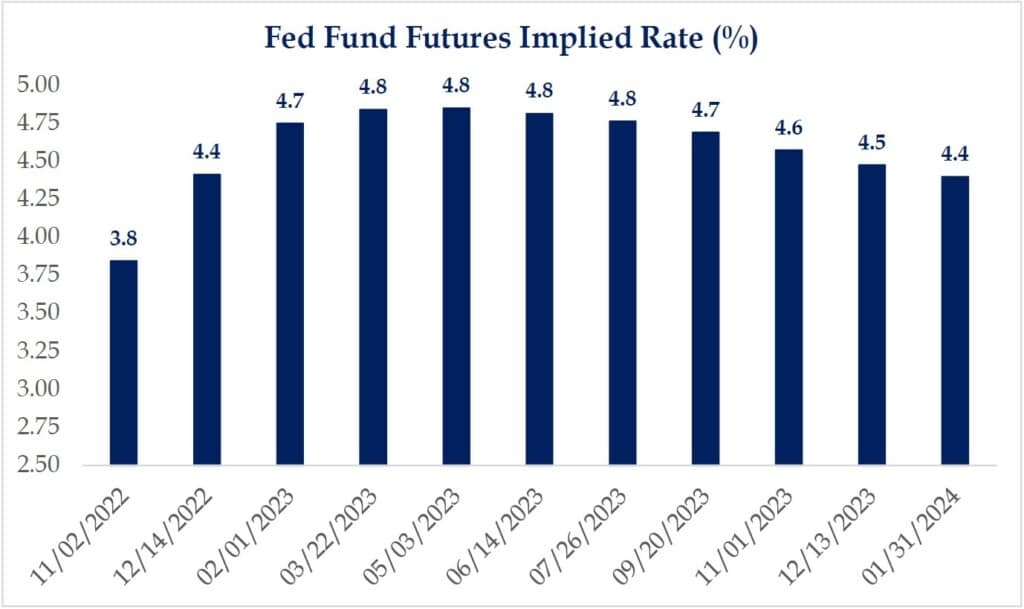

In today’s 24-hour news cycle, it’s easy to forget that the Fed only started hiking rates off the zero bound in March of this year. While no one — not even those inside the Fed — can accurately predict how far the Fed will go, we can refer to current and past market behavior for insight.

Based on the Fed’s own guidance (unless some unanticipated change in the data causes it to pivot), the policy rate appears slated to rise to the 4-4.5% range by the first quarter of 2023. As depicted in Figure 3, the market is currently pricing within that range.

Figure 3

Source: Strategas Strategies, LLC

A New Normal

In our last newsletter, we discussed three major factors that we believe are creating a capital market environment that’s vastly different from the benign one presented over the previous decade. These factors, which are critical to understanding how market dynamics are shifting, are:

- In response to Russia’s invasion of Ukraine, energy sourcing options have shifted, global security risks have heightened, and military preparedness and western collaboration have been renewed.

- As the endemic phase of the COVID-19 pandemic begins, nations are conducting retrospective supply chain examinations and enacting strategic diversification tactics.

- The Federal Reserve’s decision to move away from quantitative easing (QE), a monetary policy that allowed the Fed to reduce longer-term interest rates by purchasing Treasury and agency mortgages.

As these three factors continue to shift and new supply lines are created with a greater focus on national security and strategic considerations, costs will rise.

Another factor that’s recently come to light, most notably at the Fed’s Jackson Hole Conference but elsewhere as well, is the Fed’s deep concern about maintaining stable prices in the U.S. economy. Today, a 2% long-term inflation target is the Fed’s primary objective. Not since the days of Federal Reserve Chairman Paul Volcker — which ended 35 years ago — has this degree of focus on price stability been seen, taking precedence over the Fed’s other mandate: full employment. The upshot, however, is that the U.S. has migrated from a zero interest-rates policy (which accrued to benefit owners of risky assets such as stocks, bonds and real estate) to a policy focused on eradicating high inflation.

The Fed sees high inflation as something that harms all Americans but is disproportionately borne by the poor, who spend a larger portion of their income on food, shelter and energy. Fed Chair Powell said, “You can think of price stability as an asset that delivers large benefits to society over a long period of time.” While the prior QE policy unduly benefited the wealthy (i.e., those who own capital assets), this new policy is targeted toward helping the middle class and is unlikely to create a tailwind for risk assets.

Now is Not the Time to Panic

While bear markets and economic recessions are never enjoyable, they are a normal phase within a capitalistic economic system. Our client portfolios are built to withstand these types of eventualities; however, if the price volatility in your portfolio feels like it is too much to bear, we can make strategic adjustments. Our advisors have the tools and experience needed to tame portfolio volatility thoughtfully and effectively. During uncertain times, we reach out more frequently to our clients, but we also invite you to contact us at any time, with any questions or concerns.

Weathering Hurricane Ian

On September 28, Southwest Florida and the greater Fort Myers region — our hometown — was struck by a devastating Category 4 hurricane. Fortunately, all of our associates are safe and well, however, a number of our offices were closed temporarily in the aftermath of the storm. Today, we are fully operational and more committed than ever to upholding our founding mission statement: “To make a positive impact on the individuals, families and communities we serve while being good stewards of FineMark’s resources.”

Currently, we’re living that mission by giving back to a community that is in desperate need of hurricane relief supplies. Our associates are active in our neighborhoods, volunteering their time and talents to help those in greatest need. If you require any special assistance during this recovery period, please reach out — we’re here to help! With tenacity, strength, resilience and fortitude, we know our great community will rally and return brighter and better than ever.

2022 Third Quarter Review and Commentary

By Christopher Battifarano, CFA®, CAIA

Executive Vice President & Chief Investment Officer

Articles In This Issue:

Tax Relief for those Impacted by Hurricane Ian or Other Disasters

Download 2022 Q3 Newsletter Here