In hindsight, the words spoken by former Russian President Boris Yeltsin in 1999, quoted above, seem particularly prescient. Clearly, Yeltsin knew that his successor’s plans for Russia’s future differed greatly from his own desire for a Western-styled democracy.

With the preceding 70-years-long Cold War fresh in their minds, Western world leaders naively turned a blind eye to the transgressions Putin made over his subsequent two-decade rule. When Putin decided to invade Ukraine on February 24, 2022, however, that tacit acceptance ended abruptly and unleashed an economic assault. The West is now galvanized in its condemnation of Putin and his invasion of Ukraine.

We believe this is a watershed moment in history.

AND JUST LIKE THAT…

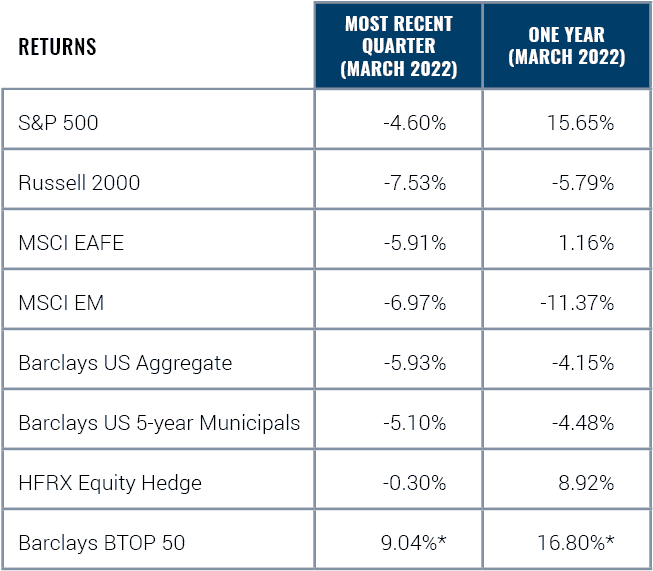

The new year had barely begun when we suddenly found ourselves in a volatile market environment. The significant and persistent inflation trends that appeared in 2021 due to COVID-related supply chain bottlenecks and government stimulus have been exacerbated by the Russian invasion of Ukraine. Recent inflation rates are running at levels the United States hasn’t experienced in 40 years. Additionally, this is the first quarter that’s shown negative returns in the S&P 500 since First Quarter 2020.

However, the fixed income losses for First Quarter 2022 are far more historic. As shown in Figure 1, the losses displayed in the Bloomberg US Aggregate Index were 5.93% for the quarter. When combined with the losses from last year, however, the fixed income benchmark index is in a 7.57% drawdown, a decline that hasn’t been this deep for fixed income values since 1981. Thanks to a 40-years-long, secular environment of steadily falling interest rates (remember, bond prices and yields are inversely correlated), investors aren’t accustomed to seeing losses in fixed income investing.

Source: eVestment *Estimated data as of 04/11/2022

Further fueling this bond bull market was quantitative easing, the Federal Reserve’s bond-buying program. Originally adopted during the 2008 Global Financial Crisis, the program ended on March 16, 2022, at the last Fed meeting. In addition to hiking policy rates, the Fed indicated it’s likely to begin shrinking its balance sheet, known as quantitative tightening. These two actions will act as further headwinds to holders of fixed income instruments.

Conversely, our alternative strategies in long-short equity and managed futures performed well for the period. Managed futures were particularly strong due to the large uptrends in commodity markets and adopted short positions in fixed income.

THE LONG-TERM RAMIFICATIONS OF WAR

While the quarter proved challenging for markets, more volatility may lie ahead. The situation in Ukraine will have long-lasting market impacts even if hostilities end (as we hope they will) and a cease-fire is agreed upon. In addition to the mass Ukrainian civilian casualties and refugee crisis the invasion has triggered in Europe, its spillover effects for the rest of the world are significant.

The war, combined with the ensuing sanctions placed on Russia by the U.S. and its Western allies, has resulted in the removal of certain percentages* of these commodities from the global market: wheat (30%), corn (20%), sunflower seed oil (75%), and crude oil (10%), further fueling inflation in these products. Additionally, there is high risk that the winter wheat crop in Ukraine won’t be harvested and future plantings will not occur. According to the March 29, 2022, Reuters article entitled, “With Ukraine Farmers on Frontlines, U.N. Food Chief Warns of ‘Devastation’,” David Beasley, executive director of the United Nations World Food Programme, has warned the United Nations Security Council that 50% of the grain it purchases to feed 125 million people is sourced from Ukraine, which could result in famine, the destabilization of multiple countries, and mass migration.

The fertilizer industry is also at risk, which would have a direct, negative impact on future crop yields. Fossil fuels, farming, and the global food supply are inexorably linked beyond what most people realize. Despite all the fanfare about organic farming, most of the world’s food is supplied through petrochemically-produced nitrogen, phosphorous and potassium (NPK) fertilizers. Many of this industry’s critical feedstocks come from Russia, Belarus, and Ukraine. Specifically, Russia and Belarus control 40% of the world’s potash supply. Additionally, the majority of nitrogen used in fertilizer production comes from natural gas; Russia exports 30% of global NPK fertilizer. The American Farm Bureau is highlighting these risks and farmers worldwide are bracing for shortages of — and higher prices for —fertilizer.

Collectively, these issues don’t simply translate into higher prices for cereals or meats — they increase the risk of social unrest, particularly in poorer nations that are more reliant on grain imports. These circumstances could also lead to ill-conceived nationalistic government policy creation such as grain export bans. Memories of the 2011 Arab Spring are still fresh; much of North Africa and the Middle East are highly dependent on cereal imports.

GLOBAL ENERGY REALITIES

Along with inflation, the future of global energy and its interdependencies are now evolving. In retrospect, it’s clear that continental Europe allowed its energy needs to become reliant on a rogue nation.

Europe imports 40% of its natural gas from Russia. While both the U.S. and the U.K. have now banned the importation of Russian-produced energy, Europe is unable to do the same. More likely, Europe will look to other sources (including the U.S.) for fossil fuels and seek further development of alternative energy sources such as wind and solar (though any viable energy solution set not including a dependency on Russia is a long way off).

Europe wants to stop buying all fossil fuels from Russia before 2030. To that end, the U.S. announced in late March that the U.S. liquified natural gas (LNG) industry will supply an additional 15 billion cubic tons of gas to Europe for the remainder of 2022. The agreement endeavors to increase European supply of LNG to 50 billion cubic tons through 2030. Europe uses approximately 130 billion cubic tons annually.

Benefitting from Western sanctions will be Asia’s importers (primarily India and China, its major economies) of Russian oil. Both India and China are highly dependent on foreign oil for their energy needs; New Delhi and Beijing have close ties with Moscow. One of America’s foremost experts on energy, Dan Yergin, the vice chair of IHS Markit and a member of the Energy Advisory Board under Presidents Clinton, Bush, Obama, and Trump, recently said in an interview with CNBC, “It does look like Asia would be the default market for barrels of Russian oil that would have normally gone to Europe.”

During the same interview, the Paris-based International Energy Agency said Russian crude is being sold at discounts of $25-$30 a bbl. This discounted energy pricing will give these economies a clear structural economic advantage. Discounted Russian crude will now comprise a larger portion of the Asian import total.

While the costs to the world will be great, the costs to Russia will be even more severe. From a military standpoint, in just over a month of armed conflict, Russian casualties have been high. NATO estimates between 8,000-15,000 Russian soldiers have perished to date. This is comparable to the total number of Soviet soldiers who died during 10 years of war in Afghanistan in the 1980s.

From an economic perspective, Russia is on a path toward economic ruin. The Institute of International Finance predicts that the Russian economy will contract by 15% in 2022, effectively wiping out 15 years of economic growth and hurtling the country into a depression.

Throughout his 22 years in power, Putin has tried to undermine and fracture the West. However, his recent actions have had the opposite effect, triggering a level of Western cooperation not seen since the former premier of the Soviet Union, Nikita Khrushchev, exclaimed, “I will bury you” while banging his shoe on the delegate desk at the United Nations General Assembly in 1960.

This new level of cooperation could have enduring, positive economic ramifications for the United States. Greater collaboration, an increased focus on energy security, and a closer evaluation of supply chains for critical resources are all being reexamined as a result.

At the same time, the rising risks of a recession are also evident. Contributing factors include high inflation, rising energy prices and growing interest rates. In particular, the rapid rise in oil pricing is a strong harbinger of future recessions.

We remember clearly the twin oil shocks of the 1970s; the disbelief when Iraq invaded Kuwait in 1990 and the ensuing recession that cost George H.W. Bush his reelection bid; and more recently, the mid-2000s spike followed by the Global Financial Crisis. Further, the cost of energy has a direct impact on consumer discretionary spending. This most recent, rapid ascent could pressure consumer spending and become a contributing factor that tips the U.S. economy into a recession.

EQUITY MARKET REGIMES

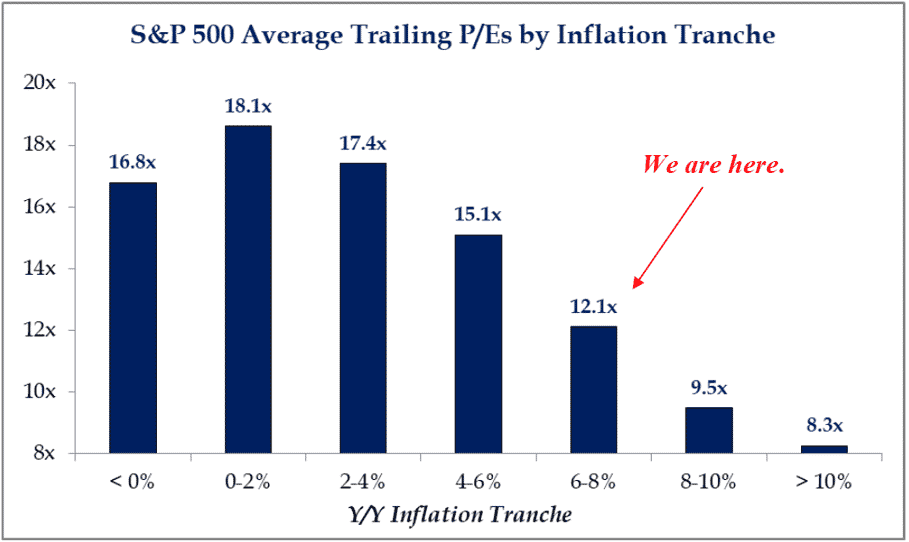

Both high inflation and high interest-rate periods contribute to lower-than-average price-to-earnings (P/E) ratio regimes. (The P/E ratio, a common valuation metric for equities, places a multiple on company earnings to derive a value.) Currently, we’re trading at a trailing P/E of approximately 20x.

From an inflation standpoint, looking at Figure 2, we’re currently mapping to a 12.1x multiple. In our view, this seems like an overdone conclusion. Inflation should moderate and we would postulate that perhaps a reduction of 3-5 multiple points are more appropriate reset compared to where we’re trading today.

Source: Strategas Securities, LLC

While this shift in valuation regime offers cause for concern, we also believe there are reasons for optimism. The two strongest encouraging factors are the robust job market — with unemployment below 4% — and a US consumer that’s in great shape due to a healthy balance sheet. These compensation factors help to moderate our future valuation expectations.

WHAT DOES THIS MEAN FOR PORTFOLIO ALLOCATIONS?

Now more than ever, we believe that portfolio diversification is the key to financial success. Therefore, we are not advocating radical portfolio changes today. We remain very underweight in investment grade fixed income and, within that asset class, are maintaining a low duration in the face of further rate risk.

To date, alternatives are an asset class that’s weathered this storm well and we believe their non-correlated nature will continue to help buttress portfolio values. While we believe alternatives should comprise only a small portion of an overall investment portfolio, their impact can be outsized during turbulent markets, for the right investor.

As yields rise, bonds will eventually present a better value to investors. We don’t believe we’re there yet and are maintaining an underweight position as a result. However, steadily rising yields will change our views to be more constructive.

A WELCOME CHANGE OF SEASONS

As the weather gets warmer, we know many of you are preparing to head north for the spring and summer seasons. We hope you’ll remember that we’re always here for you, even when you’re away. Feel free to reach out to us with any questions, market-related or otherwise. We deeply appreciate the opportunity to serve you and thank you for your continued confidence and trust.

Additional Source List

“Wheat Production by Country 2022,” World Population Review.

“Market Intel: Ukraine, Russia Volatile Ag Markets,” American Farm Bureau Federation, 3/16/2022.

Luciana Magalhaes and Samantha Pearson, “Ukraine War Hits Farmers as Russia Cuts Fertilizer Supplies, Hurting Brazil,” The Wall Street Journal, 3/5/2022.

Alistair MacDonald, “Russian Ministry Recommends Suspending Fertilizer Exports,” The Wall Street Journal, 3/4/2022.

“Oil Market and Russian Supply,” International Energy Agency (IEA).

Joel K. Bourne, Jr., “War in Ukraine Could Plunge World into Food Shortages,” National Geographic, 3/25/2022.

“Russian Exports Restrictions to Accelerate NPK Fertilizer Price Growth,” IndexBox, 11/4/2021.

“Chemicals & Resources: Export Volume of Fertilizers from Russia in 2021, by Type (in Million Metric Tons),” Statista.

Keith Good, “Fertilizer Price Records Continue, as White House Economist Sees Increased Planting in U.S.,” Farm Policy News, University of Illinois at Urbana-Champaign, 3/29/2022.

Jack Nicas, “Ukraine War Threatens to Cause Global Food Crisis,” The New York Times, 3/20/22.

Colussi, J., G. Schnitkey and C. Zulauf. “War in Ukraine and its Effect on Fertilizer Exports to Brazil and the U.S.,” farmdoc daily (12):34, Department of Agricultural and Consumer

Economics, University of Illinois at Urbana-Champaign, 3/17/22.

* These percentages are approximate.

2022 First Quarter Review and Commentary

By Christopher Battifarano, CFA®, CAIA

Executive Vice President & Chief Investment Officer

Articles In This Issue:

Benefits of a Florida Domicile

Download 2022 Q1 Newsletter Here