Chairman and CEO of Berkshire Hathaway Corporation

The onset of a new year is the perfect time to reflect on the previous year and contemplate what might lie ahead. At FineMark, we don’t operate under the delusion that markets can be forecast in the short term. Instead, we believe that history can be a useful guide, providing valuable insight into what the future may hold.

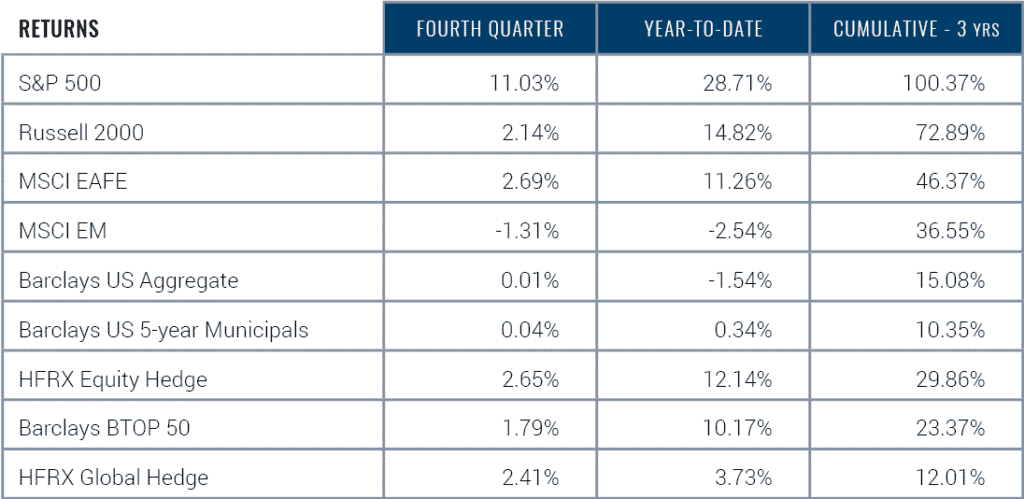

Within the specter of equity returns, when examining market performance across asset classes and styles, it is apparent that nearly all recent measurement periods have exceeded historical rates. In Figure 1 below, we’ve highlighted return data as of December 2021 for the 4th quarter, the past year, and cumulatively for the past three years.

The three-year returns of the S&P 500 are the highest they have been since 1999. (As a reminder, from January 1970 through December 2021, the S&P 500 has annualized at 11%.) These persistent, far-above-average equity returns prompted us to include the quote from Mr. Buffett, above. While it may not seem immediately intuitive, Buffett’s observation asserts that reckless behavior (either through the use of leverage or derivative instruments) only becomes apparent once the market reverses course and enters a bear market phase. While we are not bearish today, and remain constructive on the equity markets, worrisome issues on the horizon could result in a period of significantly diminished returns.

FIGURE 1

Returns as of 12/31/21

Source: eVestment

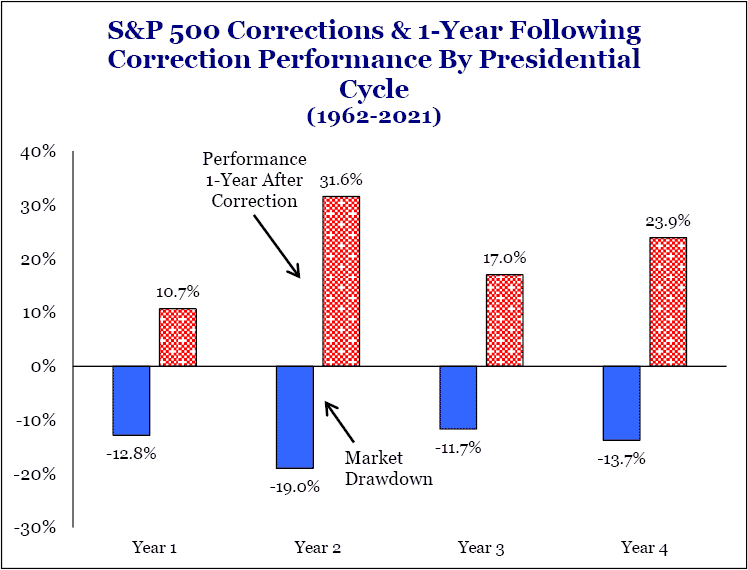

During a mid-election cycle, election years traditionally give rise to a period of elevated market volatility. We suspect that 2022 might play out similarly. According to our research provider, Strategas, historically these mid-term election-year drawdowns average 19%.

Interestingly, political outcomes don’t tend to drastically impact the market effect. Historical precedent and current polling show that the Democratic incumbent party will likely lose ground to the Republicans. Additionally, during periods of pre-election uncertainty, markets can be volatile. Post-election, however, markets generally snap back. On average, these snap-back rallies are 32% off-the-trough lows. Figure 2, below, clearly illustrates this phenomenon.

FIGURE 2

Source: Strategas Securities, LLC

Clearly, we do not know whether 2022 will play out exactly as prior mid-cycle years have; however, to anticipate how markets might react in the months ahead, it is important to be aware of past behaviors.

Expectations and Potential Risks

In our Q3 letter, we speculated that the Fed would announce a plan to end quantitative easing, the Federal Reserve’s bond-buying program. This plan, commonly known on Wall Street as “the taper,” will allow the Fed to taper off gradually by trimming bond purchases over an extended period. Announced during the fourth quarter and now underway, this process should conclude by the end of Q1 2022. Hikes to the federal funds rate will likely occur thereafter.

Today, we envision two to three rate hikes occurring in 2022 and again in 2023. If this in fact happens, we anticipate the federal funds rate will sit between 1-1.5%, a level that still would be characterized as low in any historical context.

However, this outcome could change for a variety of reasons. In the case of persistent inflation, a more hawkish plan might be required and could include the outright shrinking of the Fed balance sheet through asset sales, to bring inflation back in line with pre-COVID levels. Alternatively, there is also a risk that something may derail the strong economic growth we have seen, requiring the Fed to proceed at a slower pace.

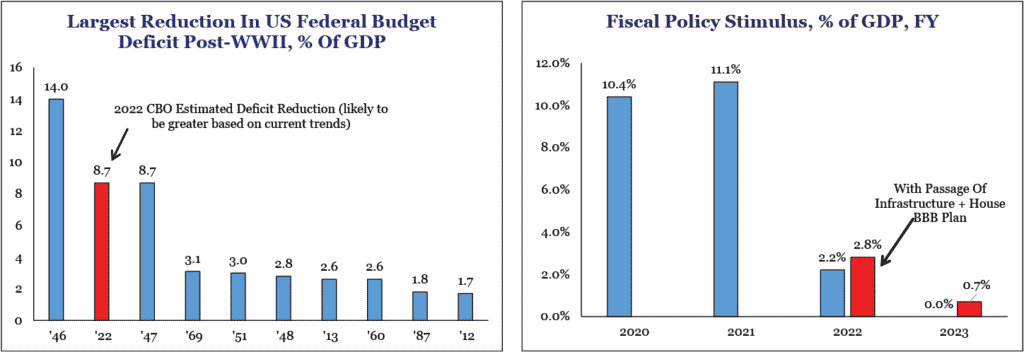

Fiscal Tightening

In addition to these headwinds, in 2022, America is poised to experience one of the largest fiscal contractions it has seen since 1947. With COVID stimulus ending and tax revenues rising due to greater economic activity, this estimated contraction could equal nearly 9% of gross domestic product (GDP).

Historically, the ending of COVID spending just might match its notable beginning. The only other time the United States experienced a significant fiscal tightening was after the nation ceased spending on World War II (in 1946 and 1947). Interestingly, the only other time the U.S. fiscal stimulus rose to the degree it did in 2020-21 was also during World War II!

FIGURE 3

Source: Strategas Securities, LLC

For now, President Biden’s Build Back Better framework has stalled; even if it had passed, its impact would only have modestly blunted the fiscal contraction expected for 2022 and 2023. Given both the current medical and economic realities, it makes sense to end any crisis-type stimulus. However, the adjustment in a consumer-based economy such as the U.S. will likely manifest in Y/Y comparisons.

COVID Impacts

In our Q3 letter, we acknowledged the risk that COVID may reassert itself, and in November, Omicron was identified. This new variant of the virus, originally recognized in South Africa, quickly made its way across the European continent and into the U.S. While the spread has been robust, its economic impact has been far less than with prior waves. Vaccination and therapeutic advancements have helped stymie this strain, making its effects less lethal and its symptoms less severe.

We believe that the U.S. economy has grown more resilient, largely through technological solutions (such as remote work and online commerce); therefore, it is unlikely that subsequent waves will result in long-lasting economic retrenchments or large-scale, national level restrictions. Any future restrictions are apt to be localized (and largely driven by regional ICU capacity in hospitals).

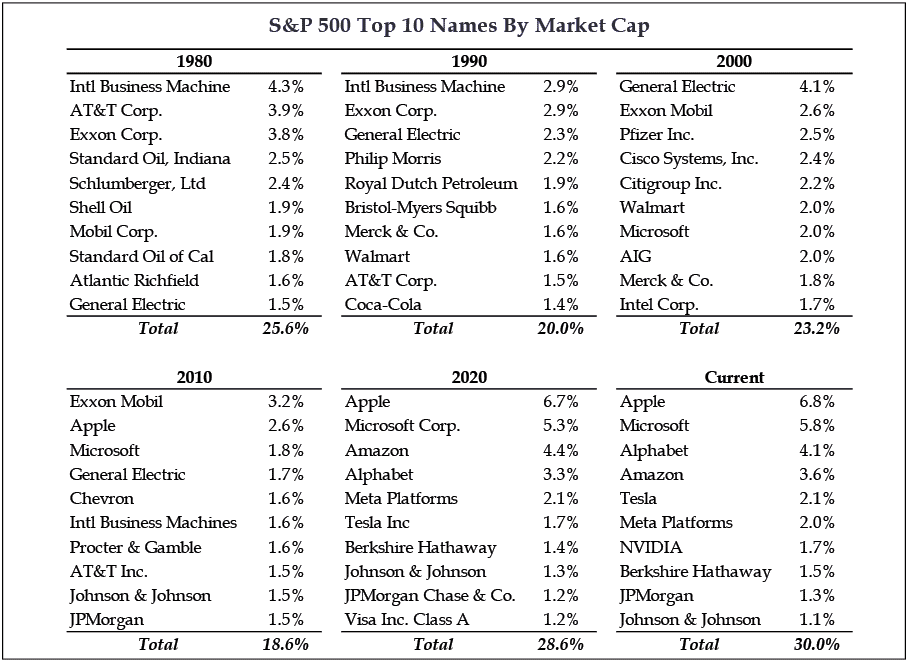

The Market You Thought You Knew

The composition of the S&P 500 — a topic we have discussed in the past — warrants revisiting. Most would consider this index, a standard-bearer of broad U.S. equity market performance, to be a well-diversified and well-represented compilation of securities. While this view may have been true in the past, the index’s current composition is growing more concentrated at the top.

The nature of a market capitalization-weighted index such as the S&P assures that high-performing large issues will receive greater representation within the index. As a result, the top 10 holdings currently represent 30.3% of the index’s total weight. This is the most concentrated the index has ever been!

Looking back historically, the top 10 holding’s average concentration over the past 40 years is 21%. Investors need to consider this fact because this concentration is having greater effect on index performance than one might expect. While we understand the virtues of passive investing, low-cost implementation, highly liquid, good tax efficiency, we also acknowledge that concentration risk is not a gamble many would generally take. However, under the current composition, it is a factor that investors must recognize and consider.

FIGURE 4

Source: Strategas Securities, LLC

Another element to keep in mind is index composition. Our clients often resist the idea of selling their Apple or Tesla holdings because the gains are large and they believe these companies “will always be there,” pushing their share prices ever higher. Figure 4, above, dispels this myth by showing that today’s leaders can become tomorrow’s laggards.

This leader-to-laggard scenario happens with surprising frequency. For example, in 1980, the index displayed an energy-heavy composition. In 1990, the top components (AT&T, Exxon, GE, IBM, and Phillip Morris) were companies deemed to be invincible. It is important to remember that risk always comes with concentration. Investors need to be aware of — and should never ignore — these risks.

We Miss You, Too

At every FineMark location, hospitality and cheerfulness are hallmarks of our personalized service. Due to the current prevalence of the Omicron variant, any plans for upcoming in-person gatherings have been postponed. We will reschedule these events when it is safe to do so. In the meantime, we remain available to you one-on-one (both virtually and in-person) and are happy to help with anything you need.

The stewardship of your investment assets — along with your health and safety— are duties that we hold sacred. We appreciate the opportunity to serve you and your loved ones; thank you for your continued trust and confidence.

2021 Fourth Quarter Review and Commentary

By Christopher Battifarano, CFA®, CAIA

Executive Vice President & Chief Investment Officer

Articles In This Issue:

Highlights of New Florida Trust Acts from 2021

Download Q4 Newsletter Here