This year has been full of unprecedented events, economic upheaval, and elevated market volatility due to the coronavirus pandemic, and the second quarter of 2020 proved no different. While we were pleased to see the steep selloff and 20% decline suffered by the S&P 500 Index during the first quarter come to an abrupt halt and give way to a new bull market, we can think of no other period in history where economic fundamentals and stock market performance have been so disconnected from one another. We witnessed a swift, 16-session bear market vanish in just over four weeks!

This year has been full of unprecedented events, economic upheaval, and elevated market volatility due to the coronavirus pandemic, and the second quarter of 2020 proved no different. While we were pleased to see the steep selloff and 20% decline suffered by the S&P 500 Index during the first quarter come to an abrupt halt and give way to a new bull market, we can think of no other period in history where economic fundamentals and stock market performance have been so disconnected from one another. We witnessed a swift, 16-session bear market vanish in just over four weeks!

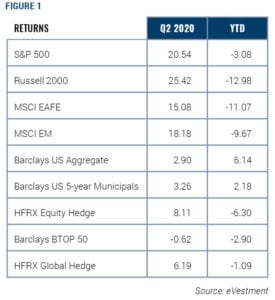

In hindsight, our decision to both adopt and maintain a more defensive, risk-averse stance in our investment allocations appears to have been mistaken. As Figure 1 illustrates, U.S. stocks rebounded strongly in the second quarter, trimming the market’s year-to-date loss to just 3% through June 30, as investors betting on a V-shaped economic recovery gobbled up shares at lower prices. We maintained cautious portfolio positioning due to concerns that the coronavirus pandemic would adversely affect the U.S. and global economy for the foreseeable future. While that downbeat macroeconomic view has been accurate thus far, validated in part by a June unemployment rate of 11.1% and 17.8 million Americans out of work, the stock market has remained bullish. Fiscal stimulus from Congress and liquidity pumped into the system by the Federal Reserve have propped up the prices of stocks and other financial assets.

We remain concerned that the next move in equities may be to the downside. There are a few risks that have been keeping us awake at night. The most obvious one is that we are still waiting for a Covid-19 vaccine to be approved for widespread public use by the Food & Drug Administration (FDA). With a potential vaccine perhaps six to 12 months away, or even longer, the coronavirus will remain a longer-term issue for the economy and markets. To be clear, we remain optimistic that there will be an eventual vaccine.

Based on the medical research we have reviewed, the pandemic problem is solvable. The big question is how long it will take to get the vaccine into the arms of the public at large. A vaccine is key to making Americans feel safe again. If the economy is to regain its footing, consumers need to feel confident that they can return to their normal behavior patterns without contracting the virus.

A second concern is a lack of corporate earnings guidance, which has been suspended by more than 40% of S&P 500 companies due to the lack of clarity many CEOs have about their near-term business prospects. Our view is that earnings estimates from Wall Street are likely higher and more optimistic than what may ultimately be realized by companies. Because the stock market has performed so strongly since the bear market low on March 23, companies may choose to take advantage of the crisis by announcing substantial write downs or the setting aside of sizable reserves to offset coming losses. Many corporate CFOs may adopt the so-called “kitchen sink mentality,”—i.e., announcing all of their bad news all at once—if they believe the market will give them the opportunity to do so under the guise of Covid-19.

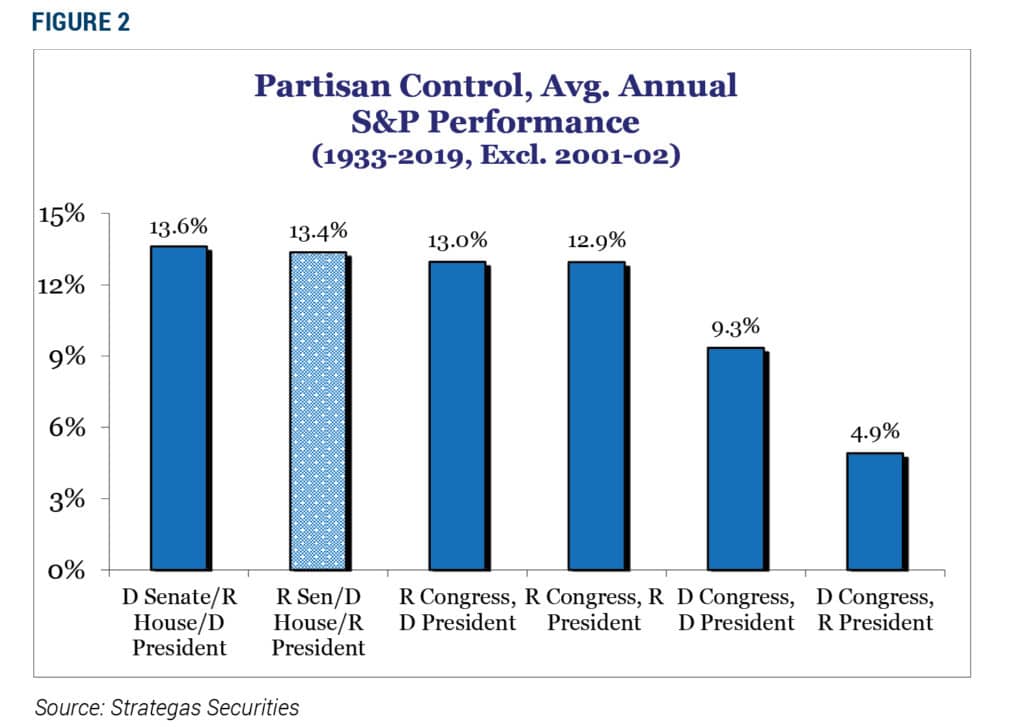

Another headwind to future equity returns that has surfaced more recently is a Democratic sweep in the November elections. Political views aside, we believe that such an outcome would have a negative impact on markets, at least in the near term. But based on historical data, we don’t see a power shift in Congress and the White House as a major long-term risk. Figure 2 below depicts historical stock market performance under various political outcomes in elections held from 1933 through 2019. As the chart illustrates, a Democratic sweep of the House of Representatives, Senate, and White House, has not historically been a worst-case scenario for market returns. In periods when Democrats hold power in both houses of Congress and the presidency, the S&P 500 has produced average annual returns of 9.3%. The weakest returns have actually occurred during periods with a Republican president and a Democratic-controlled Congress. While recent presidential election polls show President Trump trailing and losing ground to presumptive Democratic nominee Joe Biden, there is still much that could happen between now and November to influence the election outcome. We believe equity market performance in the three months leading up to November will have an outsized influence on the election result.

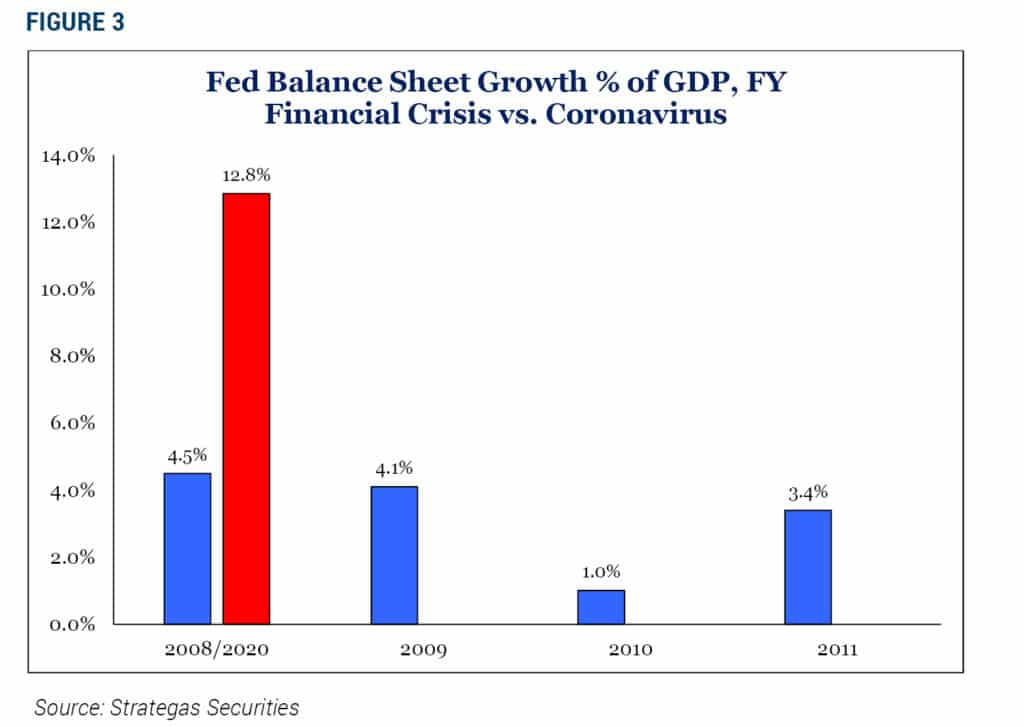

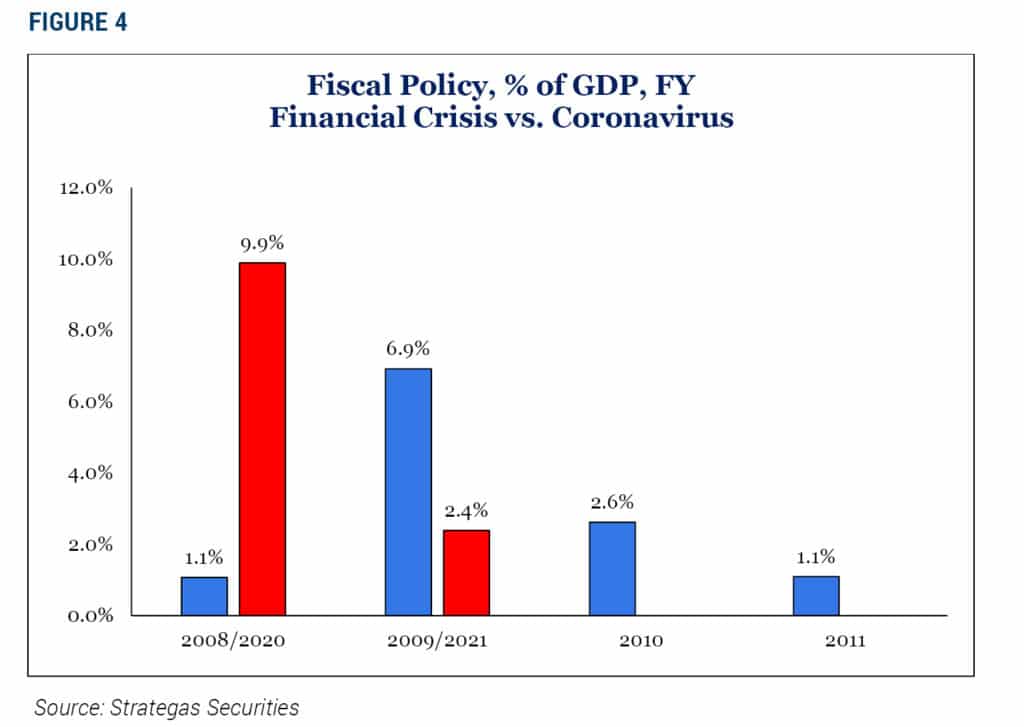

We firmly believe that over the long term, corporate earnings determine stock prices, and profits can be significantly affected by macroeconomic conditions. But in our view, the stock market is not currently trading on what companies are earning today or even what companies are forecasted to earn a quarter or two in the future. Instead, we believe stock prices are being driven by investors who are betting that the nation’s central bank and Congress will continue to act as backstops against negative market forces. There are a few reasons why we believe stimulus programs are exerting an influence on asset prices, including the fact that the Federal Reserve has expanded its balance sheet by roughly $3 trillion this year to almost $7 trillion, and the Federal government has provided $2.8 trillion in economic stimulus in just three months. This is the equivalent of approximately 27% of the US economy!

This is an unprecedented level of intervention, and it has come at breakneck speed. Figures 3 and 4 below illustrate how the government’s response to Covid-19 has dwarfed its response to the 2008-2009 global financial crisis. Of course, the purpose of the coronavirus aid was to help support markets, the economy, businesses, and American workers. So, it is not entirely surprising that financial markets are divorced from fundamentals and instead focusing on an eventual economic recovery.

Essentially, the government has backstopped private industry by pumping money into the economy. While this stimulus-driven activity is not sustainable over the long term, it is going a long way to help limit the hardships that would otherwise be felt by ordinary Americans. We strongly believe this government support will continue for a while longer. The fact that the coronavirus is still rapidly spreading throughout the country just four months before a national election presents a strong likelihood that Congress will find ways to provide additional government aid to hard-hit workers and business owners.

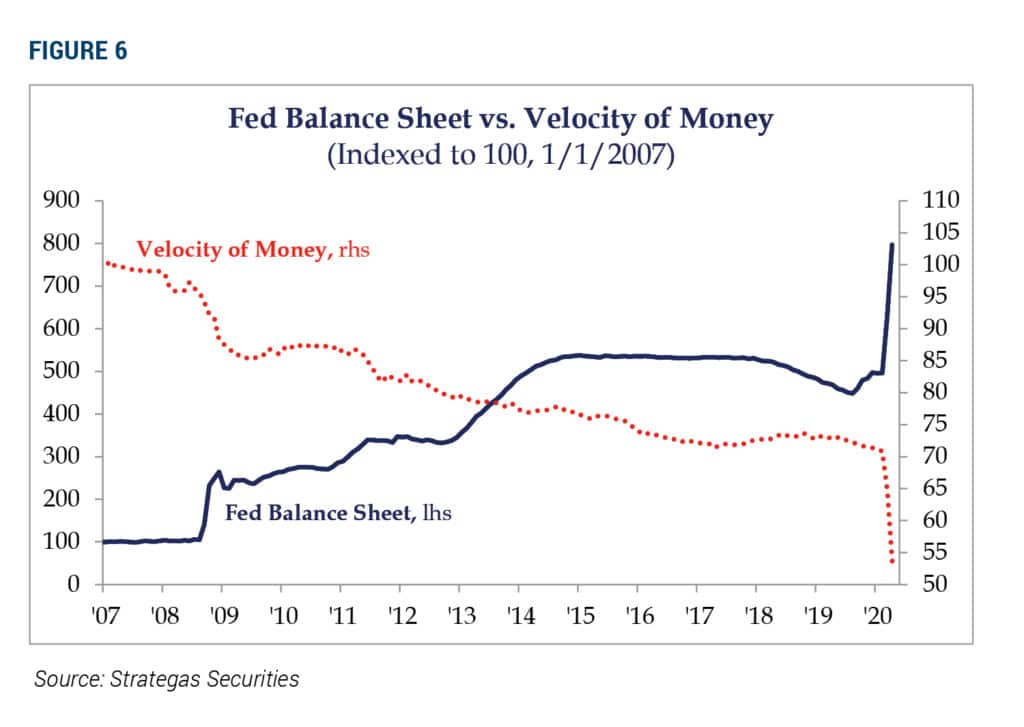

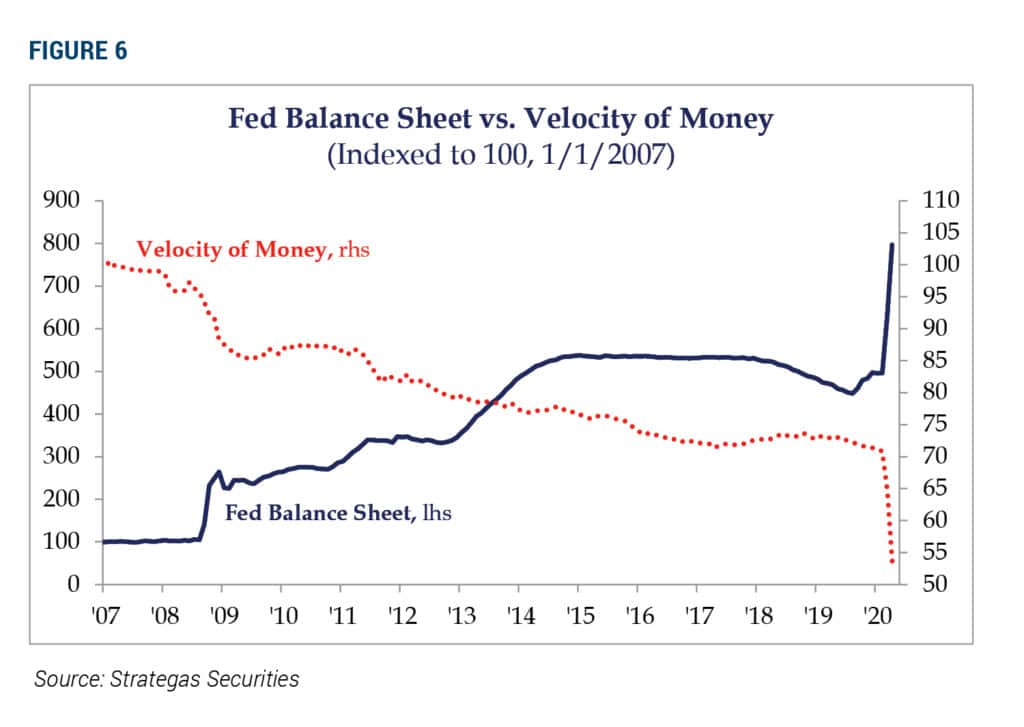

Importantly, as the pandemic persists, all of this new money injected into the economy is not flowing through the system as it would ordinarily. That is because consumer behavior has adjusted radically due to social-distancing measures. Essentially, this flood of liquidity has been funneled into financial assets, which have disproportionately benefited from these government stimulus programs.

In addition to an overall rise in stock prices, we have seen a massive dispersion in share price appreciation among sectors. Despite the economic recession caused by the Covid-19 crisis, there are a number of specific businesses that are thriving. The big stock market winners are largely found in the technology sector. In fact, the five largest stocks in the S&P 500 Index as measured by market capitalization are tech-driven stocks benefiting from trends such as digital and virtual communications, cloud-based data storage solutions, and online shopping. The list includes Apple, Microsoft, Amazon, Facebook and Google parent Alphabet. Figure 5 below shows how narrow market leadership has become—the five biggest stocks in the large-company stock index now make up nearly 22% of its overall weighting.

This growing dominance of just a few stocks has led stock market benchmarks like the S&P 500, which is typically viewed as broadly representative of the U.S. equity market, to be far more concentrated than usual. While this is not necessarily problematic, it does give rise to some unintended consequences. The first is that passive investors who invest in index funds and believe they own a broadly diversified basket of stocks must understand that this is no longer true. This concentration issue also makes it challenging to measure relative performance, such as the performance of S&P 500 Index funds relative to an active strategy. This concentration in a few large companies creates a market benchmark that has greater factor risk than it has historically.

LONG-TERM EFFECTS OF COVID-19 AND THE FISCAL AND MONETARY RESPONSE TO IT

There’s no denying that Covid-19 has been a massive burden on society, particularly when viewed through the lens of societal well-being, as evidenced by the over 14 million cases and more than 600,000 fatalities globally. Sadly, the United States has the dubious distinction of having the highest numbers in both categories of any other nation. Aside from the human toll, it is our role as capital allocators to consider the economic ramifications of the disease and the consequences of government intervention to assuage its ill effects. Broadly speaking, we believe that some of these consequences will be deflationary, while others will be inflationary.

On the deflationary front, we believe that many business trends that were already underway have been radically accelerated due to Covid-19. These include the move to online shopping and away from brick-and-mortar stores, online banking, and telecommuting, to name a few. These trends, which are all being driven by new technological solutions and applications, will increase worker productivity and result in the more efficient and thoughtful allocation of capital. There will be winners and losers during this transitionary phase, but over the long term, such moves are positive for corporate earnings and profitability. Real estate that is currently home to a bank branch or a retail location, for example, will have to be repurposed for a new use, perhaps for student or senior housing. Similarly, as portions of the American workforce migrate out of high-cost cities, such as New York, San Francisco, and Boston, and into lower-cost suburban settings, those cost savings will ultimately flow through to both business and consumers.

Some of the government intervention will also contribute to deflationary trends. To date, the U.S. has run a deficit of $3.8 trillion dollars; as of January 2020 (pre-Covid-19), the deficit was estimated to be just $800 billion. This increase has been facilitated in part by the issuance of new U.S. Treasury securities valued at $1.3 trillion, which were subsequently purchased by the Federal Reserve. While the practice of printing money during economic crises is now an accepted part of the Fed’s toolkit, this strategy has real-world consequences and is not a sustainable long-term economic policy. The debt that the U.S. is incurring today will ultimately need to be repaid—we are borrowing from future earnings that will need to be directed at some point toward debt repayment in lieu of either future savings or spending. Essentially, the long-term effect of the trillions of dollars in fiscal stimulus is just plugging holes in the economy caused by Covid-19. It is, unfortunately, not sowing seeds of what could be new productive growth investment, such as infrastructure spending. Our current type of aid spending will reduce long-term economic growth, not increase it.

Juxtaposed with these deflationary factors are the inflationary risks of the actions taken by both our federal government and central bank. Because we operate under a debt-based, fiat monetary system, the creation of new money could ultimately cause inflation. This would require an increase in the velocity of money through the system, which has yet to manifest itself, largely due to the changes in consumer behavior resulting from social distancing restrictions.

Another inflation risk is the comparative weakness in the U.S. dollar as compared to other currencies. If the U.S. remains on this path of simply monetizing debt, eventually the value of the dollar could erode, and its value relative to foreign currencies could weaken. A weaker U.S. dollar, of course, reduces its purchasing power. This would result in the effective importation of inflation to America in the form of higher costs for goods manufactured abroad.

OUR STEADFAST COMMITMENT TO OUTSTANDING CLIENT SERVICE

While our offices have remained closed to regular foot traffic since March in an effort to keep both our clients and associates safe, we remain ready to serve our clients. Many of our regular meetings have migrated to video or telephone. But we are still able to meet with clients face-to-face by appointment using enhanced safety protocols if required. We know that the summer months are a time when many of our clients retreat to cooler northern locales to escape the heat, and therefore these new meeting formats are perfect for discussing any financial concerns or questions you might have while on your summer holiday.

Have a safe and enjoyable summer.

2020 Second Quarter Review and Commentary

2020 Second Quarter Review and Commentary

By Christopher Battifarano, CFA®, CAIA

Executive Vice President & Chief Investment Officer

Articles In This Issue:

Estate Planning and Tax Considerations During Covid-19

Download Full Newsletter Here

This material is provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Information is obtained from sources deemed reliable, but there is no representation or warranty as to its accuracy, completeness or reliability. All information is current as of the date of this material and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole. FineMark National Bank & Trust services might not be available in all jurisdictions or to all client types.