-Tommy Lasorda, Legendary Dodgers Manager and Baseball Hall of Fame Member, 1927-2021

IMPROBABLE YEAR-END RETURNS IN AN UNPRECEDENTED YEAR

On January 7, 2021, the nation lost former L.A. Dodgers manager Tommy Lasorda, prompting us to reflect on the quote above. At FineMark, we believe Lasorda’s words are as apropos to the world of investing as they are to the world of baseball. We’d like to think of ourselves as “people who make it happen,” and we show our commitment to that ideal through our service and sincere desire to help improve and simplify all aspects of our clients’ financial lives.

On January 7, 2021, the nation lost former L.A. Dodgers manager Tommy Lasorda, prompting us to reflect on the quote above. At FineMark, we believe Lasorda’s words are as apropos to the world of investing as they are to the world of baseball. We’d like to think of ourselves as “people who make it happen,” and we show our commitment to that ideal through our service and sincere desire to help improve and simplify all aspects of our clients’ financial lives.

In keeping with this sentiment and Lasorda’s observation, we also believe that a failure to generate above-average rates of return on invested capital often occurs because market participants become too focused on the day-to-day noise and lose sight of their long-term goals. As Lasorda would put it, they’re left to “wonder what happened.”

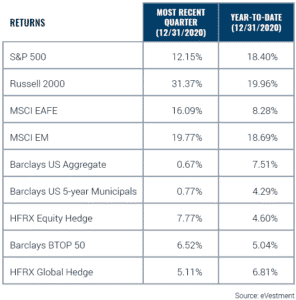

In a year dominated by the physical, financial, and economic effects of COVID-19, 2020 clearly exemplifies why market participants simply can’t allow emotions to drive investment decisions. Figure 1, details the returns of various asset classes for the fourth quarter and the year. In our wildest imaginations, we couldn’t envision the market results that were ultimately achieved. These gains, fueled by the coordinated and extraordinary actions of monetary and fiscal policymakers, were nonetheless real and created an improbable year-end outcome.

ECONOMIC IMPACTS

In our Q3 newsletter, we asserted that a vaccine would be the only real cure for what is ailing our economy. Thankfully, multiple vaccine options have been approved and are currently being distributed. These scientific breakthroughs were developed at a record-setting pace and, to date, the results are encouraging. We anticipate widespread dissemination of these vaccines to be the impetus that will allow our economy to fully reopen over time and limit the need for further monetary and fiscal stimulus. While the logistics required to inoculate the world are daunting and the rollout will take time, we do see 2021 as a year of recovery and believe there is significant pent-up demand for this remedy, particularly in the services sector of the economy.

Through governmental (and their own) actions, consumers have restricted their activities and limited their spending on services, the largest component of the U.S. economy, creating an abnormal dynamic. While we’re accustomed to seeing shortages of physical goods related to natural disasters, military conflicts, or labor stoppages, rarely have we seen such an interruption to the service side of the economy.

In our previous newsletter, we were hopeful that additional fiscal stimulus would be forthcoming; after great consternation, a bill was approved in late December. We believe this funding will go a long way toward helping those impacted by the effects of the virus and will also help prevent the economy from retrenching as the monies appropriated by Congress in early 2020 have been exhausted. With President Biden now in the White House and the Democratic Party in control of the House and the Senate, we expect another economic stimulus to occur in the first quarter.

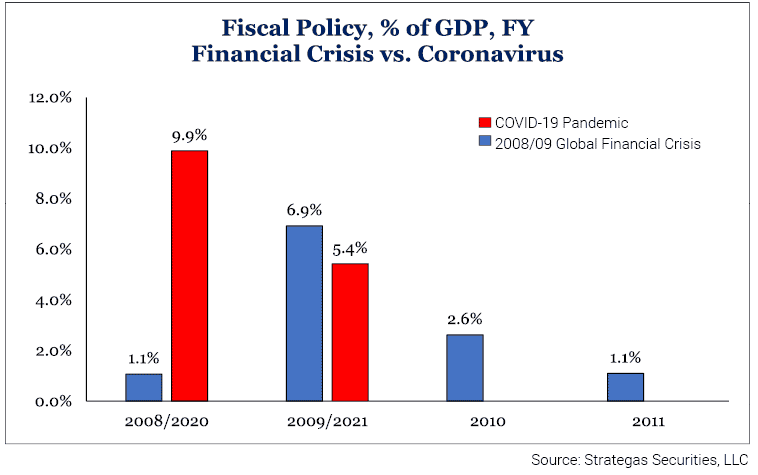

Outside times of war, the U.S. Congress’s response to the COVID-19 pandemic is without historical precedent. Figure 2, below, shows how America’s current response to this crisis has dwarfed the nation’s response to the 2008/2009 Global Financial Crisis.

FIGURE 2

The economic recovery we’ve seen thus far, combined with the vaccine rollout, leads us to believe that further stimulus could begin to have an inflationary effect on the economy. To avoid this risk, it’s critical that any additional plans be targeted toward the industries and people most severely impacted by the virus. This is the only way to offset the pandemic’s disproportionate effects on certain business sectors (such as leisure, aviation, and retail) and individuals (low-wage workers, in particular, have borne the brunt of its effects).

MAJOR INVESTMENT THEMES FOR 2021

As we enter the new year, it seems appropriate to review the themes within our current tactical views:

- Overweight Emerging Market Equity

- Overweight Gold

- Overweight Opportunistic Credit

- Underweight Investment Grade Fixed Income

EMERGING MARKET EQUITY

It’s important to note that the themes listed above are not uniformly expressed across our client base for a variety of reasons, including individual preferences or circumstances, risk tolerance, or tax considerations, to name a few. Understanding this, we feel strongly that our constructive view on emerging market equities should be implemented through our active managers (and not as a simply passive exposure).

In contrast to developed markets, the opportunity for our active managers to generate higher returns is greater in emerging markets due to their difference in information dissemination and overall market liquidity. While we were overweight in emerging market investments throughout 2020, our conviction has continued to grow; in fact, our Investment Policy Committee added to that overweight in Q4.

We currently have a stronger bias toward emerging markets as we believe their commodity exporters are better positioned than the service economies of the international developed world. We also think the emerging world’s demographics are more favorable than their developed counterparts.

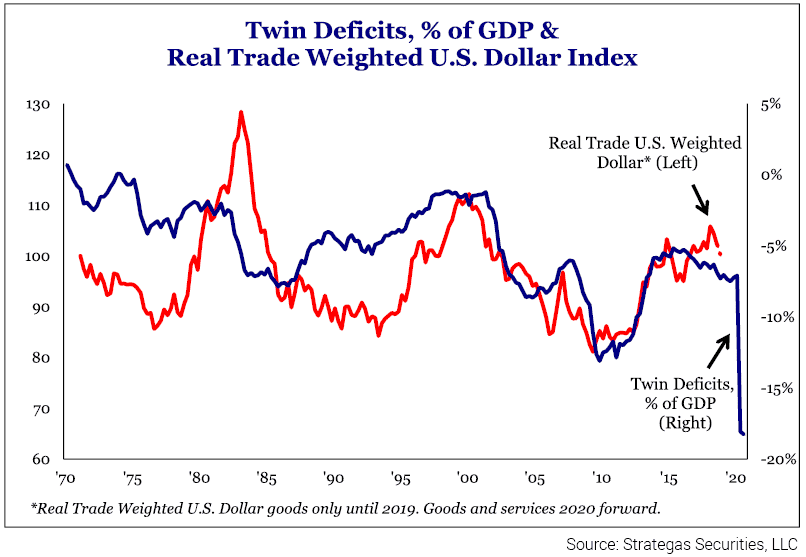

Further buttressing our case for emerging markets are the outcomes of the U.S. presidential election and the recent Georgia Senate runoff. Anticipating a combination of greater government spending, a push for higher taxes, and less aggressive tariff use as a result of these outcomes, we expect the U.S. dollar to weaken relative to other currencies. We also believe that increased deficit spending will lead to further weakness in the greenback. Figure 3, below, tracks a 50-year history of the negative impact that deficit spending has had on the value of the U.S. dollar.

FIGURE 3

GOLD

Our view on gold, originally articulated in our Q3 newsletter, remains firmly intact. That opinion centered on the fact that gold tends to rise in negative rate environments. This viewpoint makes sense because the opportunity cost in forgone interest payments, which investors typically receive on cash, are removed in a negative rate environment, eliminating the normal negative cost of carry associated with gold ownership.

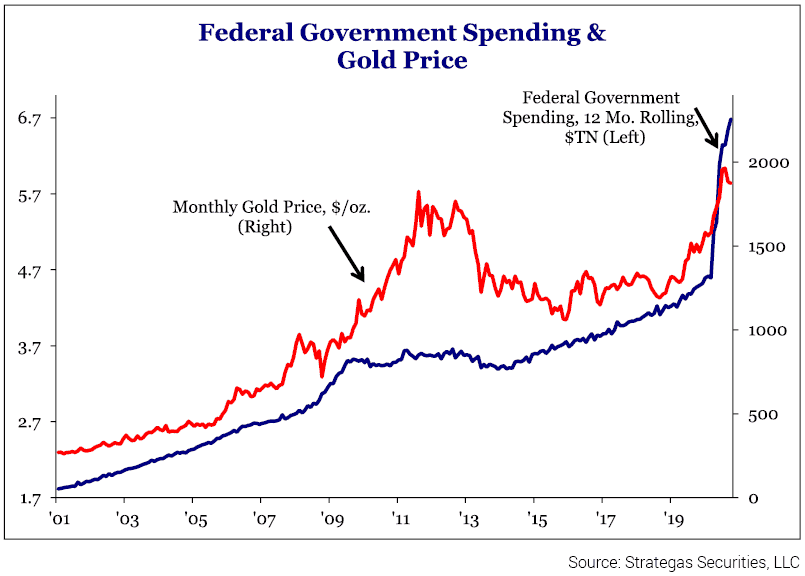

In addition to the low-rate environment, which we expect to continue for the foreseeable future, we believe that further deficit spending will help put a firm bid under the price of gold. This viewpoint also makes sense due to the fact that deficit spending is not funded through current tax receipts. As Figure 4, below, depicts, there’s been a strong positive relationship between the price of gold and increased government spending over the past 20 years. As the value of paper money is debased, the value of gold should appreciate. Our expectation for further deficit spending strengthens our bull case for gold.

FIGURE 4

OPPORTUNISTIC CREDIT

With regard to opportunistic credit, we’re finding outsized return opportunities in credit moving away from traditional investment-grade bonds. These opportunities contain a variety of instruments including non-agency residential or commercial mortgage bonds, Freddie Mac K-Deals® or credit risk transfer (CRT) bonds, convertible bonds, asset-backed fixed-income securities, and secured private credit to businesses, to name a few.

To fully understand these instruments, highly specified knowledge tends to be required; as a result, they often trade in lower volumes than traditional investment-grade bonds. Additionally, some of these securities aren’t available for direct ownership by individuals. They must be acquired by an intermediary through some sort of investment vehicle.

These instruments are generally floating rate; therefore, they’re less susceptible to the risks of rising rates. However, given the specified knowledge required to fully appreciate their risks, these securities can offer significantly higher rates of return in both liquid and illiquid forms, and the illiquidity premium can be large (sometimes between 400-600 basis points higher). In a world where nearly $18 trillion in debt offers negative nominal yields, such return rates are highly attractive for individual investors who want the quarterly cashflow and can tolerate some degree of illiquidity risk.

INVESTMENT GRADE FIXED INCOME

Within investment grade fixed income, we remain underweight. In this asset class, we don’t believe that investors are being adequately compensated, particularly when we evaluate the return opportunity minus the effects of inflation on a real basis (not simply nominal returns). Part of the pricing seen in the investment grade bond universe, we believe, is being unduly influenced by the actions of our own central bank and by the actions of other banks globally. While we still see a place for investment grade securities in most diversified portfolios, given the risk-reward opportunity we perceive today, that position is deemphasized from our neutral exposure levels.

HAPPY NEW YEAR

As we enter this long-awaited New Year, we want to wish you and your loved ones a peaceful, prosperous, and happy 2021. Though last year proved to be challenging, we have great hope that the vaccines being administered will help us all safely return to a more “normal” way of life soon. Thank you for your continued confidence and trust in FineMark. We look forward to serving you in the new year and beyond.

2020 Fourth Quarter Review and Commentary

2020 Fourth Quarter Review and Commentary

By Christopher Battifarano, CFA®, CAIA

Executive Vice President & Chief Investment Officer

Articles In This Issue:

FinTech Risks and Realities

Download Full Newsletter Here

This material is provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Information is obtained from sources deemed reliable, but there is no representation or warranty as to its accuracy, completeness or reliability. All information is current as of the date of this material and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole. FineMark National Bank & Trust services might not be available in all jurisdictions or to all client types.