FINE POINTS, The Quarterly Trust and Investment Publication of FineMark National Bank & Trust

July 2019 | Volume 4 | Issue 3

“It is not from the benevolence of the butcher, the brewer, or the baker that we expect our dinner, but from their regard to their own interest.” – Adam Smith, Scottish Economist (1723-1790)

Several notable events shaped financial markets and asset class returns in the second quarter, but the escalating trade tensions between the United States and China grabbed most of the headlines. Trade negotiations between the two economic superpowers broke down in May—at a time when U.S. Treasury Secretary Steven Mnuchin estimated that the two sides had been 90% of the way toward reaching an agreement. In response to this breakdown, both the United States and China escalated tariffs on each other’s goods, which has led to increased global economic uncertainty.

Several notable events shaped financial markets and asset class returns in the second quarter, but the escalating trade tensions between the United States and China grabbed most of the headlines. Trade negotiations between the two economic superpowers broke down in May—at a time when U.S. Treasury Secretary Steven Mnuchin estimated that the two sides had been 90% of the way toward reaching an agreement. In response to this breakdown, both the United States and China escalated tariffs on each other’s goods, which has led to increased global economic uncertainty.

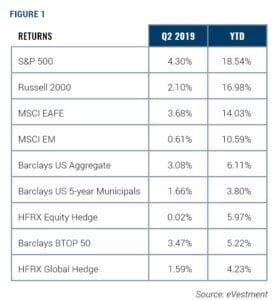

Despite this uncertainty, all major equity indexes posted solid gains for the quarter (Figure 1). The S&P 500 gained 18.5% over the first six months of the year, the index’s strongest first half in two decades. But concerns about slowing global growth caused long-term interest rates to continue to fall, leading to an inverted yield curve and increased concerns that a recession may be on the horizon.

REASONS FOR OPTIMISM ON TRADE POLICY

The quote at the top of this quarter’s letter comes from Scottish economist and philosopher Adam Smith, who authored the famous Wealth of Nations in 1776. Smith, viewed by many as the father of capitalism, advocated a shift from the mercantilist views of the time to a system of global trade based on comparative advantage for the benefit of all participants.

His theory was that market participants are rational and act in their self-interest, which spurs competition among participants in a free market. He theorized that trading occurs when both parties identify situations where they each are able to leverage their comparative advantages, which results in both parties being better off than they were before the exchange was made. Smith famously referred to this dynamic as “the invisible hand” in his magnum opus.

It is worth remembering Smith’s theory about trade because we believe that it will ultimately drive an agreement between the United States and China. Both countries, acting in their self-interest, will eventually realize that tariffs harm both nations and that reducing or eliminating them will result in better long-term economic outcomes on both sides of the Pacific and beyond. The timing of when the United States and China will reach this conclusion and resolve their policy differences is still unknown. But we are highly confident that some sort of resolution will be reached.

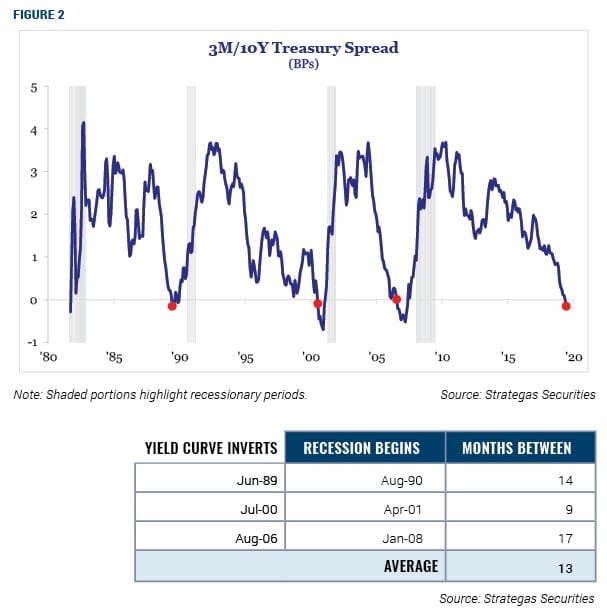

YIELD CURVE INVERSION REVISITED

In our last letter, we wrote extensively about the yield curve, inversions and the Fed Funds Rate. As a reminder, the yield curve represents the relative difference between short-term interest rates and long-term interest rates. In typical economic conditions, long-term rates are higher than short-term rates because investors demand higher compensation for the increased risks associated with lending money for longer periods of time. But when investors become concerned about the economy’s long-term prospects, they may look to invest in safer, long-term assets, such as bonds, which in turn drives up the price of these bonds and decreases their yield, or interest rate they pay. If this happens while short-term rates remain steady, the yield curve begins to flatten or may even invert, a phenomenon in which long-term rates are less than short-term rates.

In last quarter’s letter, we wrote: “… if long-term rates continue to drop—and trigger 2-year/10-year or 3-month/10-year inversions—the Fed would need to react more decisively.” The first half of that scenario occurred in the second quarter, and we suspect that it will cause the second half to come to fruition later this year.

During the second quarter, long-term rates, as measured by 10-year US Treasury bonds, continued to drop. Yield on the 10-year benchmark bond, which began the year around 2.7% and had dropped to 2.4% by the end of the first quarter, fell to about 2.0% as of June 30. The associated significant rally in bond prices has led to an inversion of the 3-month/10-year portion of the yield curve, which persists today. As a result, we believe that the U.S. Federal Reserve must now act—or run the risk that the current economic expansionary period will end.

Based on the degree of the current yield-curve inversion, short-term rates would need to decrease by about 75 basis points to restore a normal (upward sloping) rate structure. The Fed last met on June 19, and we found the following sentence on economic uncertainties in its press release highly informative: “In light of these uncertainties and muted inflation pressures, the Committee will closely monitor the implications of incoming information for the economic outlook and will act as appropriate to sustain the expansion, with a strong labor market and inflation near its symmetric 2% objective.”

We interpret this to mean that the Fed will cut short-term rates in July and possibly again in September. Many investors have similar expectations, which are already reflected by further appreciation in equity prices and continued low levels of market volatility.

At first blush, it would seem that tariffs are inflationary and that taxes on imports would result in higher prices for consumers. The market, however, interprets tariffs—correctly, in our opinion—as ultimately deflationary because they destroy demand over the long term. Markets are forward-looking discount mechanisms, which explains why we witnessed lower interest rates and lower inflation pressures during the second quarter. Falling rates will likely force the Fed to cut short-term rates to normalize the curve; failure to do so could ultimately restrict bank lending, and thus threaten continued economic expansion.

MANY NEGATIVE—OR UNHAPPY—RETURNS

If you thought interest rates were low in the United States, you should see yields in Europe and Japan. Many bonds in these regions have been trading at negative yields for several years, and interest rates continued to fall around the globe in the second quarter. The cumulative amount of debt globally yielding less than 0% has grown massively in the past nine months, from less than $6 trillion in October 2018 to $13 trillion today.

This negative carry has made alternative forms of money, such as gold or even cryptocurrencies such as Bitcoin, more attractive. However, we aren’t proponents of Bitcoin, or any other cryptocurrencies for that matter; and we don’t view them as alternative or viable stores of wealth today. Investors concerned about the viability of fiat currency, which virtually all paper currencies are today, could consider holding gold as an alternative. We don’t currently recommend doing this, but we could certainly foresee a role for gold in a diversified portfolio at certain points in the economic cycle. For now, many of our clients gain exposure to gold by investing in commodity funds, which did profit from gold’s appreciation in the second quarter.

VALUATIONS DETACH FROM FUNDAMENTALS

We are witnessing a somewhat disconcerting pattern in stock price appreciation. Particularly, investors are driving up the valuations of companies that have compelling top-line growth trajectories but don’t have a track record of being able to turn revenue into profits. This group of so-called “concept stocks” includes three companies that recently completed high-profile initial public offerings (IPOs): Beyond Meat, Lyft, and Uber Technologies. Conversely, some slower-growth segments of the market, such as energy and financials, are trading at very attractive valuation levels but aren’t attracting much attention from investors. These scenarios can be frustrating for fundamental investors, but we know that prices can ignore reality for only so long. As famous value investor Benjamin Graham put it, “In the short run, the stock market is a voting machine. In the long run, it’s a weighing machine.”

SHIFTING FROM DEVELOPED TO EMERGING MARKETS

From an allocation standpoint, the most significant tactical change we made during the quarter was to increase our exposure in emerging markets relative to developed international markets. We made this decision largely because of continued lackluster macroeconomic data out of Europe and Japan. So far, this tactical decision has not delivered the benefits we expected; developed markets have modestly outperformed emerging markets. We believe that the breakdown in U.S.-China trade negotiations was a significant cause of emerging markets’ underperformance, and we are very encouraged that emerging markets’ underperformance wasn’t greater, considering the circumstances. As a result, we remain committed to our overweight position in emerging markets relative to developed markets.

ENJOY YOUR SUMMER

We thank you for the continued confidence you place in FineMark. The stewardship of your financial assets is our highest priority, and we take the utmost care in executing this duty. We strive to continue to earn your confidence daily.

We have entered the dog days of summer, and we realize that many of you are vacationing or staying at summer homes. Regardless of where you are spending your summer, we are just a phone call away. We are always available to answer any questions you have about your portfolios or events that are shaping financial markets.

2019 Second Quarter Review and Commentary

2019 Second Quarter Review and Commentary

By Christopher Battifarano, CFA®, CAIA

Executive Vice President & Chief Investment Officer

Articles In This Issue:

Donating to Charity Directly From Your IRA: Less Money to Uncle Sam While Supporting a Good Cause

Download Full Newsletter Here