“Run for your life from any man who tells you that money is evil. That sentence is the leper’s bell of an approaching looter.” – Atlas Shrugged by Ayn Rand

HAPPY NEW YEAR!

HAPPY NEW YEAR!

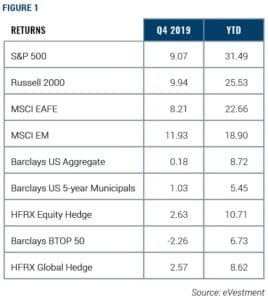

The end of 2019 marked both an extraordinary year and decade for equity markets. In this quarterly letter, we will take time to review and reflect on the successes of the past 10 years and then we will share our outlook for 2020.

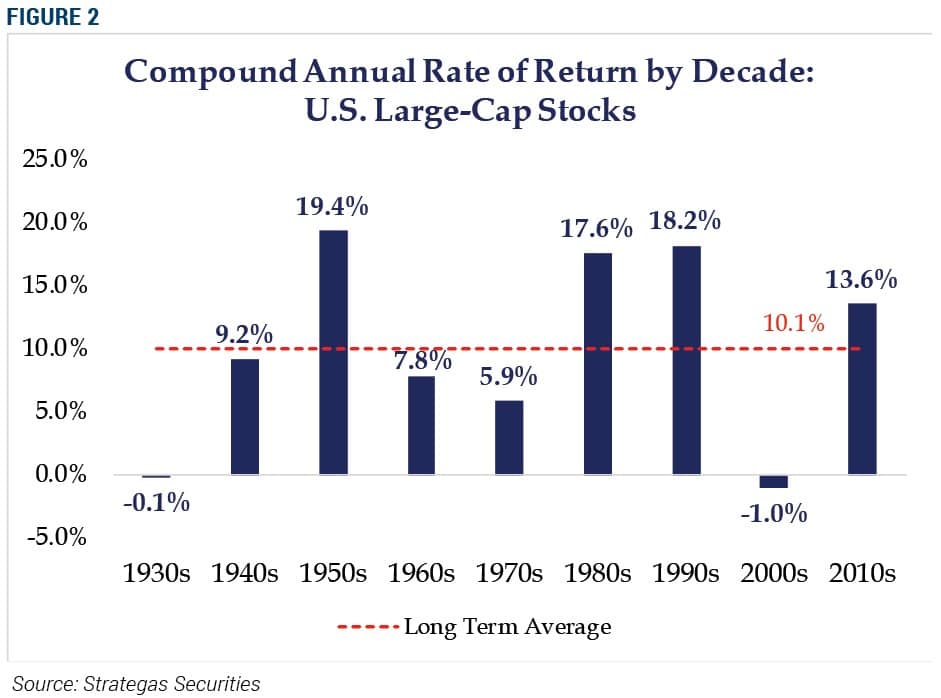

This past decade was the fourth strongest of the last nine decades in terms of equity market performance. The S&P 500 Index gained 13.6% per year on a compound basis. To illustrate how strong these returns are; if you invested $1,000 in the S&P 500 Index at the start of 2010, you would have $3,579, or approximately 3.6x your money, at the end of 2019. As shown in Figure 2, the S&P 500 exhibited an average compound rate of return of 10.1% over the past nine decades. Clearly, the 2010s were an outstanding period for U.S. equities. However, what we can also garner from the data is periods of high returns tend to be followed by periods of lower returns and vice-versa.

While it can be challenging to make short-term predictions about equity market performance, we do expect equity market returns to moderate in the coming year and even further into the decade. We believe they will revert toward the mean and perhaps modestly lower. This view is largely driven by an examination of equity market valuations.

As illustrated in Figure 3, equities are currently trading at an approximately 20% premium to the long-term average for price-to-earnings (P/E) ratios. As a reminder, P/E ratio is a common measure of how “cheap” or “expensive” a stock is relative to how much profit a company generates. Today’s comparatively high valuations generally don’t bode well for equity market returns. Because investors are paying higher-than-average prices for equities today, they should expect lower-than-average returns in the future.

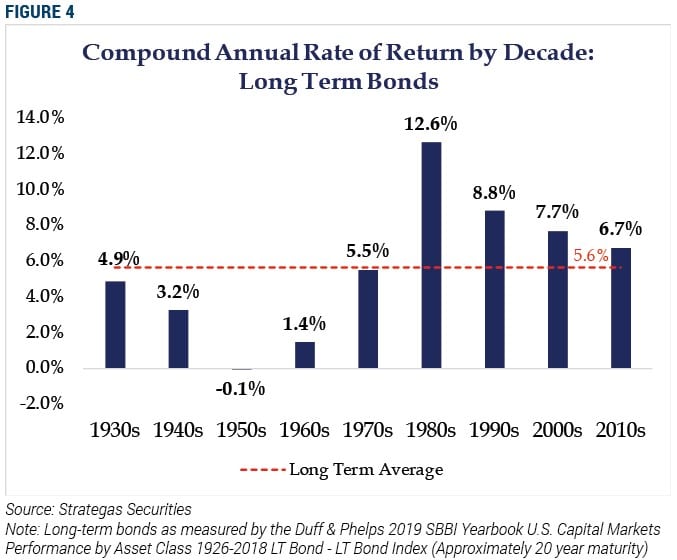

Our outlook for fixed income securities is also rather cautious, compared to historical averages. We remain in a low interest rate environment, as we saw rates falling even further in 2019. Because bond prices and yields move inversely to one another, we don’t see much room for additional price appreciation given how far interest rates have already fallen. Figure 4 shows historical fixed income returns for the past nine decades. Beginning in the 1980s, a period characterized by high inflation as well as high interest rates, we can see a very clear trend of declining returns. As this trend continues, we expect fixed income investors to earn their coupon, but not much in terms of returns beyond that in the year ahead.

We are more enthusiastic about prospects for future returns outside of the United States, specifically within emerging markets. Headlines in 2018 and 2019 were dominated by the U.S./China trade war, a topic we chronicled extensively in prior newsletters. Now that the two nations have reached “phase one” of an agreement, we think the overhang on emerging market equities has subsided. We have been positive on emerging markets since last spring, and this phase one deal bolsters that enthusiasm.

Additionally, valuations in emerging markets are rather attractive and these economies benefit from favorable population demographics and growth trends. We believe a healthy allocation to emerging markets would be worth consideration. However, it is important to note, investors should consider their risk tolerance when determining the right allocation to emerging markets, as they involve a significantly greater degree of risk that is not suitable for all investors.

RISKS

While we remain optimistic about capital markets and the economy in 2020, our optimism merits some degree of temperance. The market is currently pricing in a victory by President Trump in this year’s election. If the outlook becomes less clear—and specifically, if a candidate with less market-friendly views emerges as a likely winner—we would expect to see both an increase in market volatility as well as decidedly lower equity prices until the markets have time to adjust. As of today, we see a rather low likelihood of a U.S. recession in 2020, approximately 20% if we had to hazard a probability.

Another risk that continues to concern us, is whether U.S. and international central banks can continue to manufacture low interest rates and low inflation simultaneously. If they can maintain this Goldilocks scenario, a firm bid will continue to support risk assets. However, this “Fed put,” as it has become known to market participants, is not a certainty, particularly as monetary policy begins to reach its limits of effectiveness. We aren’t the only ones concerned about this risk; it has been raised by former U.S. Federal Reserve Chairs Janet Yellen, Alan Greenspan, and Ben Bernanke, as well as by several existing Fed governors. In light of these risks and others, we continue to advocate for portfolio diversification across strategies, geographies, and asset classes.

CHOOSING TO GIVE TO WORTHY CAUSES—AND NOT GIVE IN TO UNCLE SAM

We started this letter with a quote from Atlas Shrugged, Ayn Rand’s 1957 magnum opus that many of our readers likely read several years ago. As an organization tasked with managing the wealth of our client families, totaling well over $4 billion dollars today, we certainly don’t view money or its creators as evil. On the contrary, we have helped many clients act as a force for good in their communities.

One way we do this is by helping our charitably inclined clients, with significant unrealized capital gains, maximize the impact of their gifts by making donations in the most tax-efficient way possible. If charitable giving and minimizing your overall tax burden are topics you would like to learn more about, please reach out to your FineMark Private Wealth Advisor.

With winter firmly settled in across the country, we know many of you have returned to the warmer climates of our offices in Florida, South Carolina and Arizona. For our seasonal residents, we warmly welcome you back. And to all of our clients, we are here to serve you in any way we can.

2019 Fourth Quarter Review and Commentary

2019 Fourth Quarter Review and Commentary

By Christopher Battifarano, CFA®, CAIA

Executive Vice President & Chief Investment Officer

Articles In This Issue:

Introduction To The SECURE Act

Download Full Newsletter Here

HAPPY NEW YEAR!

HAPPY NEW YEAR!