FINE POINTS, The Quarterly Trust and Investment Publication of FineMark National Bank & Trust

April 2019 | Volume 4 | Issue 2

“Mr. Market is a kind of drunken psycho. Some days he gets very enthused, some days he gets very depressed. And when he gets really enthused you sell to him, and if he gets depressed, you buy from him. There is no moral taint attached to that.” – Warren Buffett

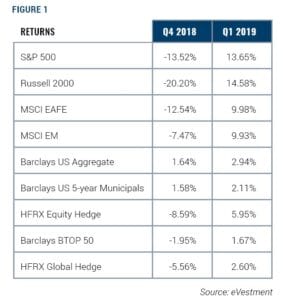

The words of famed investor Warren Buffett are extremely appropriate given the roller coaster that equity investors have ridden over the last two quarters. In the past six months, we have witnessed the S&P 500’s worst quarter since 2011 followed by its best quarter in a decade. Positive returns in the first quarter weren’t limited to domestic equities; all major classes and strategies that we monitor, particularly bonds, posted strong returns over the first three months of the year.

The words of famed investor Warren Buffett are extremely appropriate given the roller coaster that equity investors have ridden over the last two quarters. In the past six months, we have witnessed the S&P 500’s worst quarter since 2011 followed by its best quarter in a decade. Positive returns in the first quarter weren’t limited to domestic equities; all major classes and strategies that we monitor, particularly bonds, posted strong returns over the first three months of the year.

Obviously, this type of price volatility can be difficult for investors to stomach. It’s a stark reminder of why diversification is critical to long-term investment success. Investors shouldn’t react to short-term price swings in an emotional manner. Instead, investors should be pragmatic and use such volatility to their advantage.

For example, after the strong recovery in equity prices in the first quarter, we began working with families who have upcoming liquidity needs to sell positions and generate cash earlier than we might under more normal circumstances. Clients who have charitable intentions may want to consider making in-kind distributions of securities to a charity or family foundation now, rather than waiting until year end, the time when people traditionally think about gifting. This is one example of how investors can use large price fluctuations to their advantage—and not fret over the logic of Mr. Market’s vicissitudes.

MACROECONOMICS AND MONETARY POLICY: FOCUS ON SLOWING GROWTH AND FLATTENING YIELD CURVES

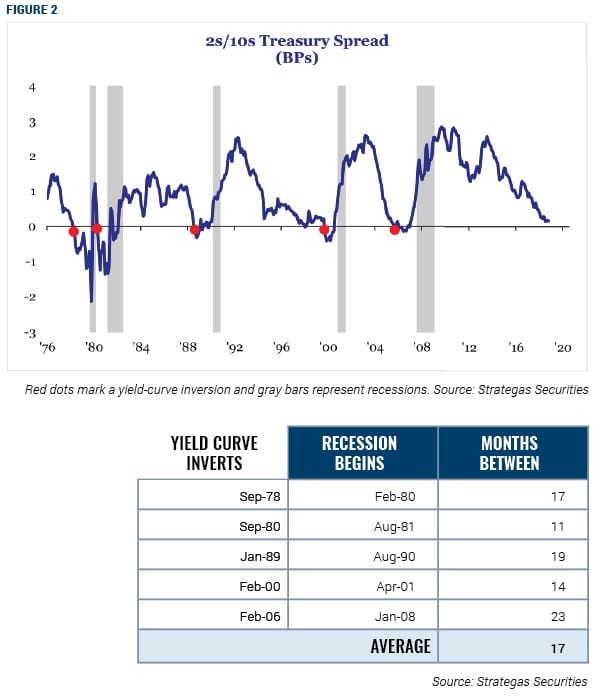

Our interpretation of the past two quarters is that we remain in an expansionary economic environment—albeit one where growth is slowing and may be approaching the end of this phase of the cycle. We monitor several indicators to gauge the overall direction of the economy, and one of the most telling can be the shape of the yield curve.

The yield curve refers to the relationship between short-term and long-term interest rates. Under normal conditions, long-term rates (often measured by yields on 10-year U.S. Treasury bonds) are significantly higher than short-term rates (often measured by yields on 3-month U.S. Treasury bills or 2-year U.S. Treasury notes). But as investors become more concerned about the near-term prospects for the economy, the yield curve may flatten (the spread between long-term and short-term rates narrows), or even invert (short-term rates become higher than long-term rates). When this happens, it often is a harbinger of recession.

Figure 2 illustrates the historical relationship between the 2-year/10-year spread (a measure of yield curve steepness) and subsequent recessions. This data spans from June 1976 through March 2019. Clearly, an inverted yield curve has been a reliable indicator of recessions. What is unclear is how long a recession takes to manifest after the inversion. For the last five instances, the span between a yield curve inversion and the start of the subsequent recession has ranged from 11 months to 23 months.

It’s also worth noting that the precise timing of recessions—defined as two consecutive quarters of negative GDP growth—is only known after the fact. One only knows the economy is in recession once it has already occurred. The equity market is a forward-looking discounting mechanism, so our allocation decisions need to reflect the reality that we see today, not theory or historical facts.

In the first quarter of 2019, yields on the benchmark 10-year U.S. Treasury fell 28 basis points from 2.69% to end the quarter at 2.41%. Notably, there was a yield-curve inversion between 3-month and 10-year rates in late March. This inversion was very modest in both duration and severity, which we believe influences how reliable it is as a recession signal.

The Federal Reserve reacted to this inversion by communicating a far more dovish rate forecast than what the U.S. central bank conveyed in December. The bond market quickly adjusted to this new orientation. We believe that the Fed’s policy is an appropriate response given current economic conditions in the United States. But if long-term rates continue to drop—and trigger 2-year/10-year or 3-month/10-year inversions—the Fed would need to react more decisively.

The last Federal Open Market Committee (FOMC) statement released on March 20 contained the following language: “The Committee (FOMC) will be patient as it determines what future adjustments to the target range for the federal funds rate may be appropriate to support these outcomes.”

We interpret the latest FOMC statement to mean that the Fed will be judicious with further rate hikes. In testimony to Congress last summer, Fed Chairman Jerome Powell was very clear that he believes that the 10-year yield is highly informative as to where neutral rates should be. He has spoken at length about the slope of the yield curve and how important it is. Unlike the previous three Fed chairmen, Powell isn’t an economist; he is a banker and appreciates how the shape of the yield curve provides significant insight into the broader economy. Despite the Trump administration’s criticisms of Chairman Powell, we believe that his current policy appropriately incorporates current market signals—and if those signals were to become more negative, Chairman Powell and the FOMC would change direction.

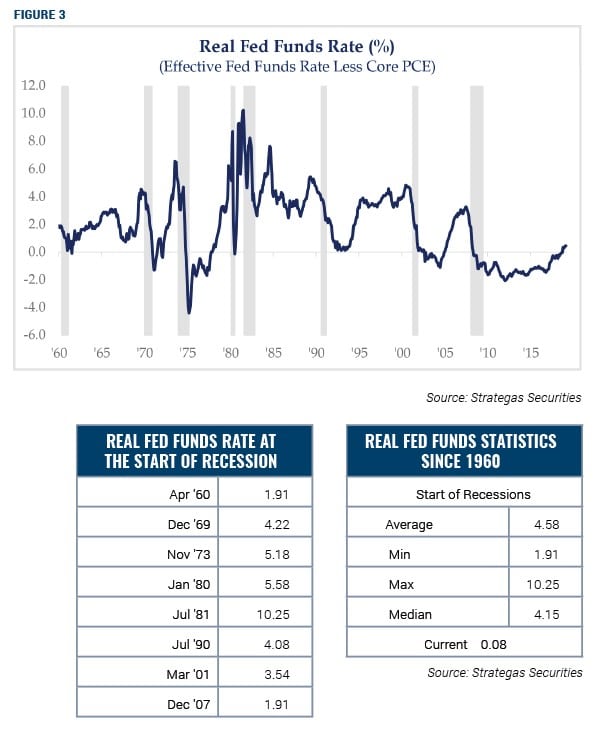

Figure 3 helps to better illustrate our point. It shows where real Fed Funds rates—the Fed Funds rate minus core PCE (inflation)—were at the onset of a recession. Since 1960, this figure has averaged 4.58%, and the lowest real rate before entering a recession has been 1.91%. The current real Fed Funds rate—even after nine hikes—is just 0.08%! This reflects the fact that the Fed has been in a very accommodative monetary policy stance for a prolonged period of time. As a result, we think that the current positioning is appropriate for the level of economic activity we are seeing today—and not overly restrictive.

U.S.-CHINA TRADE RELATIONS: REASONS FOR OPTIMISM AND A POSITIVE RESOLUTION

We remain confident that we will see a resolution to the U.S.-China trade war, which began escalating in 2018. The tit-for-tat nature of the trade dispute included the United States and China imposing increasingly punitive tariffs on each other. Since December, the two countries’ trade delegations have had several substantive meetings, with no further escalation in tariffs. Naturally, these negotiations will likely result in some degree of concessions by both parties. More importantly, we believe that the net outcome of these negotiations will be increased trade between the two economic superpowers—benefitting not just China and the United States, but the global economy as a whole.

PORTFOLIO ALLOCATION OPPORTUNITIES: WATCHING U.S. AND INTERNATIONAL EQUITY VALUATIONS

Despite the market volatility of the past two quarters, we don’t see imminent signs of a recession. We have definitely seen a slowdown in growth, but we believe that the Fed’s recent shift in monetary policy appropriately accounts for these conditions. Broadly speaking, we remain constructive on equities. We are finding better value in international equities than in U.S. equities, but we haven’t yet moved to an overweight position in international equities. We continue to favor the United States over the rest of the world, despite the higher valuations domestically.

Now that spring is here, we want to remind all our clients who are about to make their annual journey north for the summer that we remain at your service. If you have any questions about your portfolio or the overall market conditions, we are always just a phone call or email away. We thank you for your continued confidence and look forward to our next meeting.

2019 First Quarter Review and Commentary

2019 First Quarter Review and Commentary

By Christopher Battifarano, CFA®, CAIA

Executive Vice President & Chief Investment Officer

Articles In This Issue:

Spring Cleaning for Your Estate Plan

Download Full Newsletter Here