FINE POINTS, The Quarterly Trust and Investment Publication of FineMark National Bank & Trust

October 2018 | Volume 3 | Issue 4

Surging U.S. Equities, Monetary Tightening and Emerging Market Debt Shape the Investment Landscape

“The four most dangerous words in investing are: ‘this time it’s different.’” – Sir John Templeton

The old Wall Street adage is to sell in May and go away. That would have been a very expensive mistake in 2018. The S&P 500 was up 7.71% during the third quarter, the index’s best quarterly return since 2013.

The old Wall Street adage is to sell in May and go away. That would have been a very expensive mistake in 2018. The S&P 500 was up 7.71% during the third quarter, the index’s best quarterly return since 2013.

This illustrates the dangers of trying to time the market. Instead of market timing, we advocate that investors remain committed to a long-term focus and make decisions based on fundamental evaluation of underlying portfolio investments. This counsel is particularly valuable for investors who have a large percentage of their portfolio invested in equities.

As investment advisors, we are often asked to make short-term market forecasts. While we certainly have a view on where markets are heading over the next few months, we don’t place much confidence in our ability to predict short-term fluctuations. We have much greater confidence in our longer-term forecasts, which are based on market valuation as well as convergence and divergence from historical norms.

Successful investing requires building a portfolio that’s diversified across asset classes and strategies. You also need to combine these investments in a way that reduces their interdependencies—“correlations” in Wall Street parlance—thus strengthening the portfolio’s ability to endure unforeseen market movements and avoiding overexposure to any one risk factor. That’s a long way of saying, you don’t want to put all of your eggs in one basket.

Using diversification to enhance risk-adjusted returns is the foundation of modern portfolio theory. While having your assets concentrated in the stock of a single company can result in tremendous wealth creation—just ask Amazon founder Jeff Bezos or Microsoft founder Bill Gates—such singular concentrations also pose a substantial risk of potential financial ruin. The wealth created by these two men was a direct result of their massive concentrations in their company stock and the unprecedented success of those businesses. However, the vast majority of investors are concerned with wealth preservation which involves a far more balanced investment portfolio, with exposure across the spectrum of asset classes and strategies.

During the third quarter, the U.S. Federal Reserve maintained its pace of gradually draining liquidity from the financial system. This is being conducted through two primary mechanisms: gradually increasing the Fed Funds rate and reducing the central bank’s balance sheet. Balance sheet reduction is a direct result of unwinding the quantitative easing (QE) program that was put in place to resuscitate the economy after the global financial crisis of 2008. The Fed has been reducing its balance sheet at a pace of $40 billion per month; that pace is slated to increase to $50 billion per month in October. The Fed hiked rates by 0.25% once again during the third quarter, its third rate increase in 2018. We expect one more hike of 0.25% in December, and then two to four hikes in 2019.

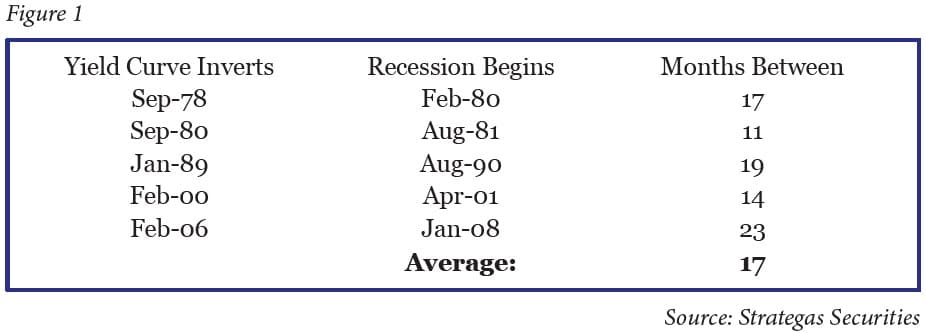

The greater the number of rate increases in 2019, the greater the risk that the yield curve will “invert,” a phenomenon that occurs when short-term rates are higher than long-term rates. While this isn’t a certainty, it’s something of which we are mindful. As we do with nearly all macroeconomic data, we view history as a guide to how the economy might perform after such an occurrence. Historically, yield curve inversions have been a reliable barometer of future recessionary periods.

On average, the yield curve for U.S. 2-year and 10-year rates inverts about 1.5 years before a recession. Currently, the yield curve is flattening but hasn’t inverted yet. According to the minutes from the most recent Fed meeting, U.S. central bankers believe that the current economic momentum should give the Fed enough time to shift from its accommodative policy to a more normalized neutral posture. Even if the yield curve does invert in the coming weeks or months, there will still be several quarters until a recession begins, based on historical trends. But the impact on “risk assets,” such as equity prices and credit spreads will likely be more immediate.

As the chart indicates, since 1978 the average time between a yield-curve inversion and a subsequent recession is approximately 17 months. So, if the yield curve inverts in the next few quarters, this would portend a recession sometime in 2020 or 2021. Recall, however, that markets are forward-looking discounting mechanisms, so a selloff would likely occur before the recession formally takes hold. In addition, remember that the start of a recession is only apparent in hindsight.

It’s important to note that there are factors at work today that didn’t affect previous inversions, namely the unwinding of QE in the U.S. and the continued injection of liquidity abroad by foreign central banks. As a result, foreign investors continue to gravitate to longer-term U.S. debt instruments, which have rates that are far more attractive than the rest of the developed world.

We won’t be so bold as to claim “this time it’s different” when it comes to how the economy and markets would react to an inversion. That’s a step too far. But we will consider the current facts and circumstances as we develop our plan of action if an inversion comes to pass.

Strengthening Dollar Puts Pressure on Emerging Markets

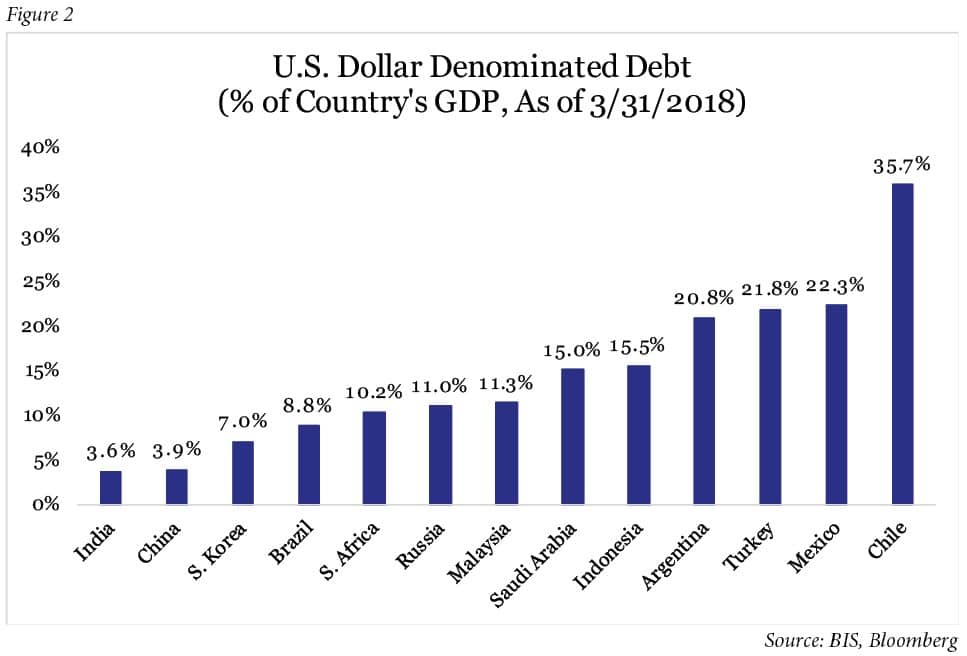

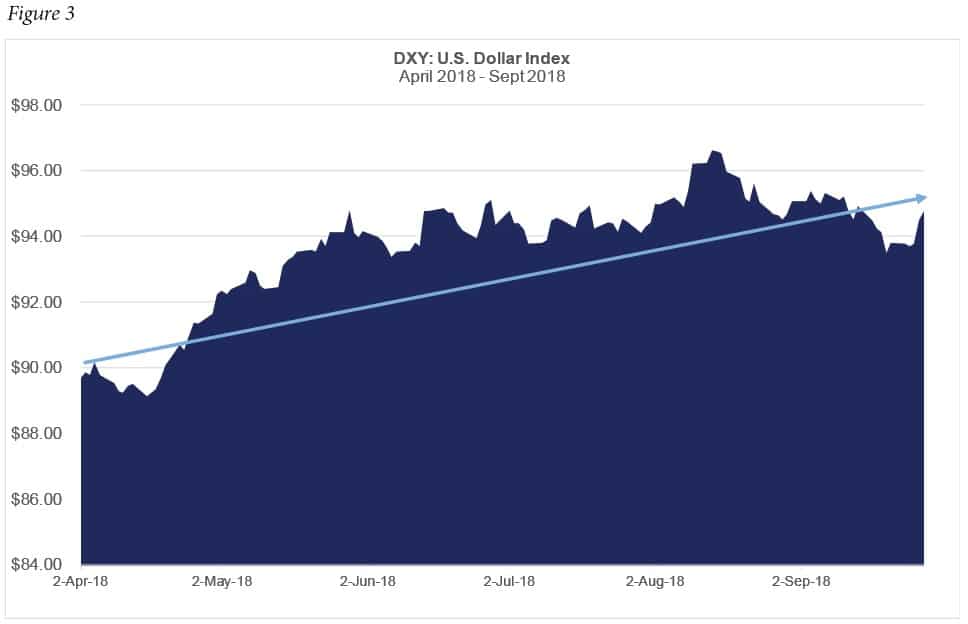

The steady draining of liquidity from the financial system by the Fed has led to several notable market effects. One of the most significant has been the ascent of the U.S. dollar vs. other currencies. This has been an impediment to many emerging market economies in 2018. There is more than $8 trillion in U.S. dollar-denominated debt globally. Tighter U.S. monetary policy has made the repayment of these bonds more burdensome for foreign borrowers.

These markets can be further adversely affected if they lack sufficient U.S. dollar foreign-exchange reserves, which is generally caused by a current account deficit. The biggest offenders of this are Turkey, Chile, Argentina and Mexico. Mexico and Chile are on far better footing than either Turkey or Argentina, given their U.S. dollarized economy. Based on a percentage of each country’s GDP, Mexico’s current account deficit is much smaller than Turkey’s or Argentina’s. Additionally, neither Chile nor Mexico suffers from double-digit inflation, something plaguing both Turkey and Argentina.

So far in 2018, U.S. dollar appreciation has generally contributed to negative equity performance in emerging markets. The MSCI Emerging Market Index is down 7.68% through the end of the third quarter. Some of this weakness is due to the ongoing trade war the Trump administration has waged against China, which represents more than 30% of the index, by far the largest of any country. The Chinese equity market, as measured by the Shenzhen Stock Exchange A Share Index, fell 24.1% over the first nine months of 2018.

Recall, however, that 2018’s pullback in emerging market equities comes after two strong years; the MSCI Emerging Market Index gained 37% in 2017 and 11% in 2016. At FineMark we have remained modestly underweight in emerging markets this year. Our active emerging market managers tend to steer clear of countries that are highly indebted and dependent on external funding. We don’t think that trade tensions will moderate before the November mid-term elections. Thereafter we might see a resolution, like we recently saw in the contentious trade negotiations over NAFTA. The U.S. reached a resolution with Mexico in August, and with Canada earlier this month. Such a resolution with China would provide a significant lift to emerging markets.

Here’s to a Cool, Comfortable Autumn

To those who spent the summer away in cooler locales, we welcome you back for the “season.” We have a number of exciting events scheduled for the coming months, and we look forward to you joining us. As always, if you have any questions about your portfolio, please reach out to your personal FineMark investment advisor. We thank you for your continued support and confidence.

By: Christopher Battifarano CFA®, CAIA

By: Christopher Battifarano CFA®, CAIA

Executive Vice President & Chief Investment Officer

Additional articles from this issue:

Do I still need an Estate Plan?

Download Full Newsletter Here