FINE POINTS, The Quarterly Trust and Investment Publication of FineMark National Bank & Trust

April 2018 | Volume 3 | Issue 2

Domestic equity markets posted losses during the quarter, which was the first decline we have experienced since Q3 of 2015. We spilled a fair amount of ink in our 2017 newsletters, detailing the abnormally low levels of market volatility, coupled with what we believed was unsustainably high price appreciation. Throughout the entire year, there were only eight days with a one-day move greater than 1% on the S&P, the lowest level since 1965. So far this year, we have already experienced 27 such days. To put this in perspective, an average year is about 53 days, so we are running above normal.

From a technical standpoint, the S&P 500 entered a correction phase (a decline of greater than 10%) beginning in January. While we remain in this phase today, we do not believe this current correction will accelerate into a full-fledged bear market (a decline of greater than 20%). We are closely watching a number of indicators, including the performance of the bond market. During bear markets, which are highly correlated with economic recessions, market participants tend to rotate out of equities and into the safety of bonds. This has not occurred thus far in 2018. In fact, bond market participants have also suffered losses during the quarter. Bond yields, as measured by the US 10-year treasury, have risen from 2.40% at year-end 2017 to 2.84% at the end of the quarter. Additionally, we continue to see strong macroeconomic data, including an economy operating at full employment, increasing GDP and continued corporate earnings growth.

From a technical standpoint, the S&P 500 entered a correction phase (a decline of greater than 10%) beginning in January. While we remain in this phase today, we do not believe this current correction will accelerate into a full-fledged bear market (a decline of greater than 20%). We are closely watching a number of indicators, including the performance of the bond market. During bear markets, which are highly correlated with economic recessions, market participants tend to rotate out of equities and into the safety of bonds. This has not occurred thus far in 2018. In fact, bond market participants have also suffered losses during the quarter. Bond yields, as measured by the US 10-year treasury, have risen from 2.40% at year-end 2017 to 2.84% at the end of the quarter. Additionally, we continue to see strong macroeconomic data, including an economy operating at full employment, increasing GDP and continued corporate earnings growth.

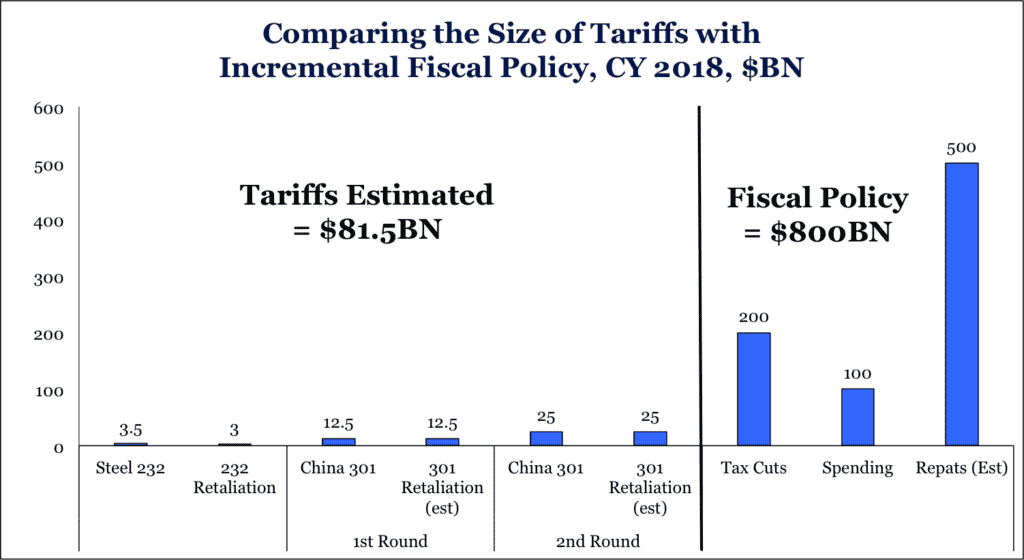

Despite the continued positive data flow, we have seen increased market volatility. Part of this higher market volatility has been a result of knee-jerk reactions by market participants to news about a possible trade war between the US and China. The proposed tariffs, however, pale in comparison to the fiscal stimulus created by the new tax bill in late 2017 (Figure 1).

Figure 1

Furthermore, economists have misinterpreted the president’s statements about closing the trade gap because they are taking his statements at face value. Instead, we believe President Trump’s objective has much less to do with US protectionism and the actual numerical value of the trade imbalance, and more to do with creating an equalized trade relationship between the two nations. Our current trade policy was established when China was a much smaller, emerging economy. At this juncture, China is a global economic powerhouse, and our relationship needs to evolve accordingly.

As a result of this favorable trading relationship that is skewed in favor of China, it has gradually become the manufacturer of the globe. Meanwhile, the evolution of the US economy has displaced US workers who do not possess a skill set that comports with the demands of a high-tech economy. This skills gap is not a unique problem to the US, but is endemic of other industrialized nations as economies move away from a manufacturing economy to a service-based economy. Europe has suffered this same path as lower skilled jobs have moved into lower-cost Asian jurisdictions. The Trump administration, like other prior administrations, is trying to find ways of coping with this issue.

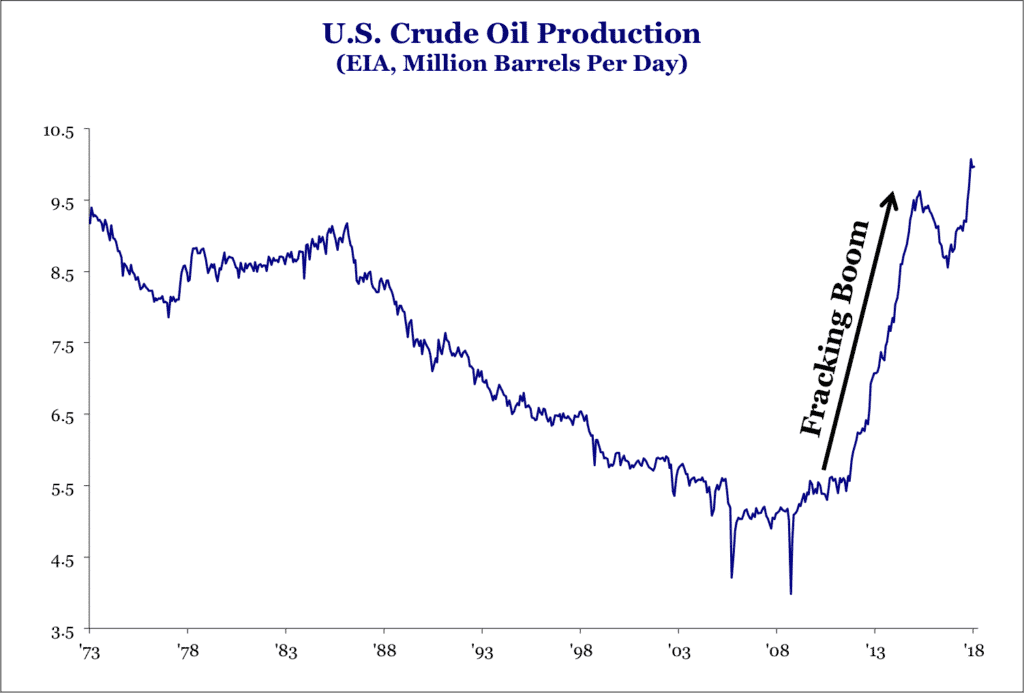

We see a strong corollary between this structural unemployment dilemma and America’s previous reliance on Middle Eastern oil, highlighted by the two US oil embargoes of the 1970s. Without a way to bring oil to the market quickly, the US was forced to use its military might to defend its supply that came from Saudi Arabia and the surrounding gulf nations. As we know, this led to two full-fledged wars (Gulf War I and II) as well as numerous lesser known military conflicts in the region. The US eventually solved this issue using technology. In this case, it was a combination of creating supply through hydraulic fracturing (aka fracking) coupled with greater energy efficiency (figure 2). These developments led to radically changing our military policy in the Middle East.

Figure 2

While it is hard to know what the ultimate solution will be for our domestic labor/skills gap predicament, it is our view that the trade policies being pursued by the Trump administration are an effort to cause the Chinese government to enact policies that would allow for more fair trade between the two nations. The proposed tariffs are not being put forth due to a lack of understanding of global trade or macroeconomics as some have suggested. This is why the current spat between the US and China has not caused us to change our asset allocation thus far in 2018, nor has it shaken our confidence in the continued global economic expansion.

Part of our job, as your trusted advisor, is to think critically about current events and historical facts. Simply reacting to market volatility will lead to suboptimal investment results. While we are highly attuned to current events, we believe that much of the negative news over the trade tariff situation has been overblown. From an asset allocation perspective, we remain positively oriented toward equities. While this current expansionary period is very well developed, we believe there is more room to run. Because of the advanced nature of this current economic recovery and equity bull market, we believe additional equity price appreciation in the US will be driven by growth in corporate earnings and not through multiple appreciation as it was early on in the recovery. Moreover, we continue to believe today, there is more fertile opportunity abroad, owning to more attractive equity market valuations as compared to those in the US.

Should you have any questions about your personal portfolio or financial circumstances, please reach out to your FineMark private wealth advisor. We thank you for your continued confidence.

By: Christopher Battifarano CFA®, CAIA

By: Christopher Battifarano CFA®, CAIA

Executive Vice President & Chief Investment Officer

Additional articles from this issue:

Are Charitable Pledges Enforceable Against an Estate?

Download Full Newsletter Here