FINE POINTS, The Quarterly Trust and Investment Publication of FineMark National Bank & Trust

January 2019 | Volume 4 | Issue 1

“Supply creates its own demand.” – Jean-Baptiste Say, French economist

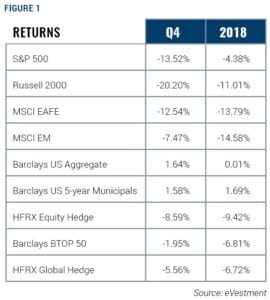

After nine consecutive years of gains, the S&P 500 finally experienced a down year in 2018. The performance of the market during the year was somewhat peculiar, as stocks remained in positive territory up until December 6th. But a vicious December selloff wiped out the gains, and then some, from the first 11 months of the year. By the end of December, the S&P 500 was down 4.4% for the year and down 13.5% for the fourth quarter alone. Stock performance outside the United States, in developed and emerging markets, was negative as well. However, the headwinds weren’t limited to equity markets. Fixed income managers struggled to post even modest returns in 2018 in the face of steadily rising interest rates. It also was a challenging year for hedge funds and other alternative strategies, and oil prices plummeted as new sources of supply came to the market.

After nine consecutive years of gains, the S&P 500 finally experienced a down year in 2018. The performance of the market during the year was somewhat peculiar, as stocks remained in positive territory up until December 6th. But a vicious December selloff wiped out the gains, and then some, from the first 11 months of the year. By the end of December, the S&P 500 was down 4.4% for the year and down 13.5% for the fourth quarter alone. Stock performance outside the United States, in developed and emerging markets, was negative as well. However, the headwinds weren’t limited to equity markets. Fixed income managers struggled to post even modest returns in 2018 in the face of steadily rising interest rates. It also was a challenging year for hedge funds and other alternative strategies, and oil prices plummeted as new sources of supply came to the market.

Volatility Returns to the Scene

One of the major themes of 2018 was the return of volatility to equity markets. After several years of relatively smooth waters for equity investors, we warned in our letters to clients throughout 2017 and in early 2018 that a spike in volatility was likely on the horizon—and that is exactly what happened in the second half of the year. At the end of 2018, the CBOE Volatility Index, which measures investors’ expectations for price fluctuations over the next 30 days, sat at about 25, above average (20 year average level 19.96 (Source: FactSet)). While volatility will likely continue in the early parts of 2019, we expect it will return to more normalized levels over the course of the year.

Equity Performance Contradicts Economic Strength

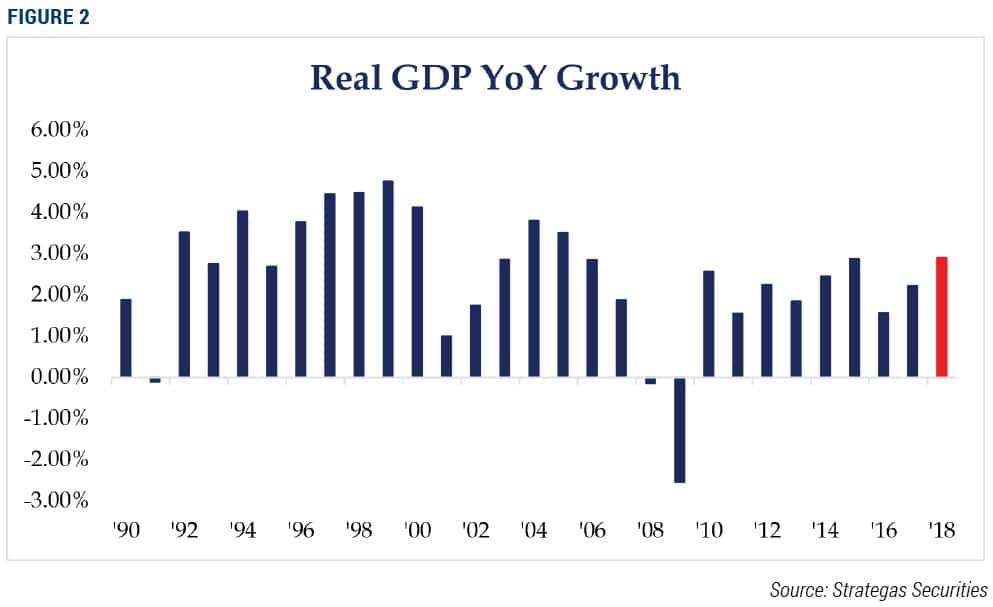

Despite the harrowing fourth quarter for investors, we remain bullish on the U.S. economy and global equity markets. We don’t believe that the equity pullback in the fourth quarter marks the end of the current secular expansionary period, which began in 2009. It’s important to note that equity performance and economic performance are two very different things. While they often are closely linked, stock valuations and corporate performance can diverge, as they did in 2018. Despite corporate earnings growth in excess of 20% and the healthiest GDP growth since 2005, equities lost value in 2018. This divergence, along with the unusual sequence of equity gains in each of the first three quarters, followed by a drastic pullback in the fourth quarter, adds to the strangeness of 2018’s financial environment.

The United States remains a standout among world economies. U.S. unemployment is at a 50-year low, and inflation is under control at approximately 2%, the level the U.S. Federal Reserve targets as optimal. The strength of the U.S. economy, partly fueled by the tax cuts implemented last year and regulatory reform implemented by the Trump administration, supports the theory alluded to in the quote at the top of this letter that economies prosper when government intervention is reduced.

Global equity market valuations are attractive relative to historical averages, and they are even more attractive if you exclude U.S. valuations. We believe that U.S. stocks, while somewhat more expensive than international stocks, are still valued at reasonable levels, especially after the fourth-quarter pullback.

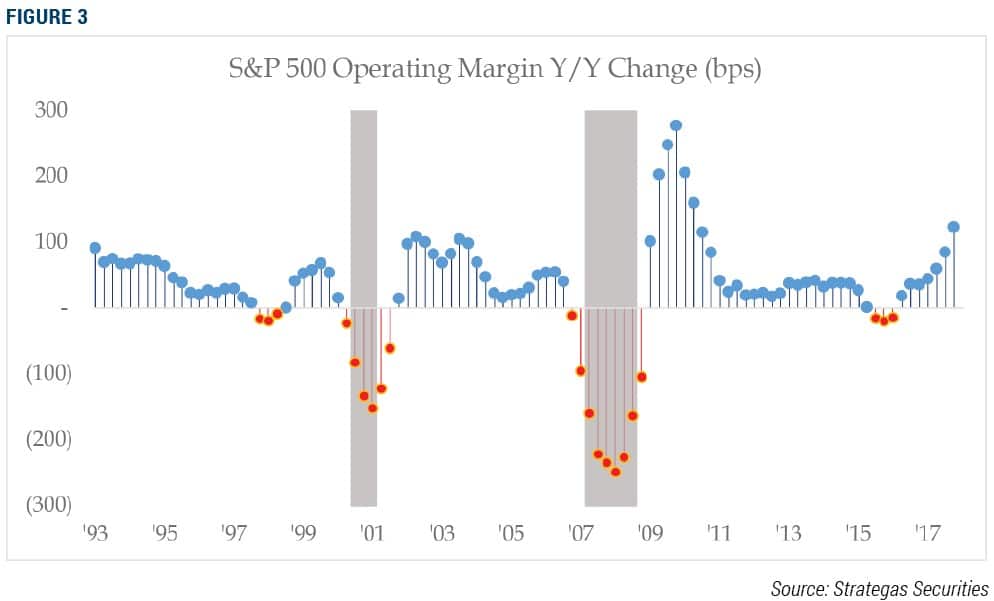

In addition to valuations, another factor we pay careful attention to is corporate operating profit margins. Historically, a significant and prolonged drop in profitability has been a reliable indicator of recessions. Currently, we are not seeing any warning signals in terms of margins, which bodes well for a continuation of the current economic momentum.

While we believe the U.S. economy is on solid footing, we do expect economic growth in 2019 to moderate from 2018’s robust pace. Again, it’s important to emphasize that a modest slowdown doesn’t equate to the beginning of a recession. Many market prognosticators, however, have more dour predictions for 2019, believing that the negative market performance in the fourth quarter was a harbinger of a forthcoming economic contraction. We disagree with this assessment because the economic data we monitor suggests continued economic growth, albeit at a slower pace than in 2018. Based on our analysis, we also expect U.S. equity markets to generate single-digit returns in 2019.

Oil Prices Plummet Amid Geopolitical Wrangling

Equity market losses in the fourth quarter were modest compared to the significant selloff in oil over the last few months of 2018. Oil prices, as measured by West Texas Intermediate (WTI) crude, fell 38% during the fourth quarter. Oversupply was the primary driver of this sudden price drop. Previously enacted supply cuts by Saudi Arabia and Russia had provided a firm foundation for oil prices, but those two, influential countries brought additional supply back online after the United States exited the international nuclear deal with Iran in May. We think oil prices are currently at a trough; as the economy continues to grow, oil prices should advance from the $42-$47 range seen at the end of 2018.

Fed Continues Its Path to Normalization

The U.S. Federal Reserve hiked the fed funds rate four times in 2018, bringing the total number of hikes to nine since the Fed started raising rates in 2015. We believe that as interest rates continue transitioning from an accommodative range to a neutral range, the Fed will slow its pace of rate hikes in 2019. We don’t expect to see more than two additional hikes in 2019 and don’t expect any in the first quarter of the year. Any hikes would be in response to continued positive economic and employment developments.

We don’t believe that the Fed has put its monetary policy on autopilot; the Fed’s decisions about further rate increases will be driven by how the economy is performing. We do, however, believe that the Fed’s quantitative tightening, which is being implemented by reducing the size of the central bank’s balance sheet at a clip of $50 billion per month, will likely continue along a more predetermined path. This pace likely won’t be changed in 2019 unless there is a significant, unforeseen, negative economic development. We view this policy as further evidence that the U.S. economy is entering a more normalized state after being in perilous condition during and immediately after the financial crisis. The road to recovery has been long, and the Fed has been judicious about returning to a more neutral policy stance.

Progress in U.S.-China Trade Negotiations

One of the most discussed macroeconomic stories of 2018 was the escalation of trade hostilities between the United States and China. While the situation continues to generate daily headlines, we expect the current trade spat with China will be resolved in 2019. We have already seen progress on this front. President Trump and President Xi sat down to discuss the matter face-to-face at the G20 Summit in Buenos Aires in December. The two leaders agreed to a 90-day halt of further escalations to give their negotiators time for additional discussions. Since then, we have seen several positive indications that progress is being made; the market, however, hasn’t seemed to focus heavily on these data points.

On the agricultural front, the positive developments include China’s resumption of purchasing U.S. soybeans, and for the first time, allowing the importation of U.S. rice. Regarding the disagreement over intellectual property rights, the Chinese have also started to liberalize laws regarding transferring technology. China has also agreed to reduce tariffs on U.S. automobiles while the negotiations continue. Broadly speaking, the concessions that the Trump administration is trying to advance align with China’s own stated goals of implementing free-market reforms in its economy and transferring control of state-owned assets to private enterprise. Part of the current tension between the two countries, however, is arising from the fact that the United States is pushing China for these reforms to occur at a faster pace. While we believe all markets will ultimately benefit from a resolution to this matter, the largest and most immediate beneficiaries will be China and other emerging markets.

The Case for Diversification

Over the past few years, diversification both by asset class and by strategy was detrimental to overall portfolio returns. Rather than spreading portfolios across regions, styles and asset classes, investors would have been best served by concentrating in large-cap U.S. equities. This recent period has been a historical anomaly; across longer time frames, portfolios with lower correlations and higher diversification generally see higher risk-adjusted returns. We believe we are moving into a new market regime that more closely aligns with historical norms favoring diversification.

If the recent turbulence in financial markets is causing you angst, now is a great time to schedule a meeting with your FineMark Private Wealth Advisor. Your advisor can help assess your current portfolio and ensure it aligns with your long-term return objectives as well as your risk tolerance. Additionally, your advisor may identify opportunities to integrate alternative assets into your allocation, which can help mitigate volatility as we navigate into the later stages of this current economic expansionary period.

Thank you for your continued confidence in FineMark. We wish you and your families continued prosperity and health in 2019.

2018 Fourth Quarter Review and Commentary

2018 Fourth Quarter Review and Commentary

By Christopher Battifarano, CFA®, CAIA

Executive Vice President & Chief Investment Officer

ARTICLES IN THIS ISSUE:

Fiduciary Rule

Download Full Newsletter Here