FINE POINTS, The Quarterly Trust and Investment Publication of FineMark National Bank & Trust

July 2017 | Volume 2 | Issue 3

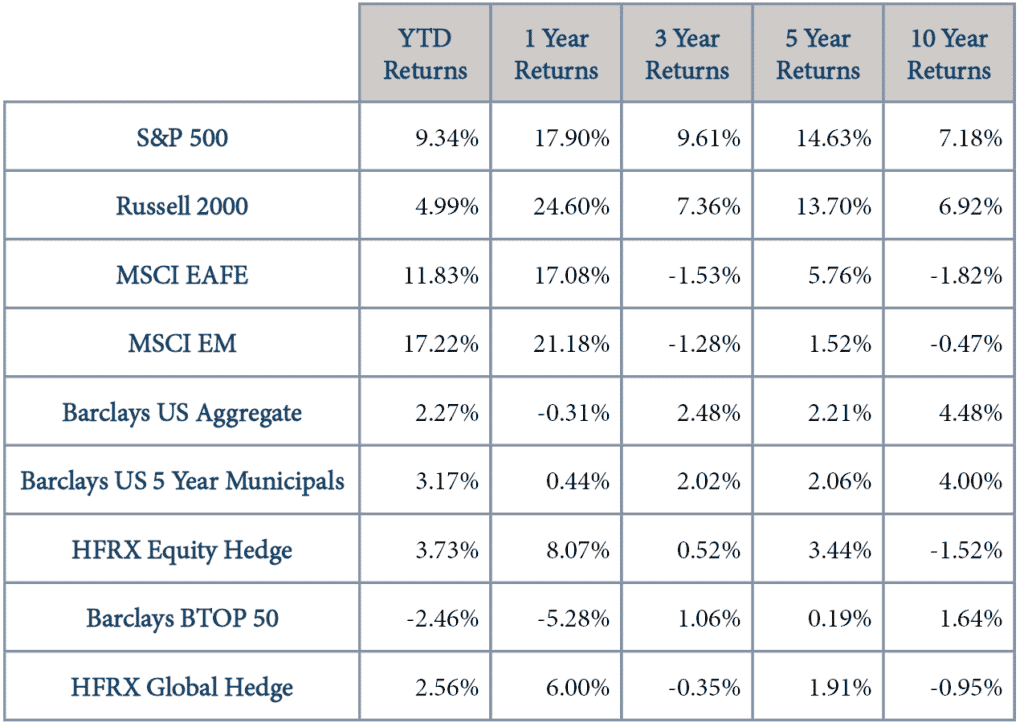

We stand at the mid-point of the year, shocked that it has gone by so quickly. There have been a number of surprises, but nothing terribly alarming apart from the very low level of market volatility, which has fallen even further than what was experienced in the first quarter.

Beyond the low level of market volatility, we are also somewhat surprised at the overall returns in equity market performance. The results have exceeded our expectations at the onset of 2017 and we would not be surprised to see a market correction before the year is over. As mentioned in the last issue of Fine Points, such pullbacks are normal, even during secular bull markets, and are the price investors pay to earn the outsized returns that equity investing affords.

Figure 1

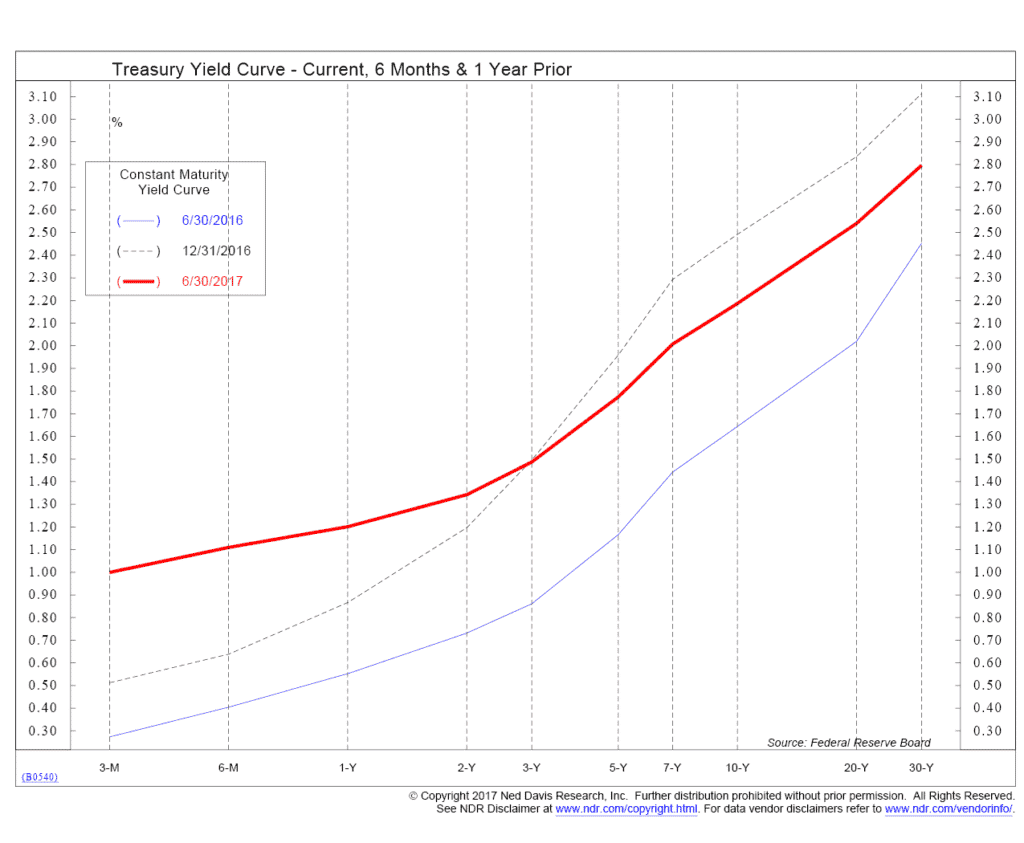

We are astounded at the returns generated thus far in 2017 in fixed income. We expected the two Fed Funds rate hikes to have a more deleterious effect on bond returns. However, returns have been unexpectedly good because of a flattening in the yield curve (see Figure 2), also known as a reduction in term premium.* The Fed’s recent discussions to normalize its balance sheet should put upward pressure on the long end of the yield curve later this year and make for a more normalized term premium structure than we see today.

*A term premium is the extra return that lenders demand to hold a longer-term bond instead of investing in a series of short-term securities.

Figure 2

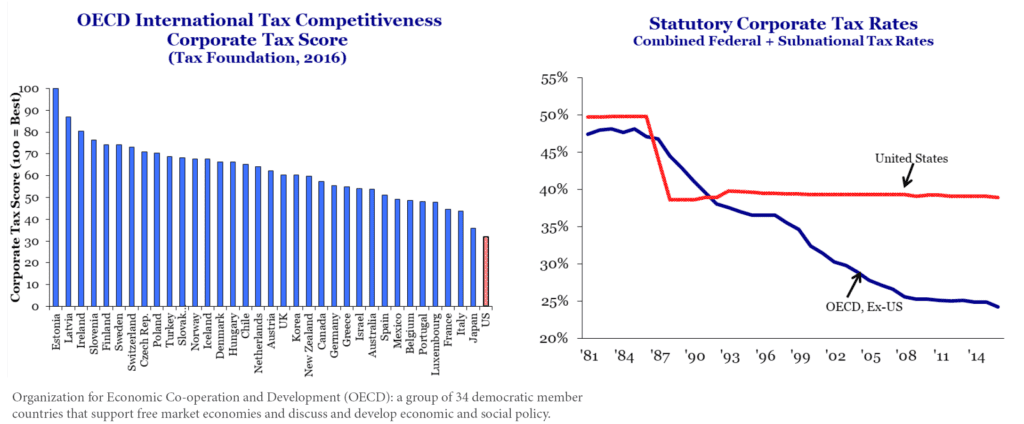

One of the most notable events that took place in the second quarter was the release of President Trump’s long-awaited tax plan. Considering its lack of detail, we believe this release was the first salvo in what will be a long negotiation between budget hawks on both sides of the political aisle. We continue to expect a reduction in tax rates for corporations and modest relief for individuals, however we do not expect to see something as dramatic as President Reagan’s 1986 Tax Reform Act. While a number of market participants seem to have given up on the prospect of a Trump legislative agenda, we believe reducing the corporate tax burden will gain support because the US is so far behind its developed market peers. As depicted in Figures 3 and 4 below, the US dramatically lags behind the rest of the developed world as it relates to the competitiveness of our corporate tax policy. The situation has worsened significantly over the past two decades.

Figures 3 & 4

We have experienced a prolonged period of positive market returns, coupled with what appears to be significant market participant complacency. Our philosophy and approach is to generate gains where we are able and to prioritize preservation of capital when times become more challenging.

“The goal in investing is asymmetry: to expose yourself to return in a way that doesn’t expose you commensurately to risk, and to participate in gains when the market rises to a greater extent than you participate in losses when it falls. But that doesn’t mean the avoidance of all losses is a reasonable objective.”

– Howard Marks, Chairman and Founder of Oaktree Capital Management

Marks, H. Memo to Oaktree Clients, Re: Dare to be Great II, Oaktree Capital Management, L.P., 4 April 2014.

We attempt to be dynamic in our client portfolio allocations through tactical asset allocation, manager due diligence and alternative assets, which have lower correlations to traditional asset classes. To generate outsized portfolio returns, we are required to have a variant perception of markets versus other market participants. It is extremely difficult to generate outsized returns without constructing portfolios that are sufficiently different than what the consensus market view dictates. This frequently puts us in the position of going against popular viewpoints, while still doing what we believe to be in our clients’ best interest.

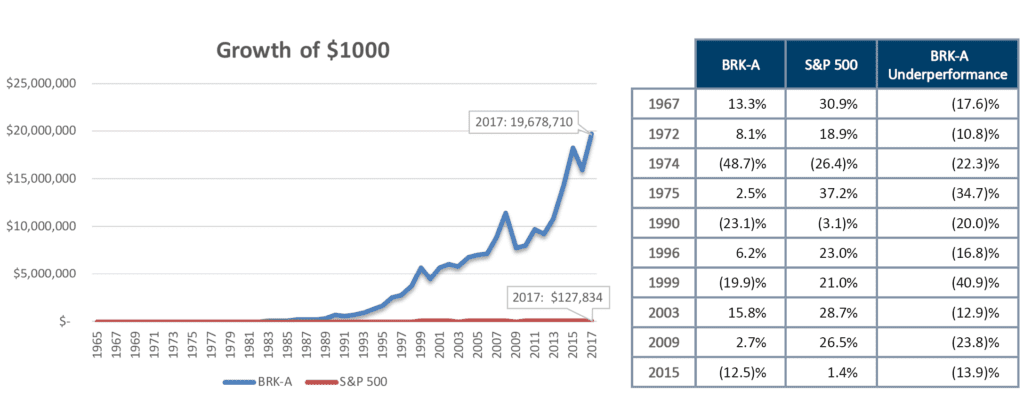

An example of this approach is a study of Warren Buffett’s chairmanship at Berkshire Hathaway. His performance has been nothing short of legendary, however, as illustrated in Figures 5 and 6, there have been significantly long periods of time where the performance of Berkshire Hathaway stock (BRK-A) has abysmally lagged the passive market index performance. Buffett and his shareholders had to endure significantly long periods of uncomfortable underperformance to generate long-term, outsized returns. Quite simply, there are going to be prolonged periods of time where active management underperforms a passive benchmark.

Figures 5 & 6

To use a baseball analogy, since we are in the dog days of summer, we can draw a corollary to pitchers who endure boos from the crowd by constantly throwing to first base. The crowd wants to see him deal to the plate, but the right, albeit unpopular, play is to keep the base runner honest. Our approach at FineMark is to always do what is right in order to generate the highest risk adjusted returns for clients, whether or not it is popular.

During the quarter we increased our rotation out of US equities and into international equities. We believe this to be prudent for a number of reasons. The most profound being relative valuation disparity, which we discussed in the last issue of Fine Points. US equities have enjoyed a much more resounding rerating, or increase in value, since the financial crisis and are now trading at a significantly higher valuation than their international peers.

The other major asset allocation action we took during the quarter was to increase the credit quality of our fixed income portfolios. For quite some time, we have been in an extremely difficult period to generate yield thus, we invested in areas outside of core, investment-grade fixed income to generate incremental yield. Today, we believe it is wise for us to adopt a defensive posture in fixed income and wait for more attractive yield opportunities to manifest in the future. Our timing may be early, but we prefer assuming the risk of opportunity cost to the certainty of losses in the fixed income component of our portfolios.

We wish you a great summer, wherever your travels may take you, and we thank you for your continued confidence. As always, FineMark is available to answer any investment questions you may have.

By: Christopher Battifarano CFA®, CAIA

By: Christopher Battifarano CFA®, CAIA

Executive Vice President & Chief Investment Officer

Additional articles from this issue:

Electronic Wills

Download Full Newsletter Here