FINE POINTS, The Quarterly Trust and Investment Publication of FineMark National Bank & Trust

January 2018 | Volume 3 | Issue 1

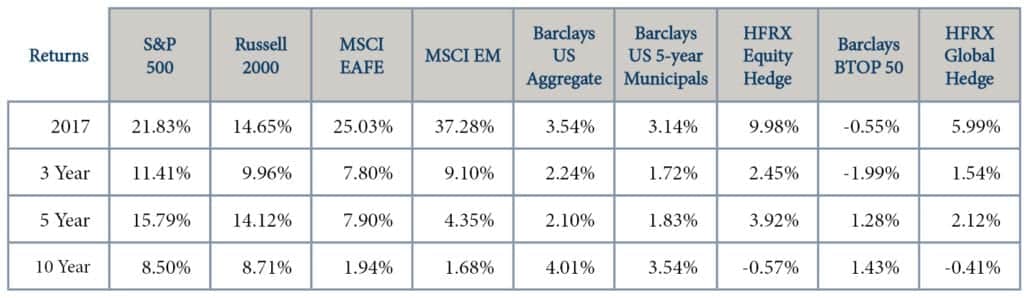

Nearly across the board, 2017 was an excellent year for investors in all asset classes, particularly equities. It will be a tough act to follow.

The 2017 upward move in equities was marked by President Trump’s ascension to the White House, which pushed major indices to all-time highs. Upon winning the election, the president promised to double the pace of economic growth from 2%, create 25 million jobs over 10 years and make the domestic economy the strongest in the world. The positive sentiments sent the stock markets rallying (see Figure 1).

Figure 1

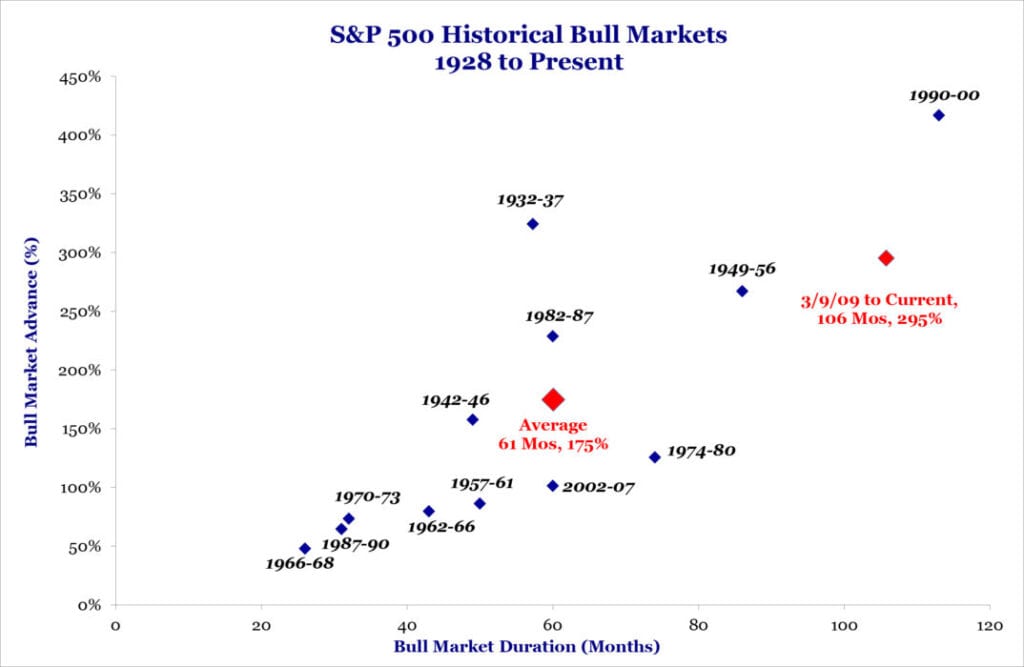

Markets were buoyed by Trump’s pro-growth policies to boost the economy and corporate profits, cut taxes and loosen government regulations. The bull run of the US equity market is now nine years old, the second longest in history as evidenced in Figure 2. From a market appreciation perspective, this bull market ranks far above average.

Figure 2

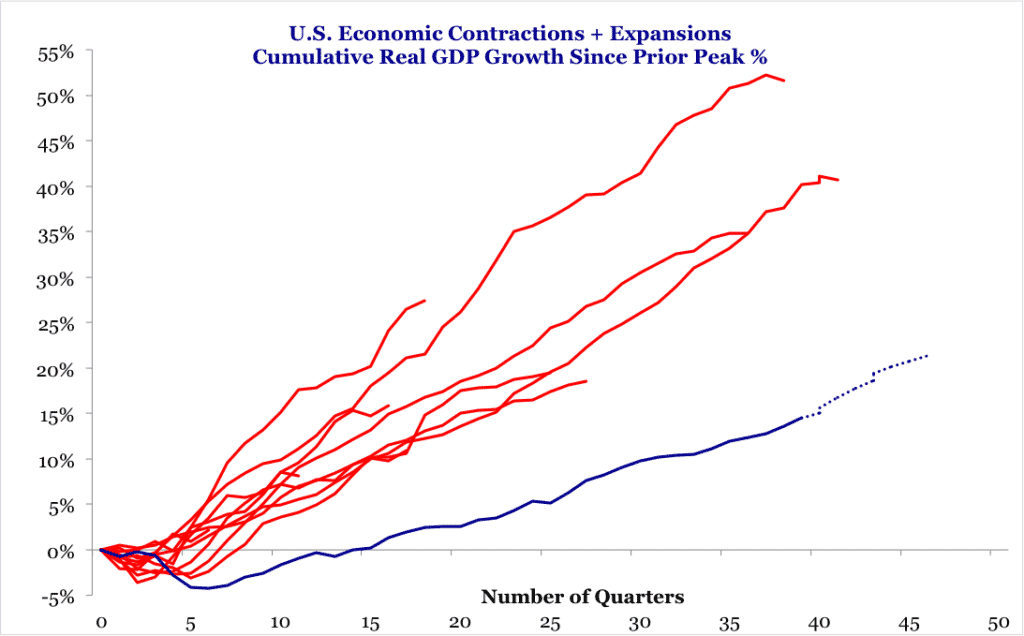

However, we have observed a number of peculiarities about this market that differentiate it from typical market rallies. Among these is the still tepid level of nominal GDP growth. Since 2009, growth has averaged just 3.4%, a level that would have been considered anemic in any post WWII recovery period (see Figure 3).

Figure 3

One of the market metrics we pay close attention to is the level of retail investor participation in the rally. Typically, strong retail investor participation marks the death knell for bull markets, as their timing is generally awful, buying at peaks and selling at troughs. Given the long duration and significant appreciation level, it’s surprising that more retail investors have not rotated greater exposure into equities. This lack of participation gives us some measure of confidence that there is still more room to run.

Another indicator we monitor is market valuation. While valuation is a terrible indicator from a short-term standpoint, over long periods of time, it can be an excellent indicator of future returns. Based on forward earnings, the S&P 500 is trading at approximately 18 times. Historically, market multiples are closer to 14, so we are above average, but not at severely elevated valuations like those we saw in March 2000.

At the onset of every new calendar year, we are asked about our views for the coming year. We preface our remarks with a reminder that neither our own forecast, nor any short term market forecast over a short period of time is highly reliable. We would counsel that the best defense against unknown market events is a portfolio that is thoughtfully constructed in keeping with your long-term goals and objectives. Specifically, your portfolio should have exposures to multiple asset classes and strategies, which afford it the opportunity to achieve its objectives in a variety of scenarios. We are strong advocates of portfolio diversity, and those that are multi-factored. This is not to suggest that such a portfolio implementation approach will provide for the best outcome in all scenarios. However, in an uncertain world, we believe this is the best approach.

With that disclosure, our current views are as follows: In the coming year, we would continue to have a favorable view of equities. That said, last year’s performance was definitely outsized from a historical perspective, and we would have far more moderate expectations about performance in 2018. Our current expectation for domestic equity returns is 5-7%. We believe that the opportunity for equity market returns is greater outside the US. Last year, we began a steady process of reducing our US exposure in favor of international exposure and this served us well. We believe that the global economic recovery from the financial crisis of 2008 is in its earlier stages outside the US than it is within the US. Additionally, valuations for international equities continue to be more attractive as compared to US equities. While performance of equities globally over the long-term can be comparable, there are generally multi-year periods where one region outperforms the other. After a long period of US dominance, we believe 2017 was the first year in what will likely be a multi-year period of outperformance of international equities.

Within bonds, our return expectations are in the low, single-digit area. We believe that the 35-year bull market we have experienced is over, and returns will be far more moderate in the future. Our expectation for the 10-year treasury would be for yields to rise to 3% over the next 12 months.

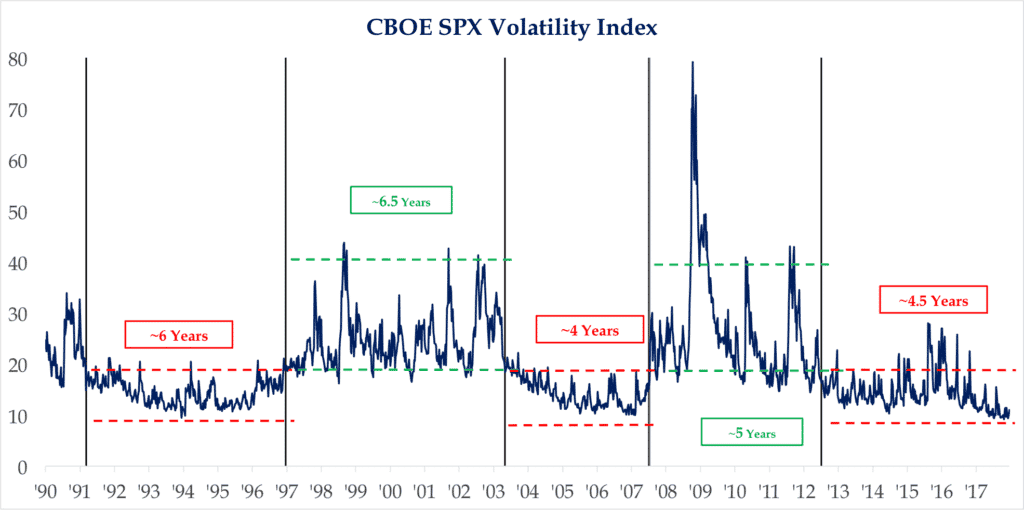

Another item of note is the very low level of volatility we experienced in 2017 (see Figure 4). As we wrote about extensively throughout our 2017 newsletters, market volatility fell to record lows during the year. Our expectation for 2018 is that we return to a more normalized level of market volatility. However, because we continue to remain at such low levels, this normalization period will likely be met with headlines that could seem shocking to market participants as this return to a normal level would be an increase between 35-50%.

Figure 4

We believe many market participants are not sufficiently paying attention to a few areas of concern. Our biggest concern for 2018 and beyond is how the normalization of the Fed balance sheet will materialize. Specifically, how this will affect the term structure of interest rates, and thus the broader global economy. Recall that economists forecasted back in 2007 and 2008 that Quantitative Easing (QE) would cause runaway inflation and growth. Neither of these predictions ever materialized. Today, economists are not forecasting any major economic ill effects as a result of a QE unwind. While we are hopeful that their forecast proves correct, we are watching the bond market diligently. Our base case expectation is that long rates (10 years) approach 3%, but not exceed that level in the near term.

Another concern is that wage inflation may start to materialize. We are well into the economic recovery, and it is unusual to see this degree of fiscal stimulus so far along in the process. Such significant stimulus, coupled with a low unemployment level, could spur inflation. This would cause a negative effect on corporate profit margins, which are currently at peak levels.

We are also concerned about the possibility of the US shifting to a more nationalistic agenda. This could manifest through a number of ways including a US pull out of NAFTA. Like Brexit, this would result in a multi-year negotiation and legal challenges. Another possibility could be reduced economic activity with China over concerns of their own trading policies toward the US. There is also a presidential election in Mexico this summer which could make matters more complicated.

Clearly, it is impossible for us to accurately handicap the precise odds of these risks coming to fruition or effects on capital markets. So, what is an investor to do? Our advice is to remain diversified. This means to include portfolio exposure to both traditional and alternative asset classes. If we enter a period that is less favorable to long equity strategies, we believe our alternative managers will be able to help portfolios maintain their value during times of stress. This will result in lower portfolio drawdowns and thus the benefit of compounding off a higher capital base when markets recover. Such an approach is difficult to maintain when markets charge ahead as they did in 2017. We have been at this long enough to know that there will be periods of time where markets retrench. Having the ability to play defense and preserve capital will be necessary during those periods.

We thank you for your continued confidence and wish you and your families all the best in 2018.

By: Christopher Battifarano CFA®, CAIA

By: Christopher Battifarano CFA®, CAIA

Executive Vice President & Chief Investment Officer

Additional articles from this issue:

The New Tax Law: What You Need To Know

Download Full Newsletter Here