FINE POINTS, The Quarterly Trust and Investment Publication of FineMark National Bank & Trust

October 2017 | Volume 2 | Issue 4

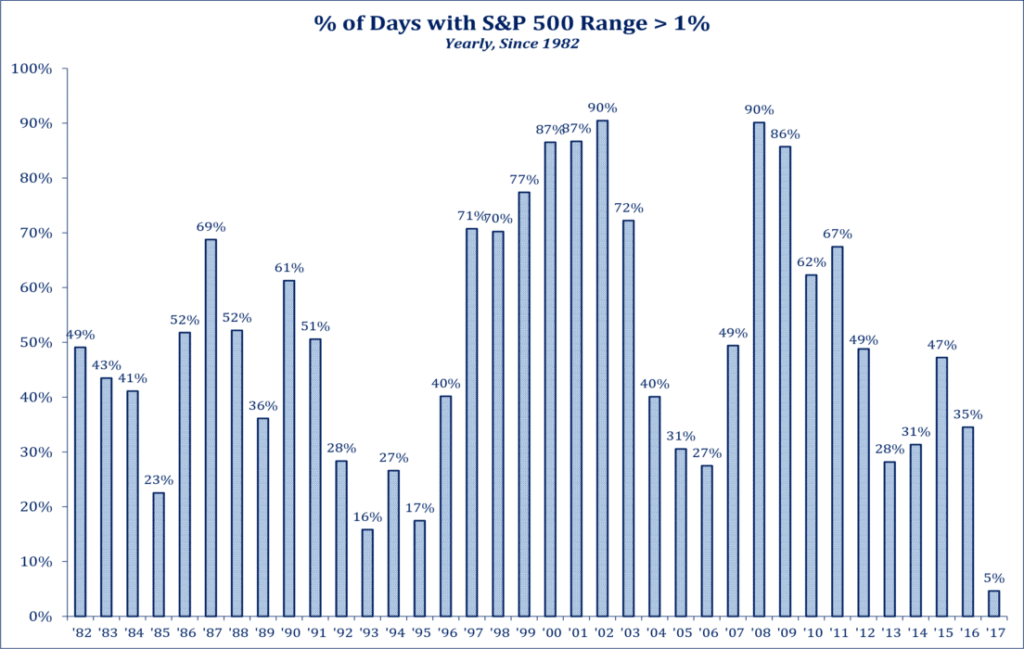

The third quarter cruised along in much of the same fashion as 2017 has to date. Equity markets continued to make new highs in the US with the S&P up +4% in the quarter, posting its eighth consecutive quarterly advance. Meantime, market volatility remains shockingly low with daily market movements averaging 0.3%, the lowest since 1968. In figure 1, you can see, 2017 is far below historical norms.

Figure 1

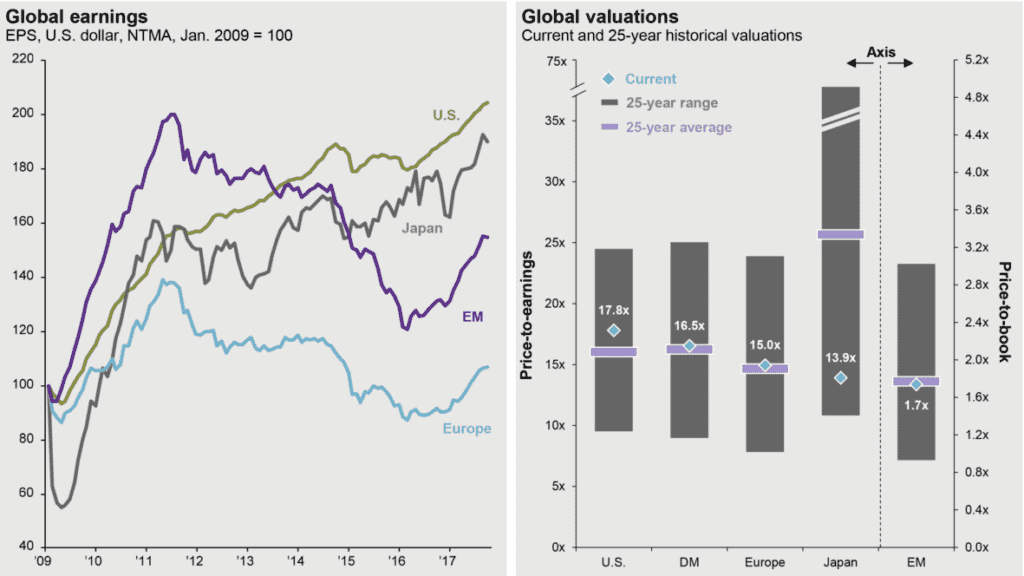

While continuing to maintain an overweight to US equities, we began moving more exposure into international markets in March and further still in June. We may continue to move additional exposure into international markets this year and into 2018. As you can see in figure 2, earnings in the US have been on a strong upward progression since 2009. International markets have been choppier, but lately, have shown strong signs of recovery.

Figure 2

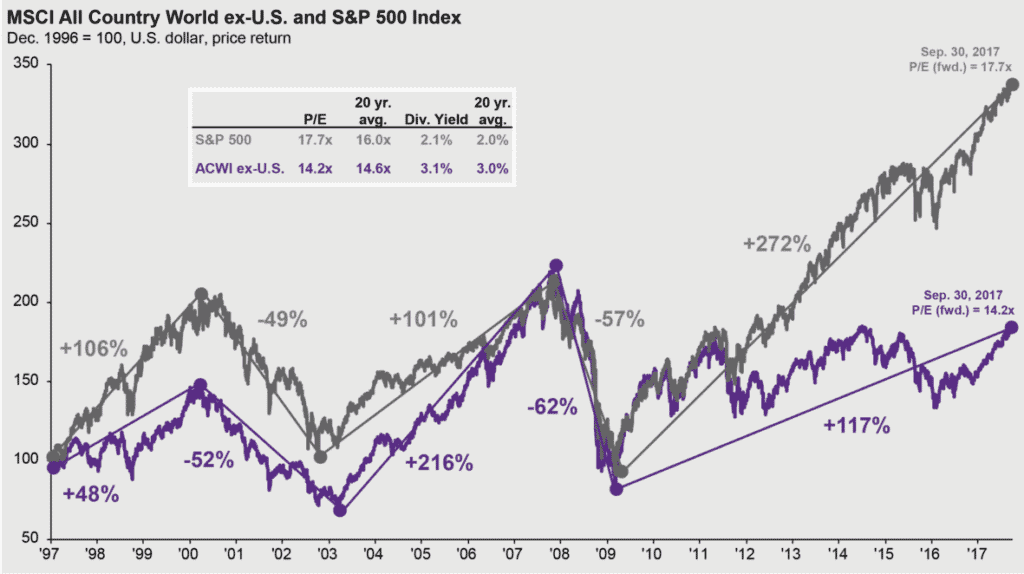

We believe the US economy and, as a result its equity markets, are much further along in the healing process since the global financial crisis of 2008, when compared to equity markets abroad. This was a result of the US taking swifter more significant action on a number of fronts, including monetary policy, fiscal policy and regulatory reform. As depicted in figure 3, these actions resulted in US markets outpacing international markets in terms of appreciation. Over the long term, the returns for equities, both here and abroad, have been roughly the same, so it would appear the international markets have significant ground to make up.

Figure 3

Now that we are in the later stages of the US recovery, we have been gradually rotating exposure out of US equities and into international, while maintaining our total equity exposure level. US markets are trading at above average valuations versus international markets, which are trading either at or below historical valuations. As we have said before, valuation is never a perfect market timing mechanism, however buying at lower prices will lead to outsized returns in the long term.

Other than the valuation metric, nearly every other metric we focus on for allocation decisions remains positive. These metrics include earnings growth, price momentum and macro-economic factors.

The third quarter was good for bonds, although they sold off in September and have shown some weakness in October. Heading into 2017, we expected much lower returns from what we are now experiencing. The Fed has raised the Fed funds rate twice this year and another rate hike appears likely in December. While we anticipated the Fed hikes, we did not anticipate long rates dropping in the face of it, particularly during a continued economic expansion. However, given the comments out of the Federal Reserve most recently, the environment for bond investors may become more challenging in the face of further hikes.

Our current expectation would be for three additional rate hikes in 2018 with long rates remaining below 3%. As the Fed has frequently stated, the risks to the downside are asymmetrical, meaning the Fed would rather run the risk of too much near term inflation in lieu of running the risk of causing deflation through hiking too aggressively.

Performance for most of our alternative investment strategies did reasonably well during the third quarter. Specifically, long short equity and multistrategy managers posted good gains for the quarter and the year. Managed futures have been more challenging. These components are intended to act as portfolio diversifiers and/or enhancers. They represent smaller allocations of client portfolios than either bonds or equities. We would suggest that now is an opportune time to take a fresh look at alternatives for inclusion into a diversified portfolio. We believe that given the duration of the bull market in equities, coupled with the lack of significant returns in bonds in this current rate environment, the addition of non-correlated strategies makes more sense than it has in the recent past.

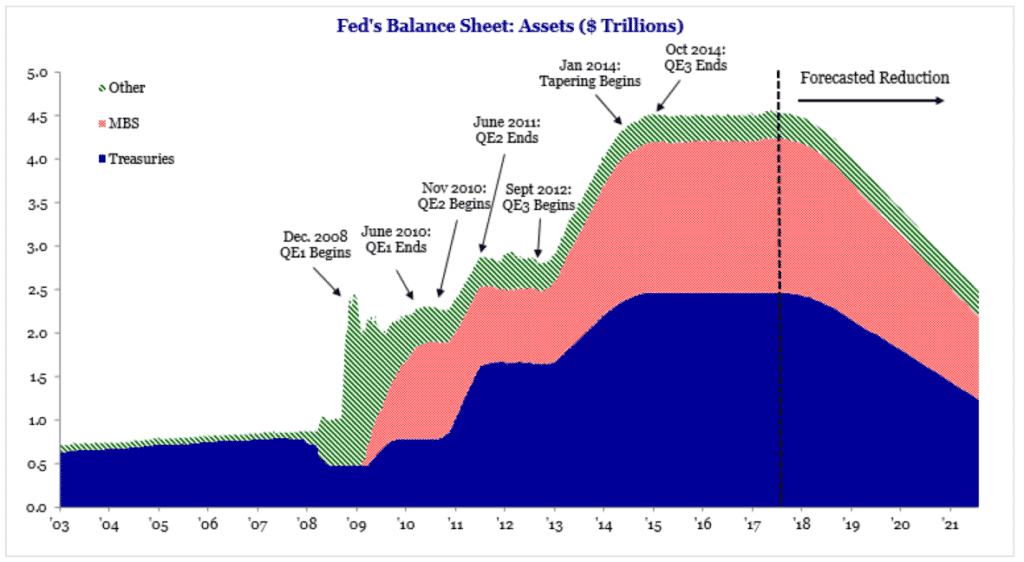

During the quarter, the Fed gave us much more clarity on plans for balance sheet normalization. We believe the chart in figure 4 is both a great reminder of how the Fed balance sheet ballooned to $4.5 trillion, and also provides a guidepost of how the Fed intends to unwind. The drawdown process began in October 2017 by allowing $10 billion in bonds to mature each month, and slowly ratcheting that number up to $50 billion per month. Based on Federal Reserve guidance, approximately $650 billion should roll off its balance sheet in 2018, and it will continue from there.

Figure 4

Quantitative Easing (QE) was the unprecedented step that started in 2008 under Chair Bernanke’s leadership where the central bank bought trillions of dollars of mortgage back securities and US Treasuries to reduce the term structure of rates. This occurred after the Fed had reduced rates to the zero bound and the economy was continuing to contract.

Chair Yellen has made it clear if economic activity should slow, the Fed’s first action would be to lower short rates to their zero bound first, which is in keeping with how the Fed created market liquidity prior to the global financial crisis. It also indicates the balance sheet unwind would continue, even if the economy contracted. This explicit and upfront level of guidance is extremely helpful given that Chair Yellen’s term ends on February 3, 2018. It is unclear who President Trump will choose as her successor.

Now that this unwind has been articulated and set in motion a successor will have a far lesser chance of spooking the market given all of the main candidates are generally on board with the idea that rates should be normalized gradually, provided growth and inflation move sideways or up from here.

We have warned our readers about the high degree of investor complacency and would advise clients to reexamine their own risk tolerance. The equity market conditions today are not normal, and if portfolios have grown more equity centric as a result of market appreciation, now is the time to rebalance back toward an asset allocation in keeping with your long term goals and objectives. The specifics of this conversation are something you should discuss with your investment professional at FineMark.

By: Christopher Battifarano CFA®, CAIA

By: Christopher Battifarano CFA®, CAIA

Executive Vice President & Chief Investment Officer

Additional articles from this issue:

Charitable Tax Deductions through IRA Distributions

Download Full Newsletter Here