FINE POINTS, The Quarterly Trust and Investment Publication of FineMark National Bank & Trust

April 2017 | Volume 2 | Issue 2

National Markets

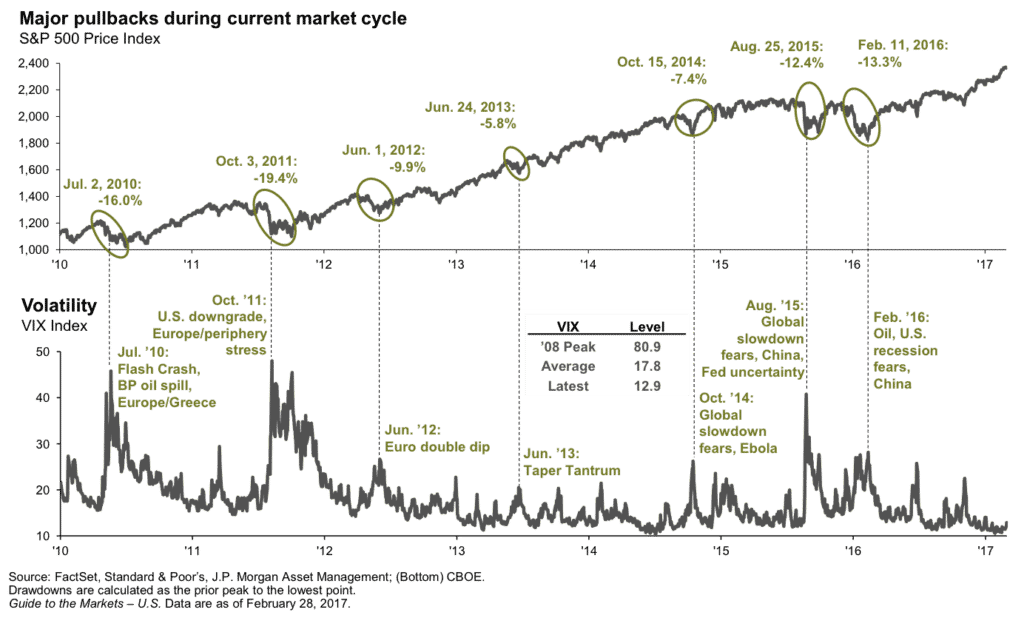

The first quarter went largely as projected in our January Newsletter however, equities performed stronger than expected. Domestic equities moved up over 9% since the November election, but began to abate somewhat in March due to investor concerns regarding the Trump administration’s slow progress enacting economic reform. The S&P 500 suffered its worst day of the year on March 21, closing down more than 1%. This was the first time in 110 trading sessions the market sold off to this degree, ending its longest streak of calm since 1995. The pullback was not surprising; in fact, such a long period of low volatility without a pullback is atypical. According to The Wall Street Journal, the first quarter was the calmest quarter in the Dow since 1965. The VIX index, which measures implied volatility for the S&P 500, posted its second-lowest, first quarter measure ever. We expect to see market volatility trend up to normal levels throughout the remainder of the year.

Figure 1

Figure 1 depicts a series of pullbacks averaging 12.9% in the market during this latest bull phase. Also, note the low levels on the VIX, which today are at sub 14 levels.

International Markets

In Europe, we heard mildly hawkish rhetoric from European Central Bank (ECB) President, Mario Draghi. He suggested there was no longer the same sense of urgency to boost eurozone inflation as the economy continues to heal. We expect the ECB to communicate further tapering of the quantitative easing program (QE) in the 3rd quarter and finally end QE in Europe sometime in 2018.

Elsewhere in Europe, the Dutch general election took place and far right candidate, Geert Wilders failed to win the majority of seats. Had he won, the notion of further Brexit-style European Union withdrawal may have been brought to the fore in Holland. In the upcoming French election, we expect far right candidate, Marine Le Pen to make it to the second round of voting, but it is uncertain who will win on May 7.

Finally, UK Prime Minister, Theresa May, triggered Article 50 of the Lisbon Treaty on March 29, initiating a two-year countdown to the UK exit from the European Union. Broadly, we believe the deep interdependencies between Europe and the UK will make the divorce process less adversarial than EU officials are suggesting.

Asset Allocation Changes

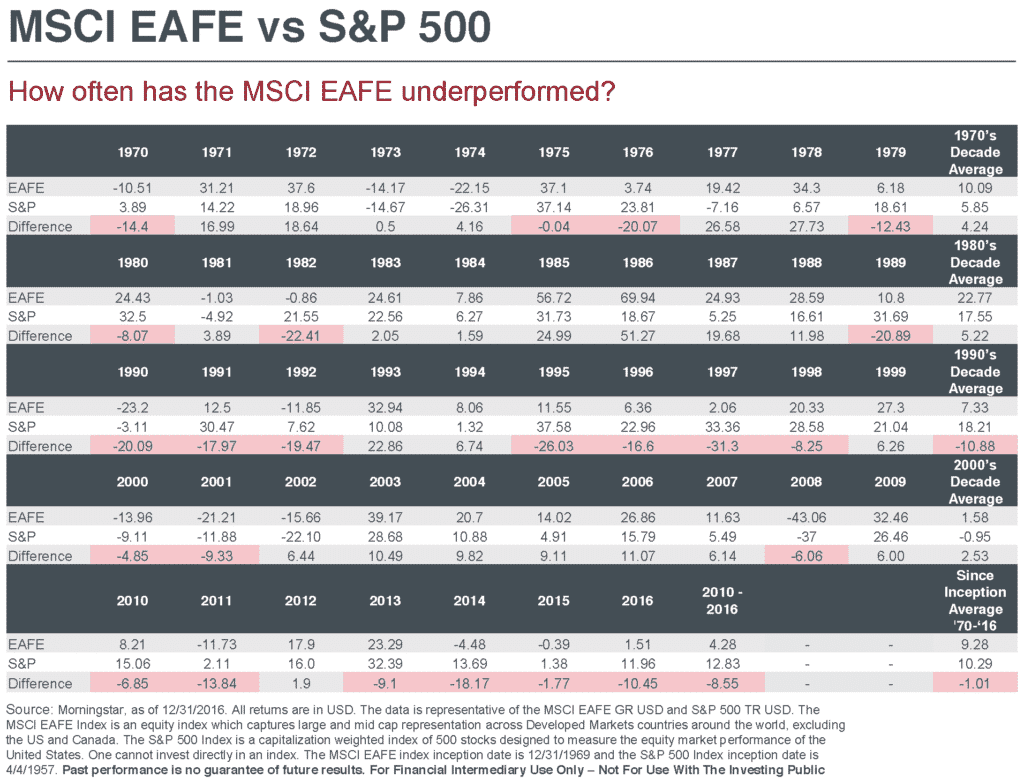

In terms of portfolio positioning, we are becoming more constructive on international equities. Long term, the returns of the S&P 500 and the MSCI EAFE (an index that includes equities from 21 developed markets excluding the US and Canada) are quite similar on an annualized basis. However they tend to go through multi-year cycles of outperforming each other. The US has outperformed international markets the past four years, and six of the past seven. While international outperformance was significant in the 70s, 80s and 00s, the US markets have dominated the 90s and this decade. Figure 2 shows return data for US and international equities beginning in 1970 and running through 2016.

Figure 2

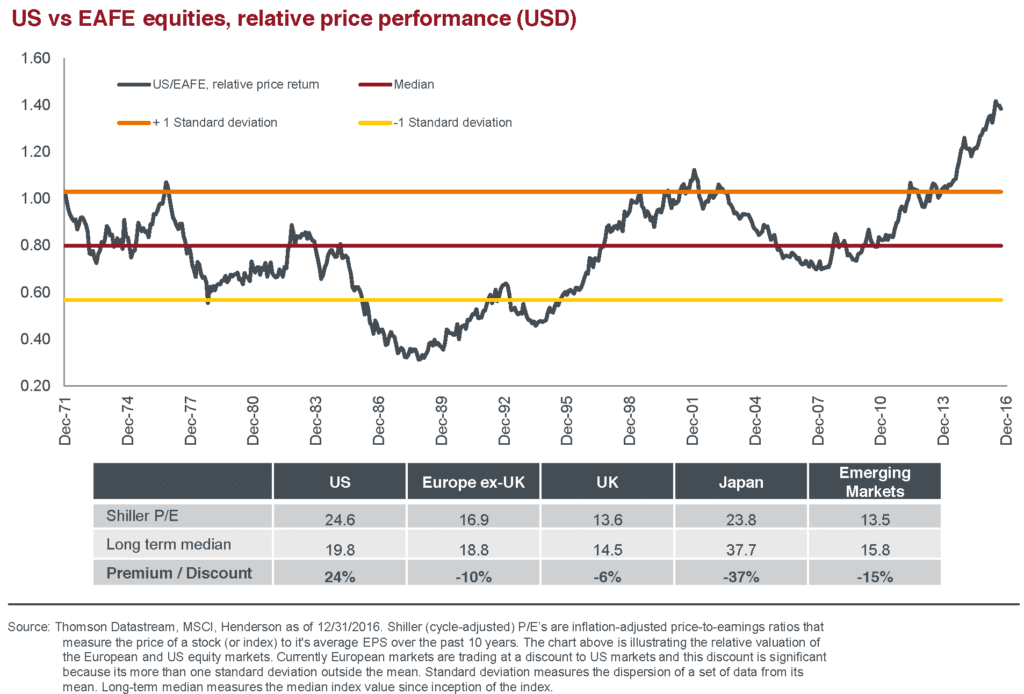

One reason we are becoming more positive on international equities is valuation. US equities, relative to international equities, are trading at a significant premium to where they have historically traded. Figure 3 shows the relative valuation as measured by P/E (price to earnings) ratio of the S&P 500 versus the EAFE index. It shows US equities trading well over one standard deviation above their developed market peers, at nearly the highest valuation disparity in 46 years. Such valuation disparities are historically rare. The further data moves away from this historical norm, the greater the tendency to revert to the median. Additionally, the bottom of the chart shows US equites trading at a premium to developed market peers.

Figure 3

The US equity market has outperformed its international peers (UK, Japan and Europe) since the global financial crisis for several reasons. Chiefly, the US economy has recovered more significantly than its peers since the great recession. This is evidenced through a more substantial drop in unemployment, greater economic activity as measured by Gross Domestic Product (GDP) and superior labor force demographics. The US remains the best jurisdiction for business management as measured by return on equity versus its developed market peers. The US has also been fertile ground for technology and still remains a land of opportunity for immigrants seeking a better life.

We see further evidence of the US recovery through the Federal Reserve’s tightening of monetary policy by ending QE in 2014, followed by a series of fed funds rate hikes. Comparatively, the Bank of Japan, the Bank of England and the European Central Bank remain more accommodative.

While we are not abandoning our view on the US, we believe it’s time to start directing capital toward international markets. As the rest of the world recovers, their equity markets should emulate the performance trends of the US market during the US Recovery.

Interest Rates & Equity Prices

We are frequently asked our view on interest rates and our expectation for monetary policy. For many of our clients this question is not prompted so much by concerns over the cost of debt, but rather how monetary policy will effect their investment portfolio.

Generally, investors believe rising rates are the death knell for equities. This can be the case where rate hikes are used as a tool to curb excess inflation. However, there are two very distinct environments where rising rates can have very different effects on equities: when rates are above 5% on the 10 year Treasury and below 5%. When interest rates are above 5%, rate hikes have resulted in lower future equity prices; whereas, in a sub 5% rate environment, rate hikes have positively correlated with higher equity prices.

Despite our expectation for higher rates, we remain constructive on equities especially in international markets. Additionally, we expect higher rates to put downward pressure on fixed income returns. Notwithstanding, we are not expecting rate hikes to be significant enough to negatively impact equity markets.

At FineMark, we are always here to serve you with your investment needs or any other questions that might arise. Whether you are heading north for the summer or staying closer to home, feel free to reach out to your investment professional at any time.

By: Christopher Battifarano CFA®, CAIA

By: Christopher Battifarano CFA®, CAIA

Executive Vice President & Chief Investment Officer

Additional articles from this issue:

Alphabet Soup is Not Just for Lunch

Download Full Newsletter Here